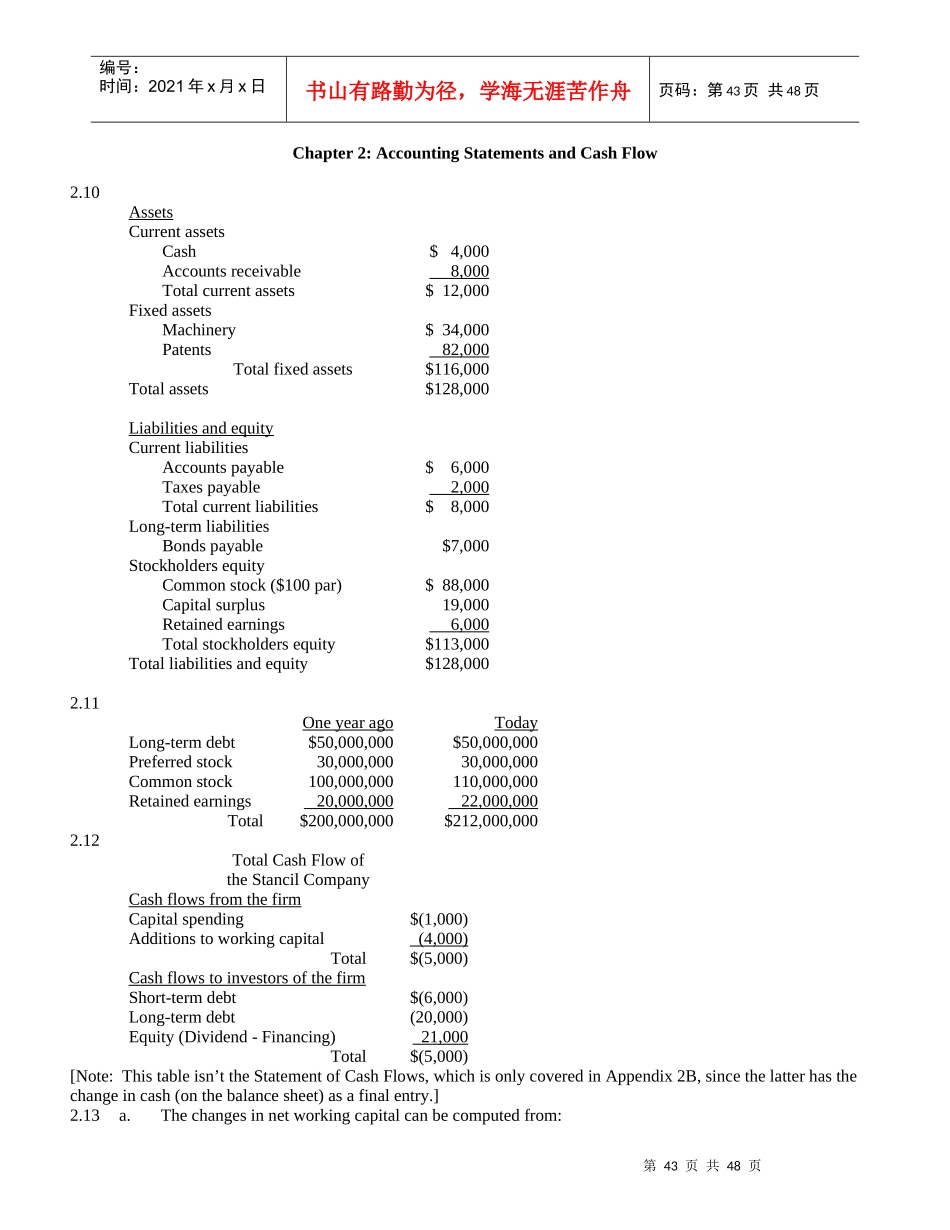

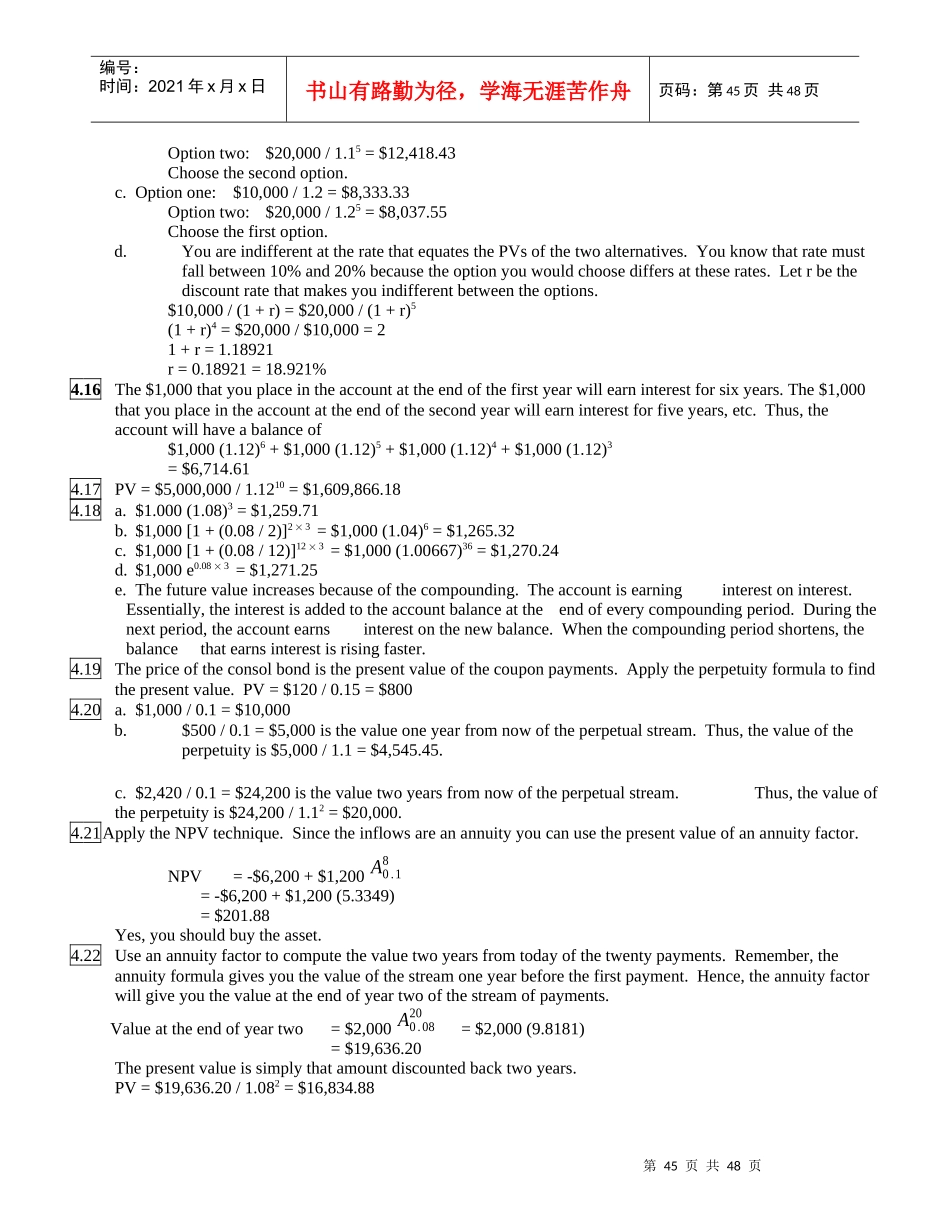

第43页共48页编号:时间:2021年x月x日书山有路勤为径,学海无涯苦作舟页码:第43页共48页Chapter2:AccountingStatementsandCashFlow2.10AssetsCurrentassetsCash$4,000Accountsreceivable8,000Totalcurrentassets$12,000FixedassetsMachinery$34,000Patents82,000Totalfixedassets$116,000Totalassets$128,000LiabilitiesandequityCurrentliabilitiesAccountspayable$6,000Taxespayable2,000Totalcurrentliabilities$8,000Long-termliabilitiesBondspayable$7,000StockholdersequityCommonstock($100par)$88,000Capitalsurplus19,000Retainedearnings6,000Totalstockholdersequity$113,000Totalliabilitiesandequity$128,0002.11OneyearagoTodayLong-termdebt$50,000,000$50,000,000Preferredstock30,000,00030,000,000Commonstock100,000,000110,000,000Retainedearnings20,000,00022,000,000Total$200,000,000$212,000,0002.12TotalCashFlowoftheStancilCompanyCashflowsfromthefirmCapitalspending$(1,000)Additionstoworkingcapital(4,000)Total$(5,000)CashflowstoinvestorsofthefirmShort-termdebt$(6,000)Long-termdebt(20,000)Equity(Dividend-Financing)21,000Total$(5,000)[Note:Thistableisn’ttheStatementofCashFlows,whichisonlycoveredinAppendix2B,sincethelatterhasthechangeincash(onthebalancesheet)asafinalentry.]2.13a.Thechangesinnetworkingcapitalcanbecomputedfrom:第44页共48页第43页共48页编号:时间:2021年x月x日书山有路勤为径,学海无涯苦作舟页码:第44页共48页SourcesofnetworkingcapitalNetincome$100Depreciation50Increasesinlong-termdebt75Totalsources$225UsesofnetworkingcapitalDividends$50Increasesinfixedassets*150Totaluses$200Additionstonetworkingcapital$25*Includes$50ofdepreciation.b.CashflowfromthefirmOperatingcashflow$150Capitalspending(150)Additionstonetworkingcapital(25)Total$(25)CashflowtotheinvestorsDebt$(75)Equity50Total$(25)Chapter3:FinancialMarketsandNetPresentValue:FirstPrinciplesofFinance(Advanced)3.14$120,000-($150,000-$100,000)(1.1)=$65,0003.15$40,000+($50,000-$20,000)(1.12)=$73,6003.16a.($7million+$3million)(1.10)=$11.0millionb.i.Theycouldspend$10millionbyborrowing$5milliontoday.ii.Theywillhavetospend$5.5million[=$11million-($5millionx1.1)]att=1.Chapter4:NetPresentValue4.12a.$1,0001.0510=$1,628.89b.$1,0001.0710=$1,967.15c.$1,0001.0520=$2,653.30d.Interestcompoundsontheinterestalreadyearned.Therefore,theinterestearnedinpartc,$1,653.30,ismorethandoubletheamountearnedinparta,$628.89.4.13Sincethisbondhasnointerimcouponpayments,itspresentvalueissimplythepresentvalueofthe$1,000thatwillbereceivedin25years.Note:Aswillbediscussedinthenextchapter,thepresentvalueofthepaymentsassociatedwithabondisthepriceofthatbond.PV=$1,000/1.125=$92.304.14PV=$1,500,000/1.0827=$187,780.234.15a.Atadiscountrateofzero,thefuturevalueandpresentvaluearealwaysthesame.Remember,FV=PV(1+r)t.Ifr=0,thentheformulareducestoFV=PV.Therefore,thevaluesoftheoptionsare$10,000and$20,000,respectively.Youshouldchoosethesecondoption.b.Optionone:$10,000/1.1=$9,090.91第45页共48页第44页共48页编号:时间:2021年x月x日书山有路勤为径,学海无涯苦作舟页码:第45页共48页Optiontwo:$20,000/1.15=$12,418.43Choosethesecondoption.c.Optionone:$10,000/1.2=$8,333.33Optiontwo:$20,000/1.25=$8,037.55Choosethefirstoption.d.YouareindifferentattheratethatequatesthePVsofthetwoalternatives.Youknowthatratemustfallbetween10%and20%becausetheoptionyouwouldchoosediffersattheserates.Letrbethediscountratethatmakesyouindifferentbetweentheoptions.$10,000/(1+r)=$20,000/(1+r)5(1+r)4=$20,000/$10,000=21+r=1.18921r=0.18921=1...