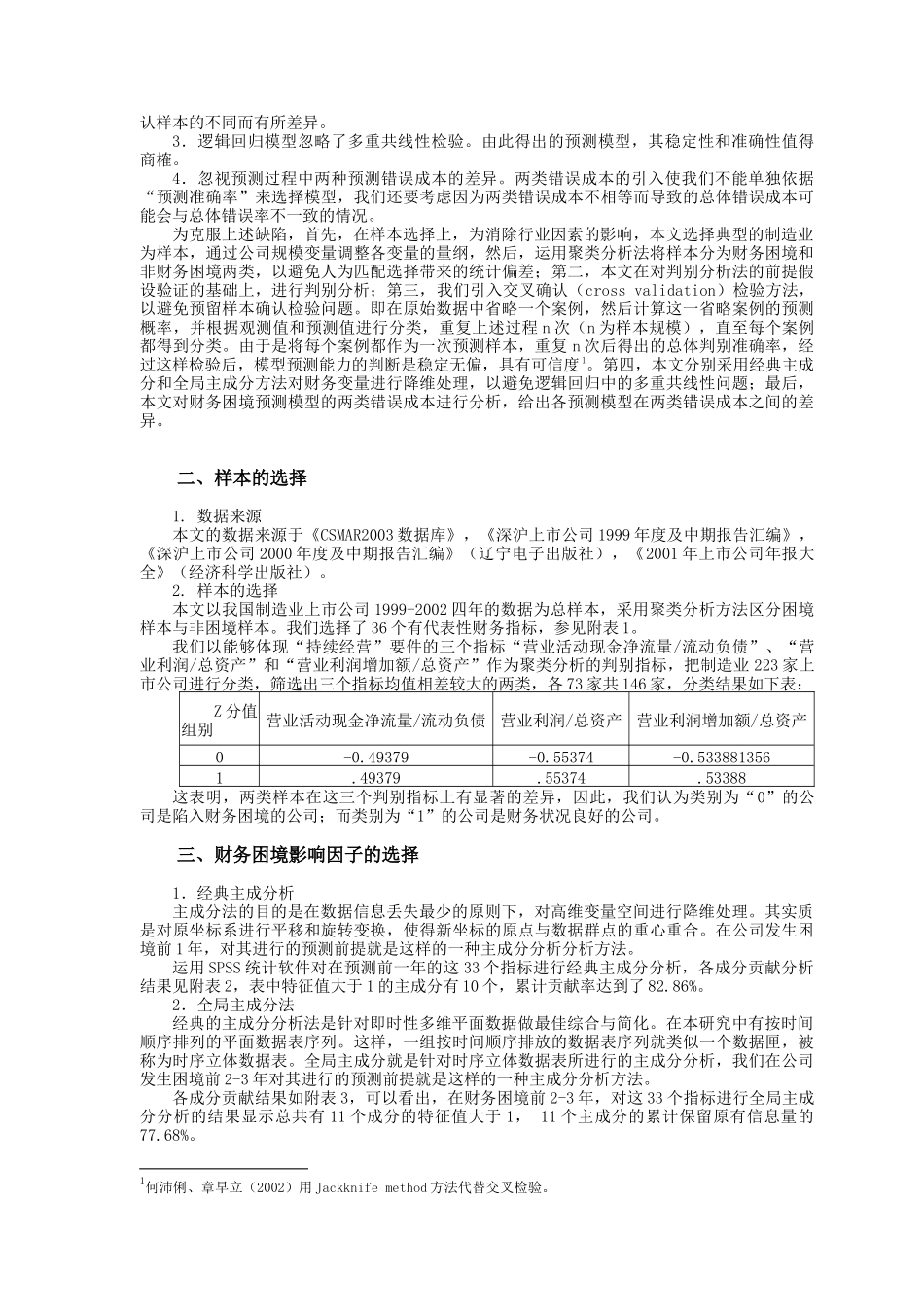

上市公司财务困境预测方法的比较研究吕长江 周现华(吉林大学商学院、吉林大学数量经济研究中心 130012)Comparative Study on Forecast Approaches of Corporate Financial DistressChangjiang Lu & Xianhua Zhou(Business School of Jilin University, 130012)AbstractHow to apply a suitable approach to forecast corporate financial distress has long been an important issue in the filed of corporate finance. Based on several main forecast approaches both from broad and domestic, and their precondition, this paper will use a sample of industry listed companies from 1999 to 2002, and apply Multi-Discriminate Analysis (MDA), Logit and Neural Network approach respectively to forecast corporate financial distress. Empirical results indicate that three approaches can forecast corporate financial distress before 1 year and 2-3 year, and Logit model can identify corporate financial distress more accurately than MDA, NN model is best one among three models.Keywords: Financial Distress; Multi-Discriminate Analysis; Logit Model; Neural Network联系作者:吕长江 吉林大学商学院 长春市前卫路 10 号,130012 Tel: 0431-5166339, 5166093, 13331771156Email: Lchangjiang@jlu.edu.cn上市公司财务困境预测方法的比较研究内容摘要:如何采用适当的方法对公司财务困境进行正确的预测,一直是学术界关注的热点问题之一。基于国内外已有的财务困境各种预测方法及其结果的差异,本文在分析各种研究方法应用前提的基础上,采用制造业上市公司 1999-2002 四年的数据分别运用多元判别分析、逻辑线性回归模型和人工神经网络模型对财务状况处于困境的公司进行预测比较分析。结果表明:尽管各模型的使用有其特定的前提条件,三个主流模型均能较好地在公司发生困境前 1 年和前2-3 年较好地进行预测,其中,多元判别分析法要逊色于逻辑模型,神经网络模型的预测准确率最高。关键词:财务困境 主成分分析 判别分析 逻辑模型 BP 网络模型 一、引言 随着资本市场的不断发展与完善,对上市公司财务困境进行预警研究一直是国内外学术界的热点问...