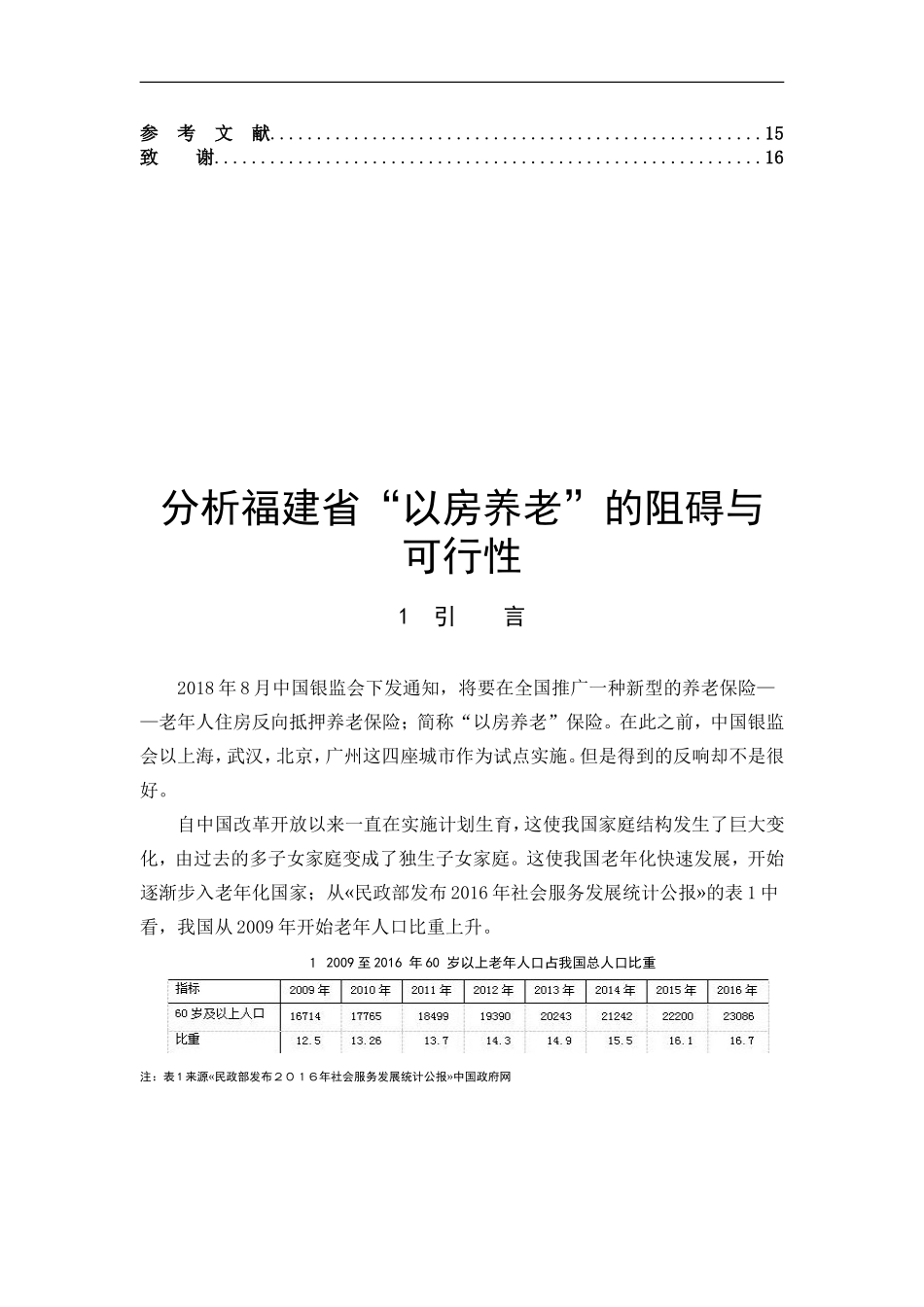

摘 要由于我国改革开放以来,一直实行计划生育,使我国各地区老年化加速,老年人基数在不断加大,面对庞大的老龄人口,我国的养老金出现短缺问题,已经不能支撑这么庞大的老年人口了,也不能够让老年群体有一个美好的晚年了。随着现在经济发展过快,生活压力的加大,让年轻一代的生活压力也在加大,再加上现在二胎政策实施,年轻一代的负担更是加重了许多,单靠儿女养老不仅会给儿女增加负担,也不能保障老人拥有一个较好的晚年生活。而现在中国老人拥有房产率较高,养老储备又不足,老人的生活晚年生活令人堪忧。2014 年我国提出一种新的养老保险——“以房养老”保险(又称“倒按揭”),在广州,北京,上海等一线城市,并在 2018 年向全国推行。本文主要研究这种新型的养老保险——“以房养老”保险在福建省的可行性与实施的障碍,并提出一些解决建议。关键词:“以房养老”;老龄化;可行性 AbstractSince China ’s reform and opening up, it has been implementing family planning, which has accelerated the aging of various regions of our country. The number of elderly people is increasing. Faced with a large aging population, China ’s pensions are in shortage and cannot support such a large population of elderly people. , Can not let the elderly group have a good old age. With the rapid development of the current economy, the pressure of life is increasing, and so is the pressure of the younger generation. Coupled with the implementation of the second child policy, the burden on the younger generation has increased a lot. Increasing the burden on children does not guarantee the elderly to have a better life in old age. And now the elderly in China have a high rate of real estate ownership, but the pension reserves are not enough. The life of the elderly in old age is worrying. In 2014, China proposed a new kind of old-age insurance-"Household Pension" insurance (also known as "reverse mortgage"), which was launched in first-tier cities such as ...