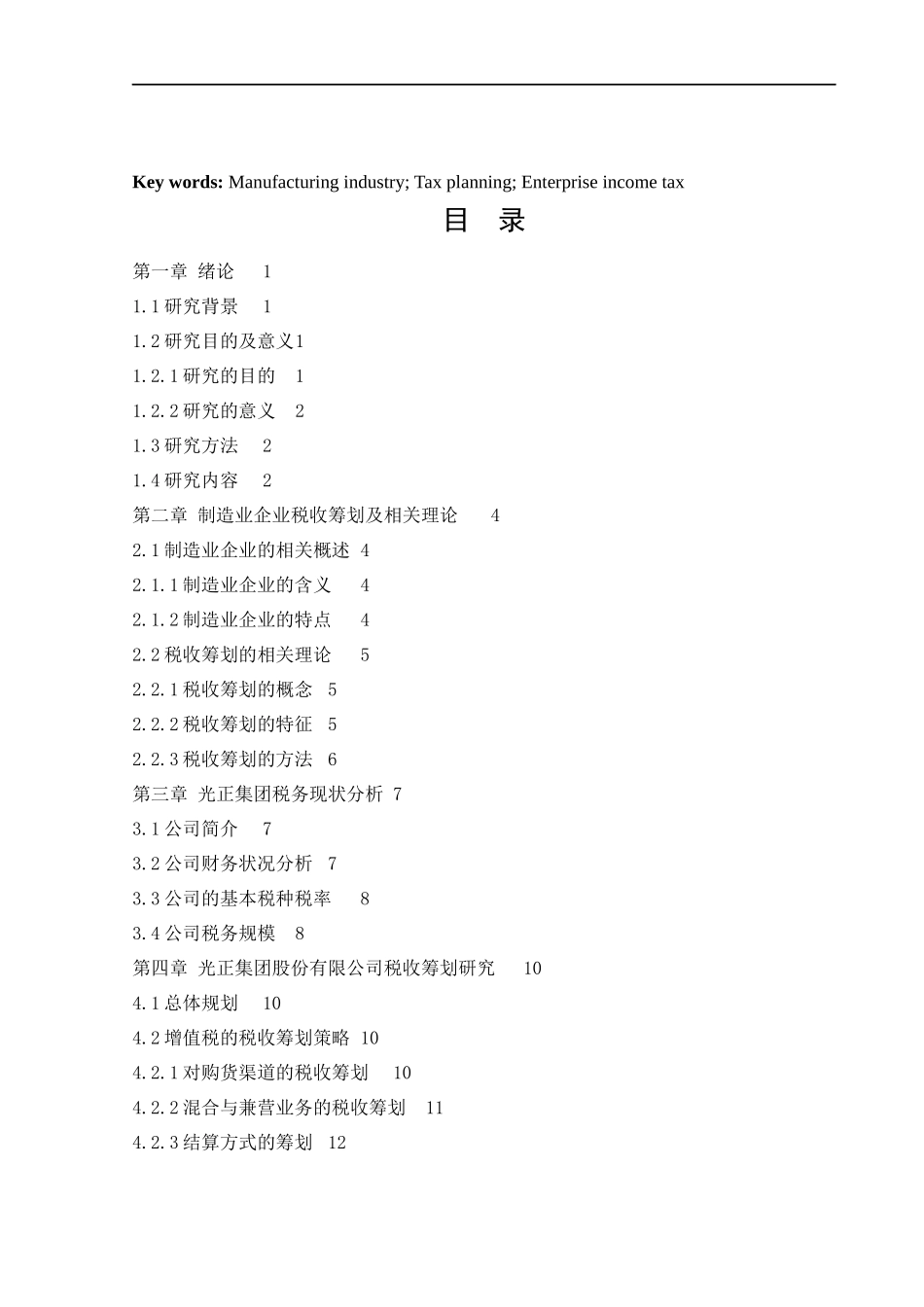

制造业企业税收筹划研究 - 以光正集团为例 摘 要随着社会主义市场经济的发展,税收筹划随之出现,其不仅可以达到预期减少企业的税负的效果,还对提高企业经济活动的计划、组织、协调和控制有一定的帮助,因此得到了各个企业的广泛关注。制造企业是现在社会经济运行期间非常重要的一项主体,它的发展直接体现了一个国家的生产力水平。通过严谨合乎常理符合法律规定的降低企业税收的手段,可以达到减少企业的税收的效果。结合实际,根据制造行业的变化成果的状况可以得出,税收筹划的起到的效果和影响是非常大的。客观、真实、完整地缴纳税款是企业的职能和使命,这一点是不能够被忽略的。本文从税收筹划概念等理论出发,表述制造业企业税收筹划的概念及特征;通过数据分析企业的经营情况;结合实际对企业在增值税、企业所得税、印花税、土地使用税等方面制定税收筹划研究,并对我国的制造业企业税收筹划出现的问题进行分析,指出在法律法规、税务筹划意识、整体控制等方面存在的缺陷;最后是提出相应的改进措施,通过让制造业企业正确认识税收筹划、创造有利的税收筹划环境、企业正确定位、积极防范来解决问题。最后,本文认为税收筹划的研究对我国制造业企业有重要作用。关键词:制造业;税收筹划;企业所得税AbstractWith the development of socialist market economy, tax planning can not only reduce the expected effect of enterprise tax, but also help to improve the planning, organization, coordination and supervision of enterprise economic activities. Manufacturing industry is a very important theme in the current socio-economic period, and its development directly reflects the productivity level of a country. In practice, according to the changes of manufacturing performance, it can be concluded that tax planning has a very important impact and impact, and objective payment is an important factor. This article describes the concept and characteristics of tax planning of manufacturing enterprises based on theories such as the concept of tax planning, and uses data to analyze the transactions of enterprises. This paper analyzes the pr...