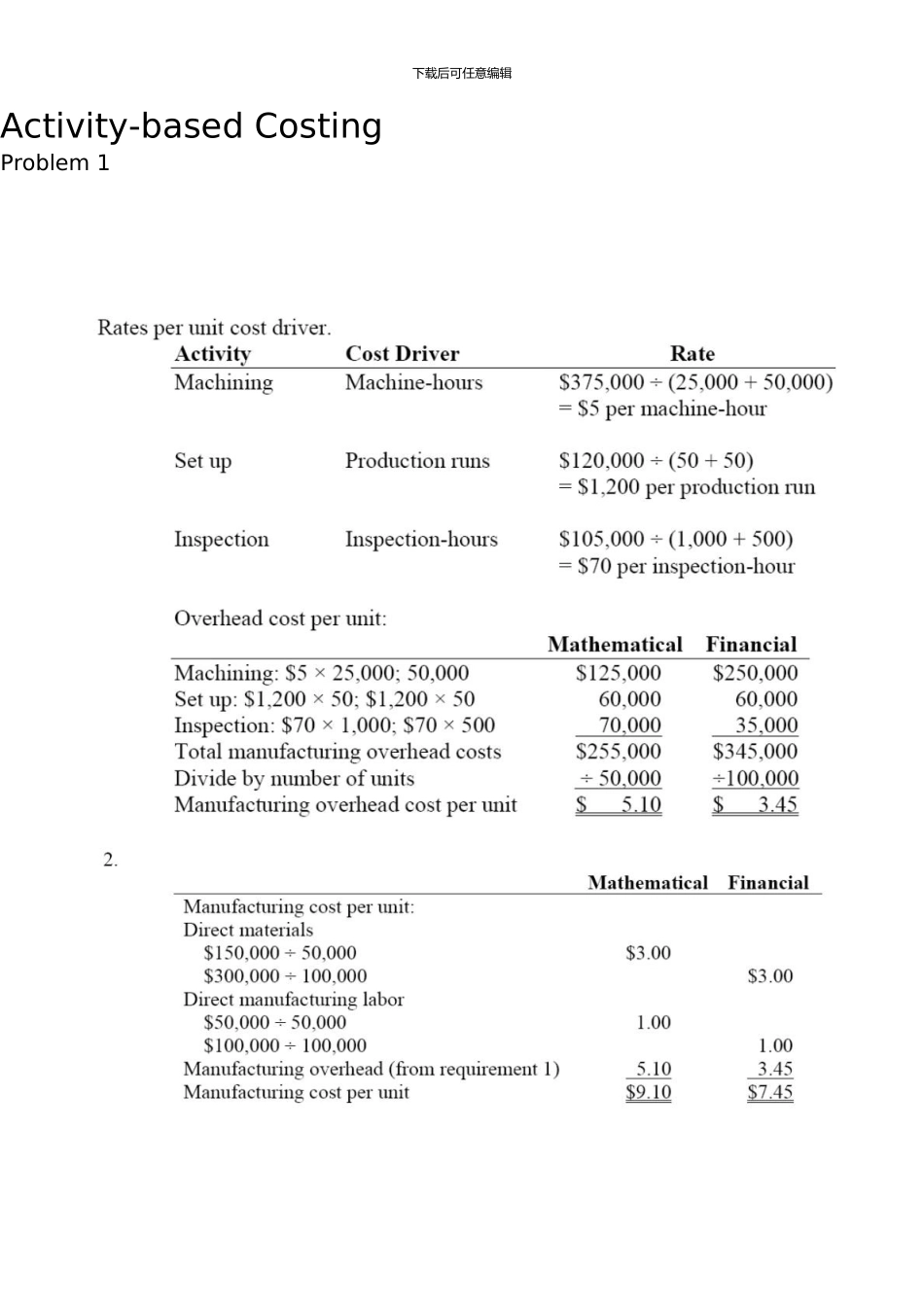

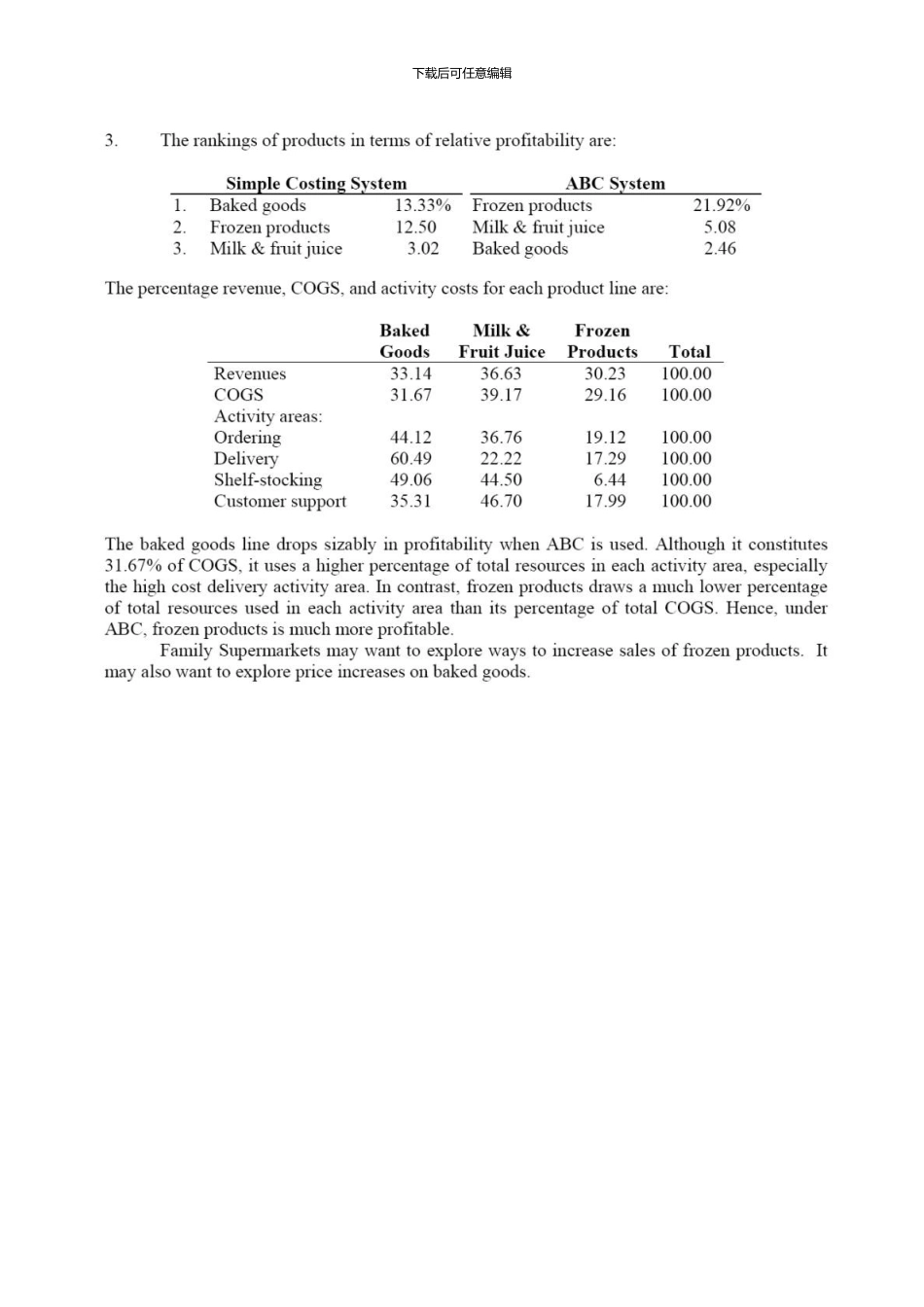

下载后可任意编辑 Activity‐based CostingProblem 1下载后可任意编辑 Problem 2下载后可任意编辑 下载后可任意编辑 Problem 31Total overhead:$520,000Costunitper$2.00Number of units260,000A2KTotal160,000 x 2.00100,000 x 2.00Total allocated$320,000$320,000200,000$520,000200,000$320,000A$200,000KTotal overheadNumber of unitsCost per unit$320,000160,000$2$200,000100,000$23ActivityAllocation$164,00040Cost per cost driver$4,100 per setupProduction setupsCostNumber of setupsMaterial handlingPackaging CostsCost$96,000160$600$1下载后可任意编辑per partNumber of partsCost$260,000260,000per partNumber of unitsProduction setups16 x $4100; 24 x $4100Material Handling112 x $600; 48 x $600PackagingAKTotal$65,600$98,400$164,00067,20028,80096,000160,000 x $1; 100,000 x $1Total cost allocated160,000100,000260,0004$292,800$227,200$520,000Total cost allocatedNumber of unitsCost per unit$292,800160,000$227,200100,000$1.83$2.275. A cost driver base is a measurable cause or driver ofperforming an activity. Increases or decreases of the cost driver base cause increases or decreases in the level of activity performed. Although it is easy to compute average costs of all types of resources over many activities, as in allocating all overhead according to the number of units produced, doing so may greatly distort the use of resources by activities and the cost of individual products and services. 下载后可任意编辑 Problem 5下载后可任意编辑 下载后可任意编辑