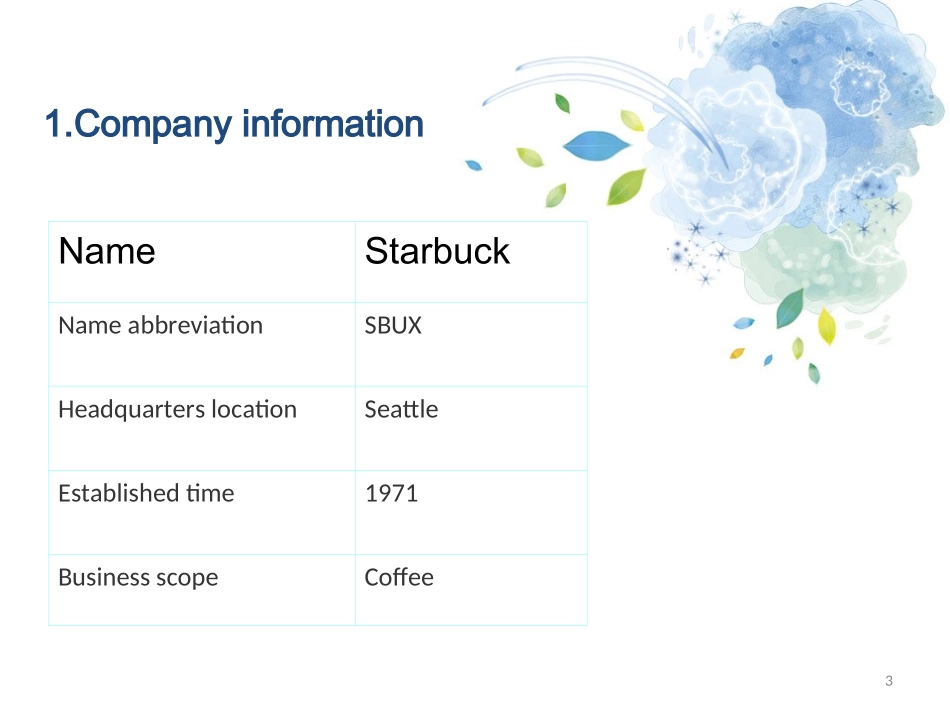

2013AnnualReportStarbuckcorporation1Chapter1CompanyProfile21.CompanyinformationNameStarbuckNameabbreviationSBUXHeadquarterslocationSeattleEstablishedtime1971BusinessscopeCoffee32.Basicsituationintroduction•Starbucksisaname,achainofAmericanCoffeecompanywasfoundedin1971,istheworld'slargestCoffe•echainstores,theheadquartersislocatedinSeattlecityAmericaWashingtonstate.RetailproductsStarbucksincludesmorethan30topglobalCoffeebeans,HandmadeallkindsofpastriesfoodconcentrationCoffeeandavarietyofCoffeehotandcolddrinks,freshanddeliciousandCoffeemachine,avarietyofCoffeecupmerchandise.Nearly12000branchesthroughoutNorthAmerica,SouthAmerica,Europe,theMiddleEastandthePacificregionStarbuckshasintheglobalscope.43.OtherinformationStockcode04337TotalnumberofHShare730600000ChairmanHowardSchultzBoardofdirectorHowardSchultz、OrinCSmith、BarbaraBass、HowardBehar、WilliamW.Bradley、CraigJ.Foley、OldenLee、GregoryB.Maffei、ArlenI.Prentice、JamesG.ShennanJr、MyronE.UllmanIII、CraigE.Weatherup5Chapter2Companyriskdescriptionandfutureplans6•Starbucksinrecentyears,withtherapidexpansionofscaletoreducecostsandothermeasures,storelocationdesign,stafftraining,etcdamagingly,moreandmorecustomersfindStarbucksadeclineinthequalityofservice,theoriginalexperienceofculturegraduallyfade.ScalerapidexpansiondidnotbringStarbucksperformanceandbrandofthesynchronizinglifting,endangeritshealthydevelopment.Hadtoshutdownoneofsurvivalpressure,Starbucksstores,redundancy,andenergyintoaimedattoimprovethecustomerexperience"Starbucks"revivalplan.1.Risk72.Plans⑴Contractionfront,buildbrandwithscarceplace;⑵Todevelopnewproducts;⑶Holdingscontinuedtopromotethecompetitivenessoftheservice;⑷Interactivemarketing,dualexperience;⑸Industrycooperation,cross-sellingsublimationcustomervalue;⑹Interweave,strengthengroupmarketingwithcustomers.8Chapter3FinancialAnalysis9⑴LiquidityofShort–TermAssets•Theratioanalysisthroughthefinancialstatementdata,abilitycanreflectthecorporateliquidity,leverageanddebt,soastoletusknowthatthefinancialsituationofenterprisesandfinancialrisk,dataareasfollows:10CurrentRatioYearsEndedMay31,2013and2011(Inmillions)2,0132,0122,011Currentassets[A]5,471.004,200.003,795.00Currentliabilities[B]5,377.002,210.002,076.00Currentradio[A÷B]1.022.091.83①CurrentRatio1112Starbucksthreeyearsthisliquidityratioroseafterthefirstdown.In2013,theliquidityratioStarbuckswas1.02,thelowestforthreeyears.Theabovedata,Starbucksshort-termdebtpayingabilityhasdeclined.Usually,highliquidityratiomeanshighliquidity,however,companiesshouldnotpursuethehighflowrate,becauseahighlevelofliquidassetsistheneedtospendmorecost.QuickRatioYearsEndedMay31,2013and2011Inmillions201320122011Remainingcurrentassets[A]379525232437Currentliabilities[B]537722102076Acid-Testratio[A÷B]0.711.141.17②QuickRatio13Thisratioisusedtomeasurethecompany'sabilitytorepaydebtsquickly,Starbucksquickratioislowanddeclining,fromthecompany'soveralldevelopment,thismayberelatedtothegrowthoftheinventory,accountsreceivable.14WorkingCapitalYearsEndedMay31,2013and2011(Inmillions)201320122011Currentassets[A]547142003795Currentliabilities[B]537722102076WorkingCapital[A-B]9421901719③WorkingCapital15Starbucksworkingcapitalfor94,2013,fellby95.7%onthepreviousperiod,thisisduetothecurrentliabilitiesin2013andgrewby43.3%lastyear.16EvaluationofLiquidityofShort–TermAssetsTheabovec...