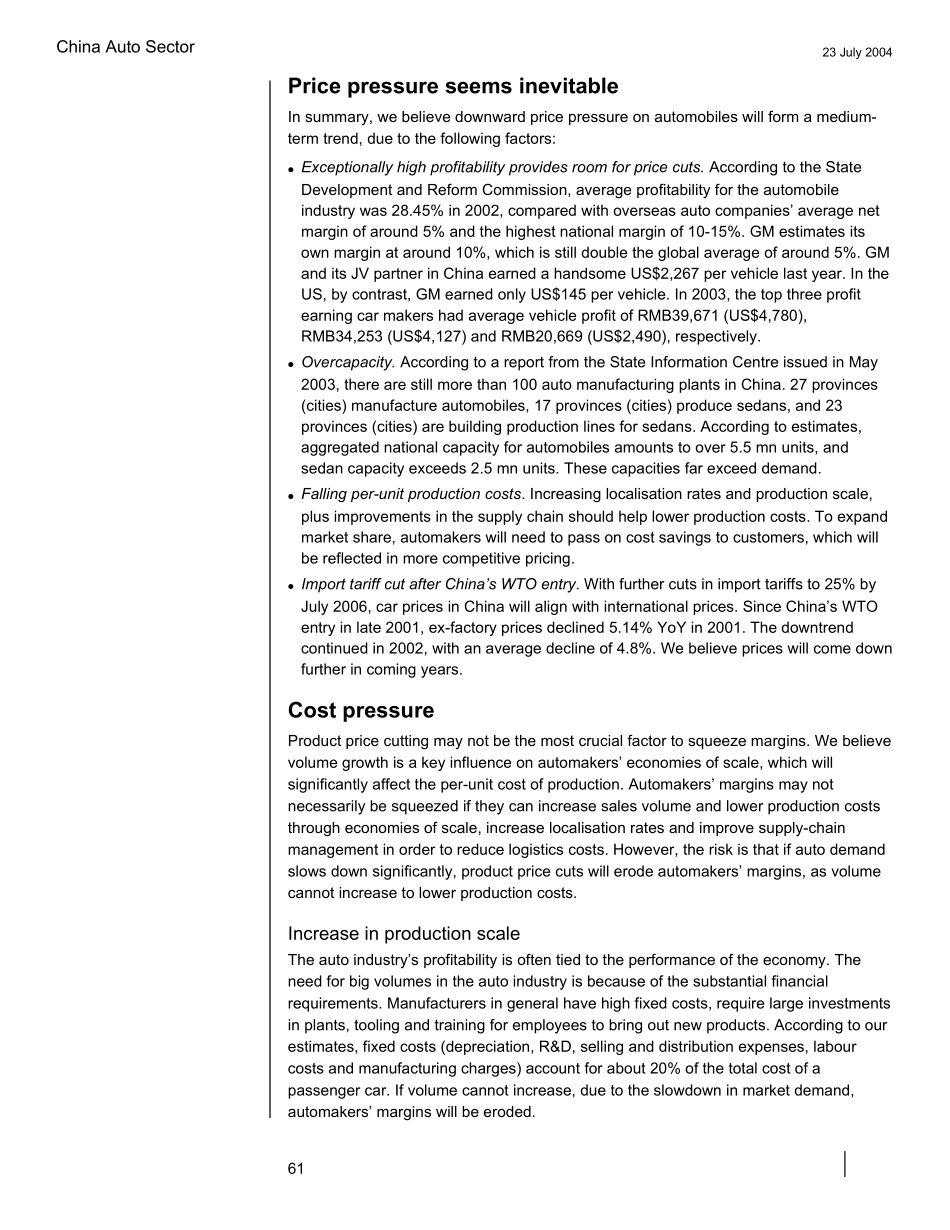

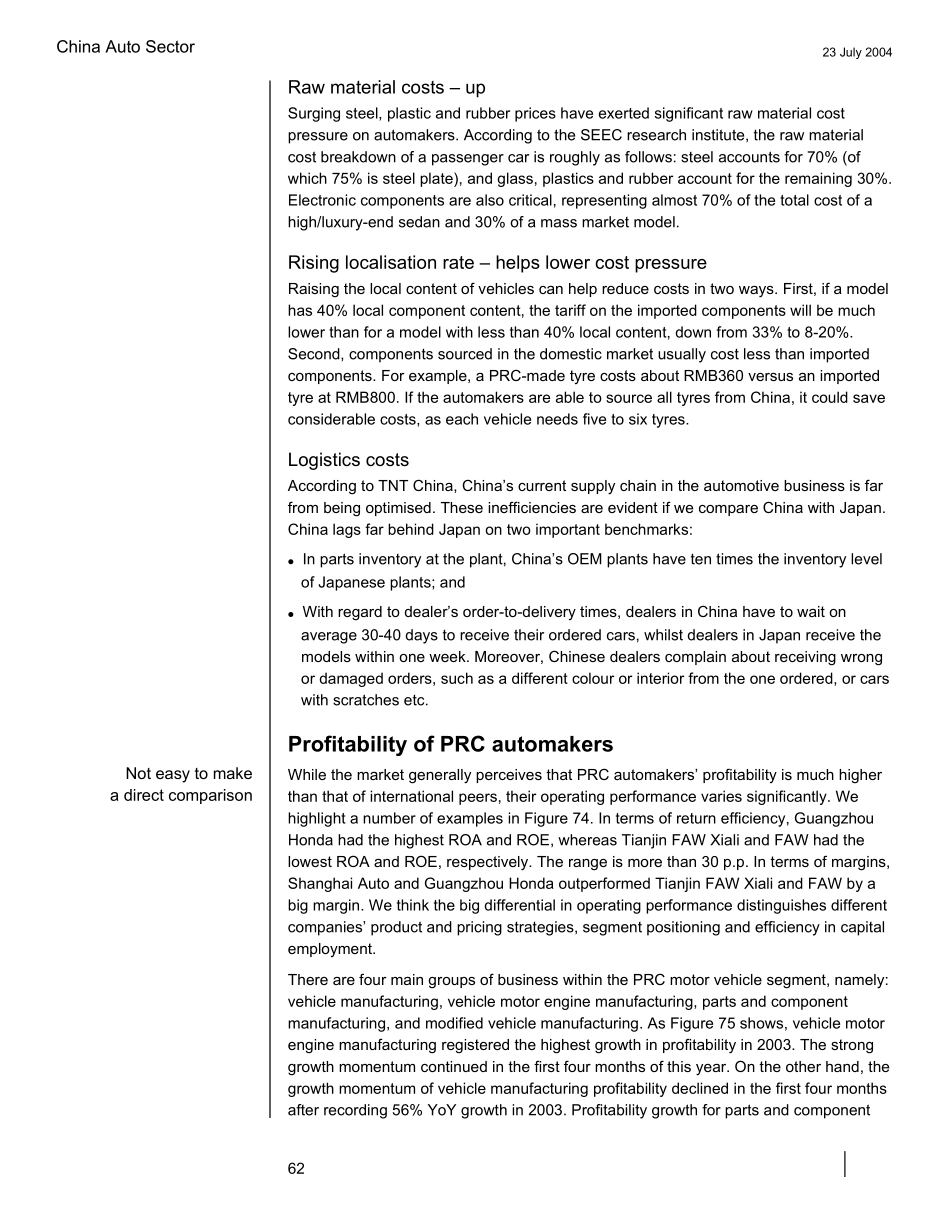

China Auto Sector 23 July 2004 61 Price pressure seems inevitable In summary, we believe downward price pressure on automobiles will form a medium-term trend, due to the following factors: · Exceptionally high profitability provides room for price cuts. According to the State Development and Reform Commission, average profitability for the automobile industry was 28.45% in 2002, compared with overseas auto companies’ average net margin of around 5% and the highest national margin of 10-15%. GM estimates its own margin at around 10%, which is still double the global average of around 5%. GM and its JV partner in China earned a handsome US$2,267 per vehicle last year. In the US, by contrast, GM earned only US$145 per vehicle. In 2003, the top three profit earning car makers had average vehicle profit of RMB39,671 (US$4,780), RMB34,253 (US$4,127) and RMB20,669 (US$2,490), respectively. · Overcapacity. According to a report from the State Information Centre issued in May 2003, there are still more than 100 auto manufacturing plants in China. 27 provinces (cities) manufacture automobiles, 17 provinces (cities) produce sedans, and 23 provinces (cities) are building production lines for sedans. According to estimates, aggregated national capacity for automobiles amounts to over 5.5 mn units, and sedan capacity exceeds 2.5 mn units. These capacities far exceed demand. · Falling per-unit production costs. Increasing localisation rates and production scale, plus improvements in the supply chain should help lower production costs. To expand market share, automakers will need to pass on cost savings to customers, which will be reflected in more competitive pricing. · Import tariff cut after China’s WTO entry....