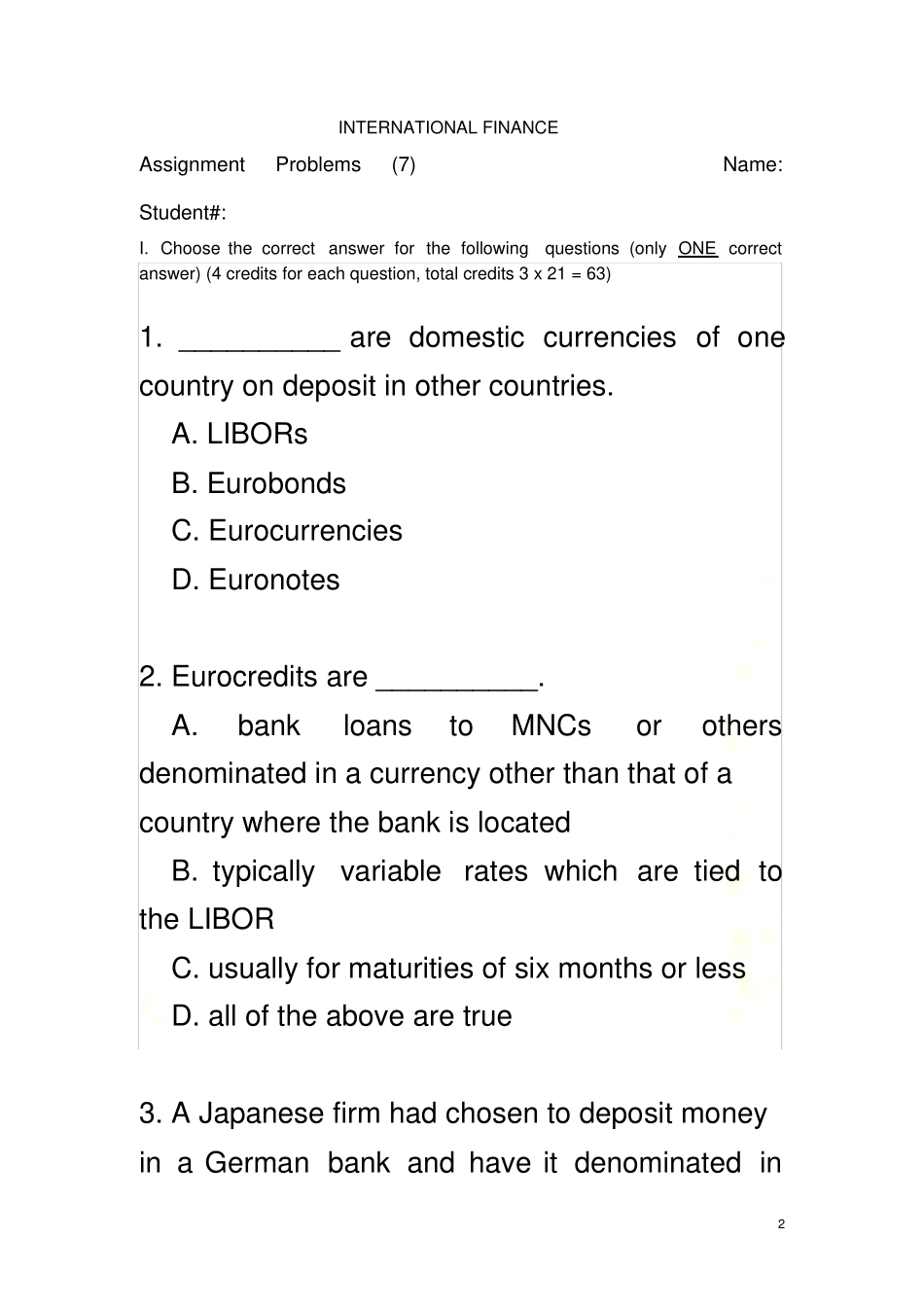

英 文 版 国 际 金 融 练 习 题Chapter-7 2 INTERNATIONAL FINANCE Assignment Problems (7) Name: Student#: I. Choose the correct answer for the following questions (only ONE correct answer) (4 credits for each question, total credits 3 x 21 = 63) 1. __________ are domestic currencies of one country on deposit in other countries. A. LIBORs B. Eurobonds C. Eurocurrencies D. Euronotes 2. Eurocredits are __________. A. bank loans to MNCs or others denominated in a currency other than that of a country where the bank is located B. typically variable rates which are tied to the LIBOR C. usually for maturities of six months or less D. all of the above are true 3. A Japanese firm had chosen to deposit money in a German bank and have it denominated in 3 Japanese yen, this is an example of a __________ deposit. A. Eurobond B. Euronote C. Euroyen D. foreign yen 4. If a bond is issued by a domestic borrower, denominated by domestic currency, marketed and regulated by domestic monetary authorities, this is a __________. A. foreign bond B. Eurobond C. domestic bond D. global bond 5. A bond that trades in the Eurobond market as well as in one or more national bond markets is a __________. A. Eurobond B. global bond C. foreign bond 4 D. domestic bond 6. __________ are issued in a domestic market by a foreign borrower, denominated in domestic currency, marketed to domestic residents, and regulated by domestic authorities. A. foreign bonds B. Eurobonds C. domestic bonds D. Yankee bonds 7. The Federal National Mortgage Association (Fannie Mae) issued a dollar-denominated bond with a 7.25% annual coupon and a maturity date in 2030 to non-U.S. investors in an external market. This bond is typically ...