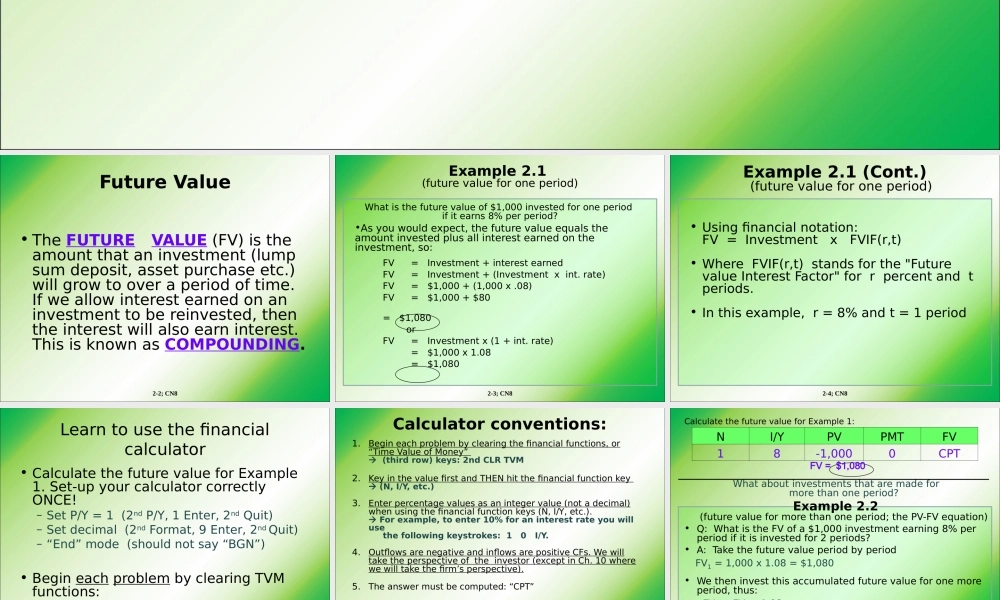

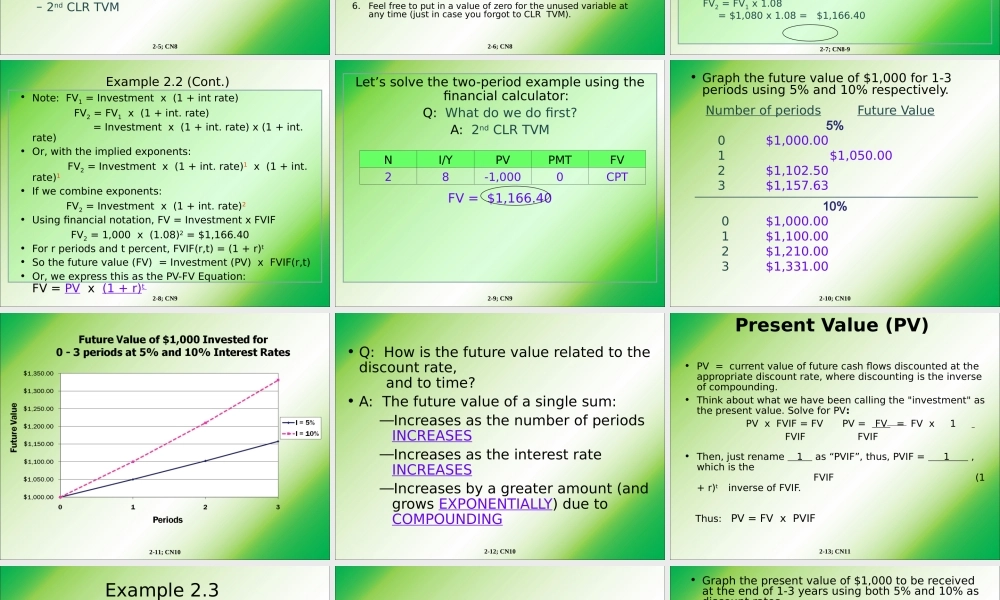

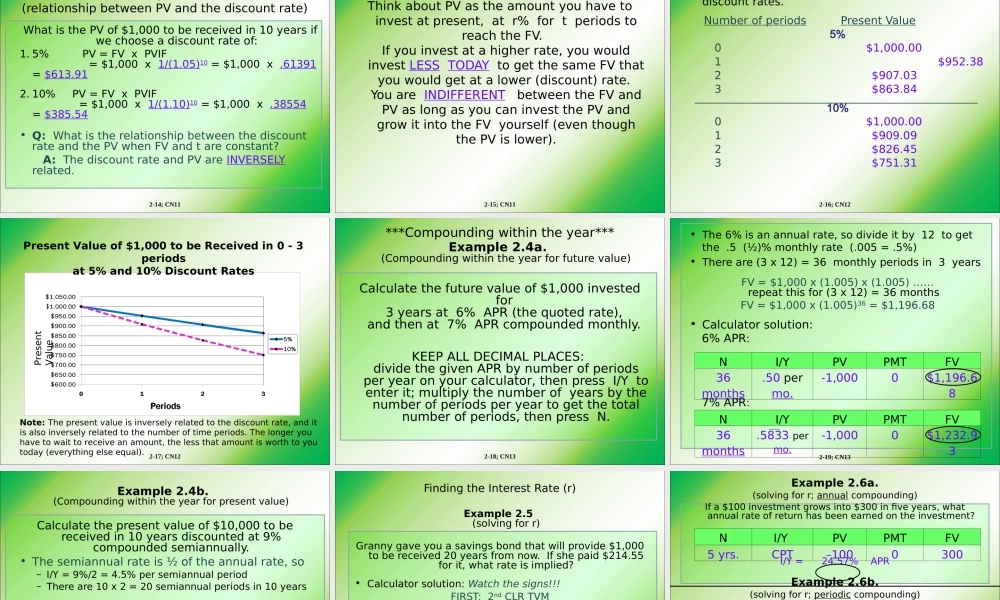

Introduction to Valuation:The Time Value of MoneyFuture Value • The FUTURE VALUE (FV) is the amount that an investment (lump sum deposit, asset purchase etc.) will grow to over a period of time. If we allow interest earned on an investment to be reinvested, then the interest will also earn interest. This is known as COMPOUNDING.2-2; CN8Example 2.1 (future value for one period)What is the future value of $1,000 invested for one period if it earns 8% per period?•As you would expect, the future value equals the amount invested plus all interest earned on the investment, so:FV = Investment + interest earnedFV = Investment + (Investment x int. rate)FV = $1,000 + (1,000 x .08)FV = $1,000 + $80 = $1,080 orFV = Investment x (1 + int. rate) = $1,000 x 1.08 = $1,0802-3; CN8Example 2.1 (Cont.)(future value for one period)• Using financial notation:FV = Investment x FVIF(r,t)• Where FVIF(r,t) stands for the "Future value Interest Factor" for r percent and t periods. • In this example, r = 8% and t = 1 period2-4; CN8Learn to use the financial calculator• Calculate the future value for Example 1. Set-up your calculator correctly ONCE!– Set P/Y = 1 (2nd P/Y, 1 Enter, 2nd Quit)– Set decimal (2nd Format, 9 Enter, 2nd Quit)– “End” mode (should not say “BGN”)• Begin each problem by clearing TVM functions:– 2nd CLR TVM2-5; CN81.Begin each problem by clearing the financial functions, or “Time Value of Money” (third row) keys: 2nd CLR TVM2.Key in the value first and THEN hit the financial function key (N, I/Y, etc.)3.Enter percentage values as an integer value (not a decimal) when using the financial function keys (N, I/Y, etc.). For example, to enter 10% for an interest rat...