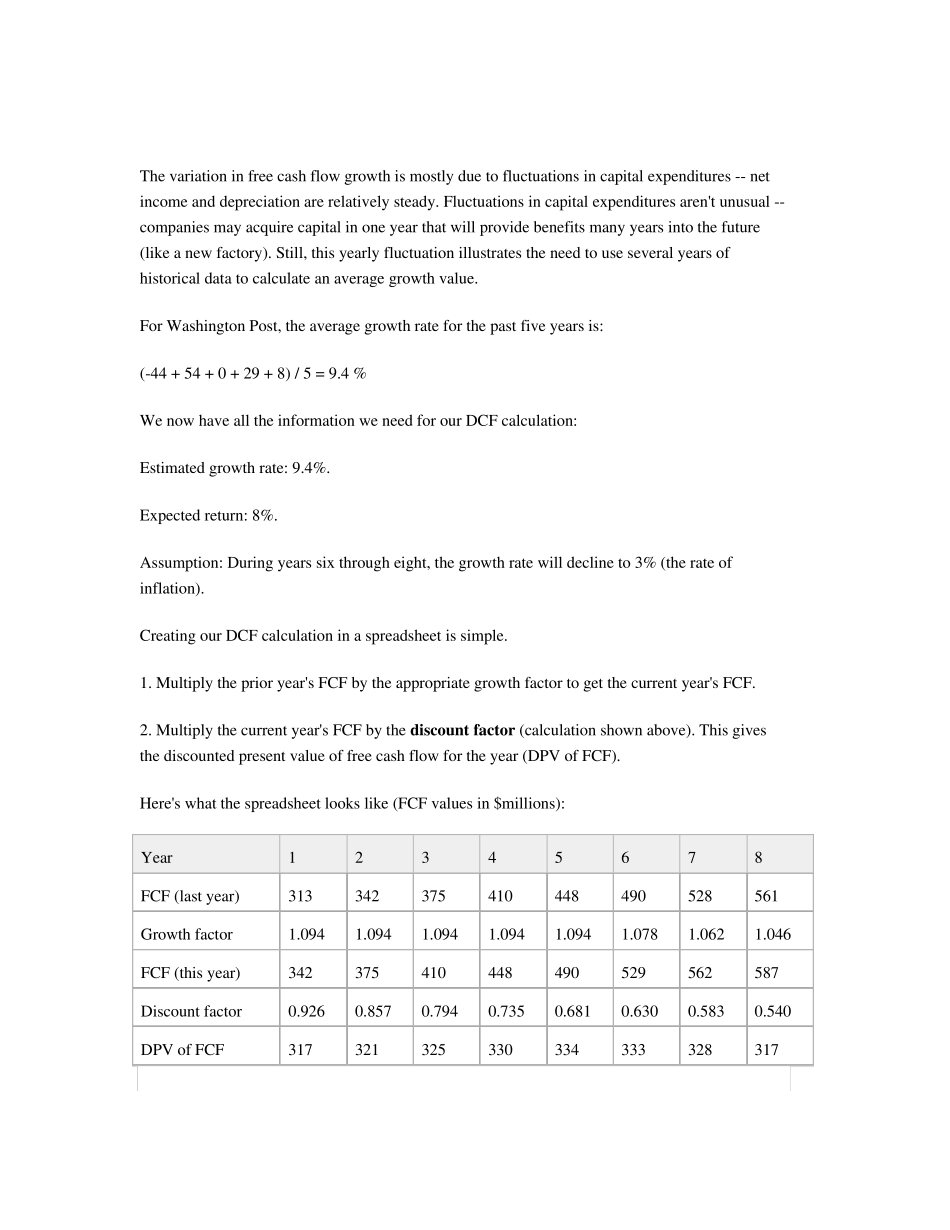

Digging Into Buffett's Numbers By Jim Schoettler | More Articles May 11, 2005 | Comments (2) Discounted Cash Flow (DCF) The concept of Discounted Cash Flow model valuation is straightforward: We discount all future cash flows the company will produce to the present day, add them up, and voila, we have our company valuation. With that, I present The Discounted Cash Flow Equation! DCF = CF0 x SUM[(1 + g)/(1 + r)]n (for x = 0 to n) OK, OK. That's not as pretty as my initial explanation. Here's the basic interpretation: DCF is Discounted Cash Flow, CF0 is today's cash flow, g is expected growth, and r is the expected rate of return. For the many of you who wish that math had ended in third grade, let that suffice -- we will look at how you can easily translate all that gibberish into a spreadsheet in a minute. For those of you who have to know exactly where that equation came from, my previous article is for you. Buffett's DCF valuations As you read that section, I expect some of you were Foolishly thinking, "What kind of cash flows? What kind of growth? What is the expected rate of return? Did I remember to turn off the stove?" Don't worry, you turned off the stove. For the answer to the rest of these questions, we look to Warren Buffett. Cash Flows and Growth: Buffett uses "owner earnings," which he defines as: Owner Earnings = Net Income + Depreciation - Capital Expenditures Sound familiar? It should. This is essentially our beloved free cash flow (FCF)! Obviously, then, it makes sense that the "growth" refers to FCF growth. We estimate future FCF growth from historical FCF growth -- averaging over five or more years to smooth out yearly variations. Expected rate of r...