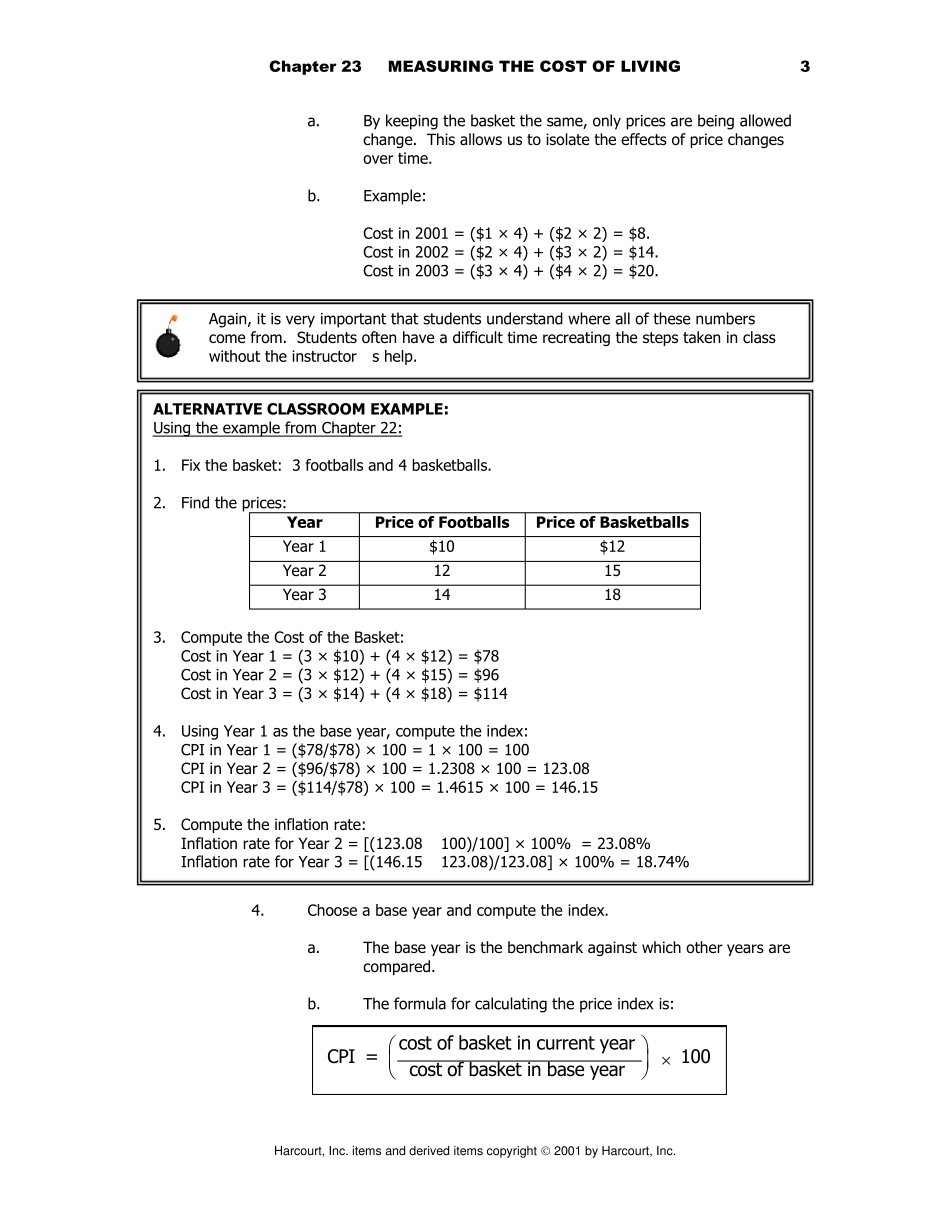

Harcourt, Inc. items and derived items copyright 2001 by Harcourt, Inc. WHAT’S NEW: The In the News box on “Mr. Index Goes to Hollywood” has been updated and is now a Case Study with a Web site reference where students can obtain continually updated information. There is also a new In the News box on “A CPI for Senior Citizens.” LEARNING OBJECTIVES: By the end of this chapter, students should understand: how the consumer price index (CPI) is constructed. why the CPI is an imperfect measure of the cost of living. how to compare the CPI and the GDP deflator as measures of the overall price level. how to use a price index to compare dollar figures from different times. the distinction between real and nominal interest rates. KEY POINTS: 1. The consumer price index shows the cost of a basket of goods and services relative to the cost of the same basket in the base year. The index is used to measure the overall level of prices in the economy. The percentage change in the price level measures the inflation rate. 2. The consumer price index is an imperfect measure of the cost of living for three reasons. First, it does not take into account consumers’ ability to substitute toward goods that become relatively cheaper over time. Second, it does not take into account increases in the purchasing power of a dollar due to the introduction of new goods. Third, it is distorted by unmeasured changes in the quality of goods and services. Because of these measurement problems, the CPI overstates annual inflation by about 1 percentage point. 3. Although the GDP deflator also measures the overall level of prices in the economy, it differs from the consumer price index...