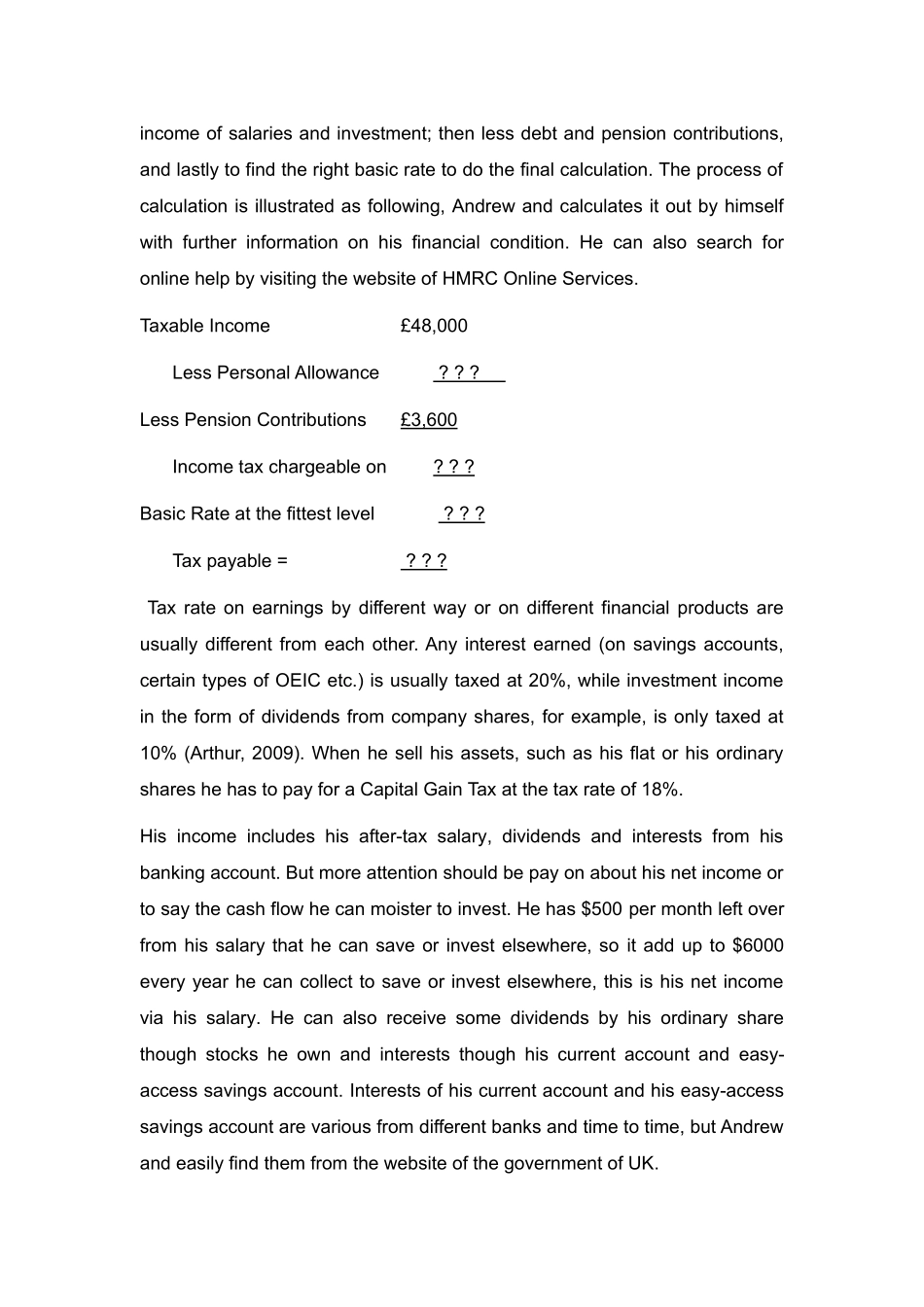

SuggestionsonAndrew’sinvestment1.IntroductionTohavecomfortablelife,itisimportantforonetoearnmore,butnolessistherightmanagementofmoney,asacclaimedbyCarlos(2009).Andrewisfacingtheproblemofmanaginghismoneyeffectively,sothisreportiswrittentogivehimsomesuggestions.Beforewriting,theworkofreferringtotheintroductionofhissituationandthecheckingoftheinternetforinformationofproperfinancialproductsandserviceshasbeendonecarefully.Aswaswrittentoillustratethefactthathowtoscheduleyourfinanceandhowtoinvestefficiently,thisreportisnotonlyfitAndrewverywellbutwillalsobehelpfulforsomeonewhoisunfamiliarwithfinancialservicesandproductsbutwanttomanagetheirwealthmoreefficiency.ThereportfirstlyanalyzedthefinancialstructureofAndrew;inaddition,ItworkedoutthefuturefinancialneedsofAndrew;then,Itcheckedtofindproperfinancialproductsorservicesmainlybyinternet;andfinally,ItcomeupwithaconclusionwhichincludesaseriesoffinancialproductsandservicesthatfitsAndrewwell,alsoIthelpedhimonhowtodealwithiteffectively.2.Analysisoffinancialservices2.1CurrentfinancialstructureofAndrewAberdeenassetManagement£30,000Prudential£6,000RoyalBankofScotland£60,000Currentaccount£1,800SavingsAccount£5,000$500/monthDividendsIncomeInterestTable1.Andrew’sfinancialstructureFormtable1wecanclearlyknowwhatAndrewhasandhowmucharetheytoinvestment.Thecalculationofhisassetsandnetincomeindetailisasfollowing:Ashehasbuyapersonalpensionforfiveyears,andhedoescurrentlypay6%ofhisgrosssalaryintoit,sointotalhehasput$14400intothepersonalpensionschedule.AccordingtotheTaxreliefonpersonalpensions,heendsuptohave$18000inhispensionpot.Hisassetsincludesomeordinarysharesofthreecompanies,moneyinbankaccountsandaflat.Thenumberofordinarysharesisasfollowing:AberdeenAssetManagement30,000Prudential6,000RoyalBankofScotland60,000Moneyinhiscurrentaccountis£1,800andinhiseasy-accesssavingsaccountis£5,000.Theflatisa2-bedroomflatnearthecentreofEdinburgh.Hisdebtisthemortgageofhisflattopayinfiveyears.Hemaypaytaxincludeincometaxandtaxonsavesandinvestments.AccordingtotherulefromthewebsiteofUK(2011),tocalculatehistaxonincome,weshouldfirstlycalculateoutthetaxableincomewhichisgrossInvestmentPensions???Portfolioincomeofsalariesandinvestment;thenlessdebtandpensioncontributions,andlastlytofindtherightbasicratetodothefinalcalculation.Theprocessofcalculationisillustratedasfollowing,Andrewandcalculatesitoutbyhimselfwithfurtherinformationonhisfinancialcondition.HecanalsosearchforonlinehelpbyvisitingthewebsiteofHMRCOnlineServices.TaxableIncome£48,000LessPersonalAllowance???LessPensionContributions£3,600Incometaxchargeableon???BasicRateatthefittestlevel???Taxpayable=???Taxrateonearningsbydifferentwayorondifferentfinancialproductsareusuallydifferentfromeachother.Anyinterestearned(onsavingsaccounts,certaintypesofOEICetc.)isusuallytaxedat20%,whileinvestmentincomeintheformofdividendsfromcompanyshares,forexample,isonlytaxedat10%(Arthur,2009).Whenhesellhisassets,suchashisflatorhisordinaryshareshehastopayforaCapitalGainTaxatthetaxrateof18%.Hisincomeincludeshisafter-taxsalary,dividendsandinterestsfromhisbankingaccount.Butmoreattentionshouldbepayonabouthisnetincomeortosaythecashflowhecanmoistertoinvest.Hehas$500permonthleftoverfromhissalarythathecansaveorinvestelsewhere,soitaddupto$6000everyyearhecancollecttosaveorinvestelsewhere,thisishisnetincomeviahissalary.Hecanalsoreceivesomedividen...