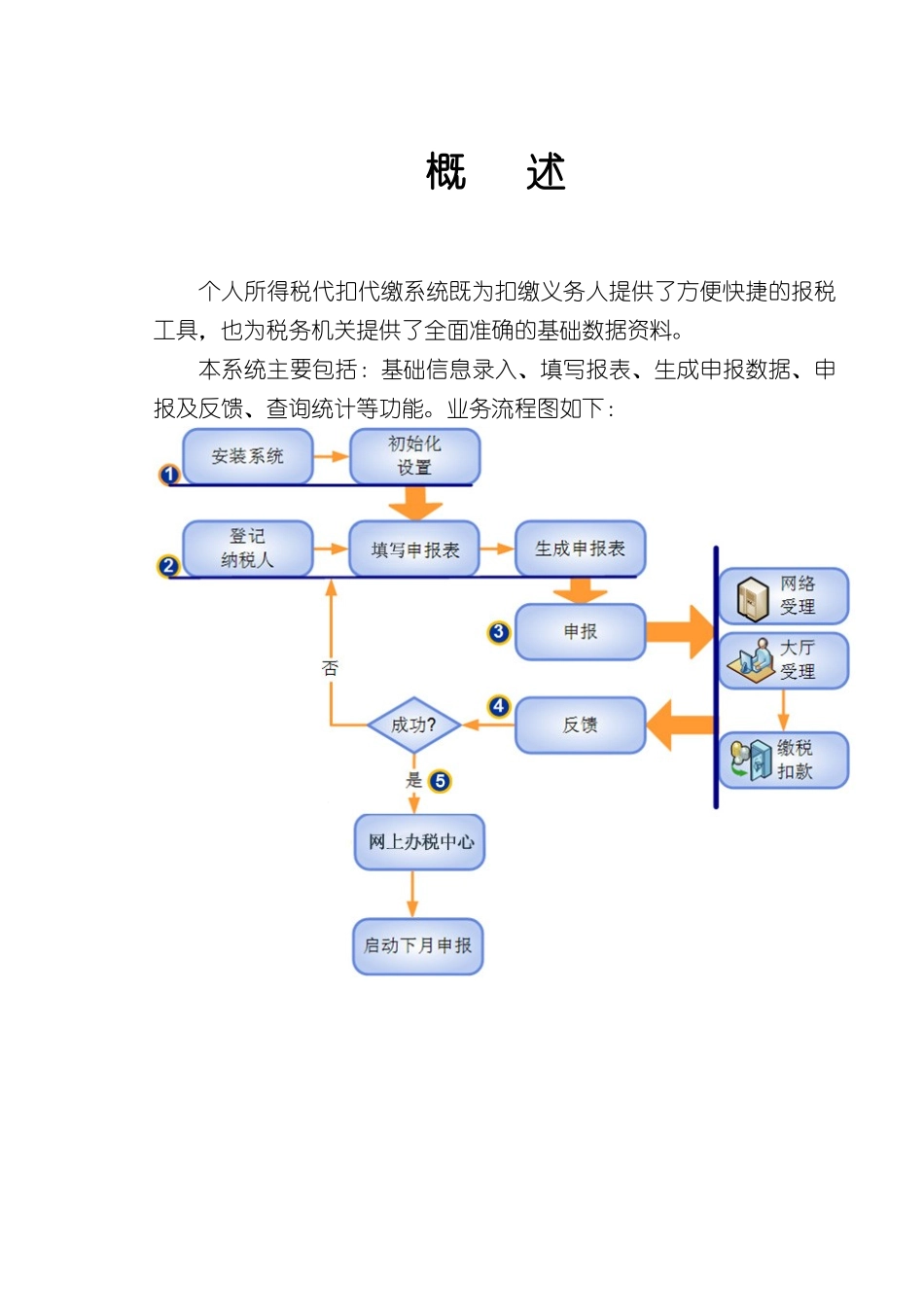

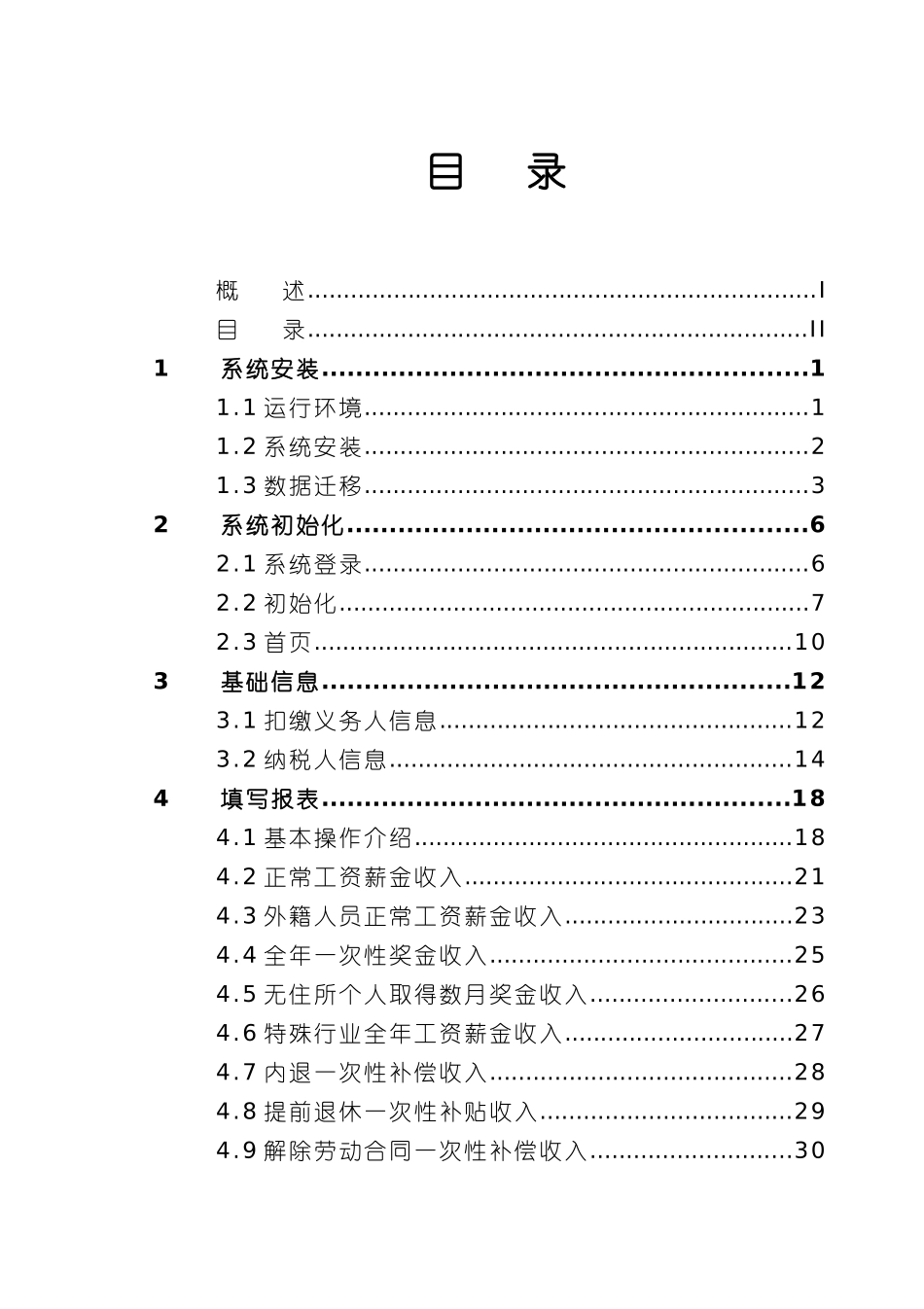

个人所得税代扣代缴系统V1.2.04用户手册二○一一年八月概述个人所得税代扣代缴系统既为扣缴义务人提供了方便快捷的报税工具,也为税务机关提供了全面准确的基础数据资料。本系统主要包括:基础信息录入、填写报表、生成申报数据、申报及反馈、查询统计等功能。业务流程图如下:目录概述.......................................................................I目录......................................................................II1系统安装.........................................................11.1运行环境..............................................................11.2系统安装..............................................................21.3数据迁移..............................................................32系统初始化......................................................62.1系统登录..............................................................62.2初始化..................................................................72.3首页...................................................................103基础信息.......................................................123.1扣缴义务人信息.................................................123.2纳税人信息........................................................144填写报表.......................................................184.1基本操作介绍.....................................................184.2正常工资薪金收入..............................................214.3外籍人员正常工资薪金收入................................234.4全年一次性奖金收入..........................................254.5无住所个人取得数月奖金收入............................264.6特殊行业全年工资薪金收入................................274.7内退一次性补偿收入..........................................284.8提前退休一次性补贴收入...................................294.9解除劳动合同一次性补偿收入............................304.10股票期权行权收入...........................................314.11企业年金(企业缴纳部分).................................324.12非工资薪金收入...............................................344.13限售股转让收入...............................................354.14财政统发当月已缴税额....................................364.15生成申报数据..................................................375申报及反馈....................................................386打印代扣代收税款凭证.....................................417查询统计.......................................................447.1查询申报明细.....................................................447.2查询申报表........................................................468参数设置.......................................................478.1证书设置............................................................478.2税务局信息获取.................................................489系统管理.......................................................509.1修改密码............................................................509.2用户管理............................................................519.3网络参数设置.....................................................539.4运行参数设置.....................................................559.5数据备份恢复.....................................................569.6日志管理............................................................609.7公告....................................................................