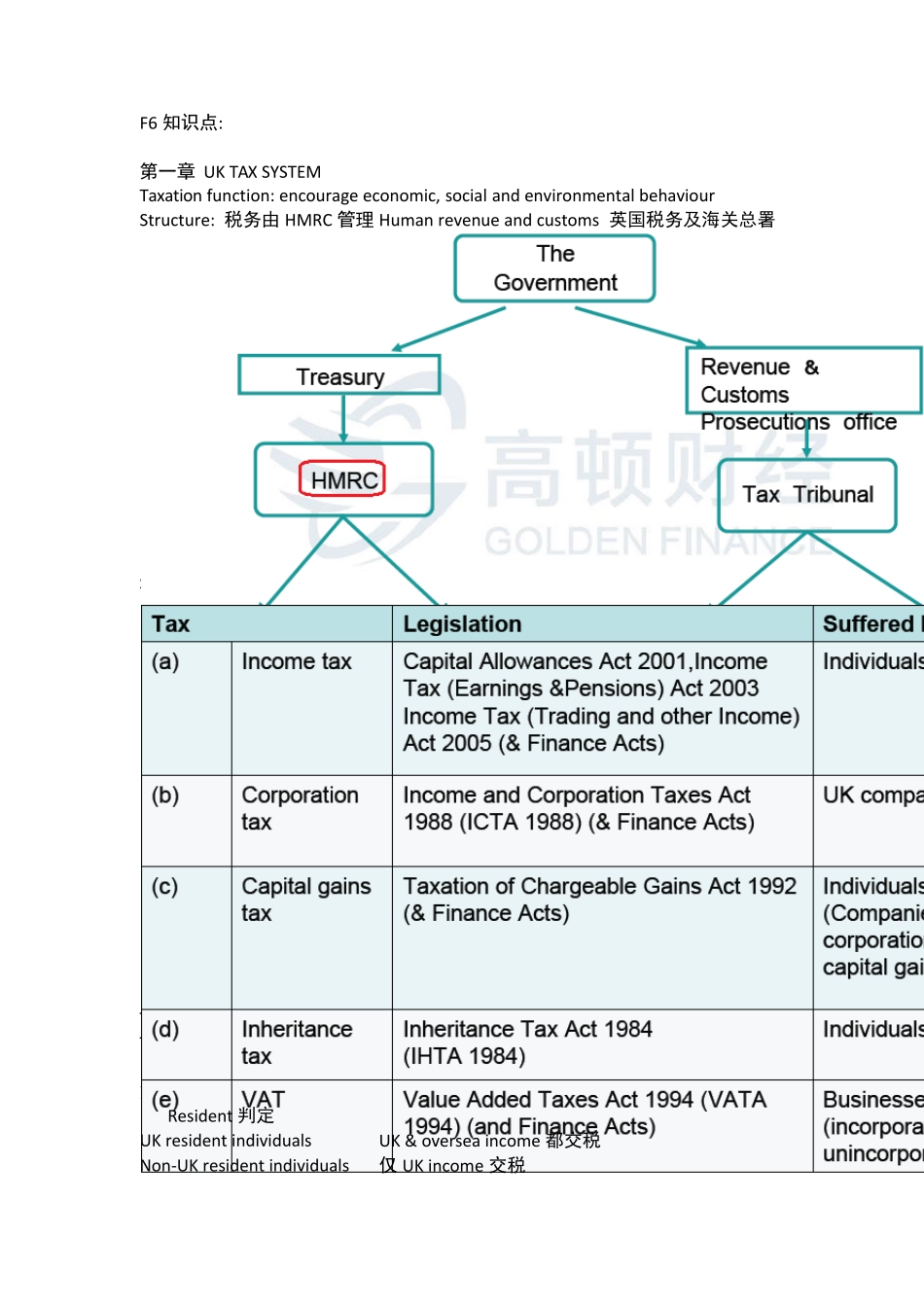

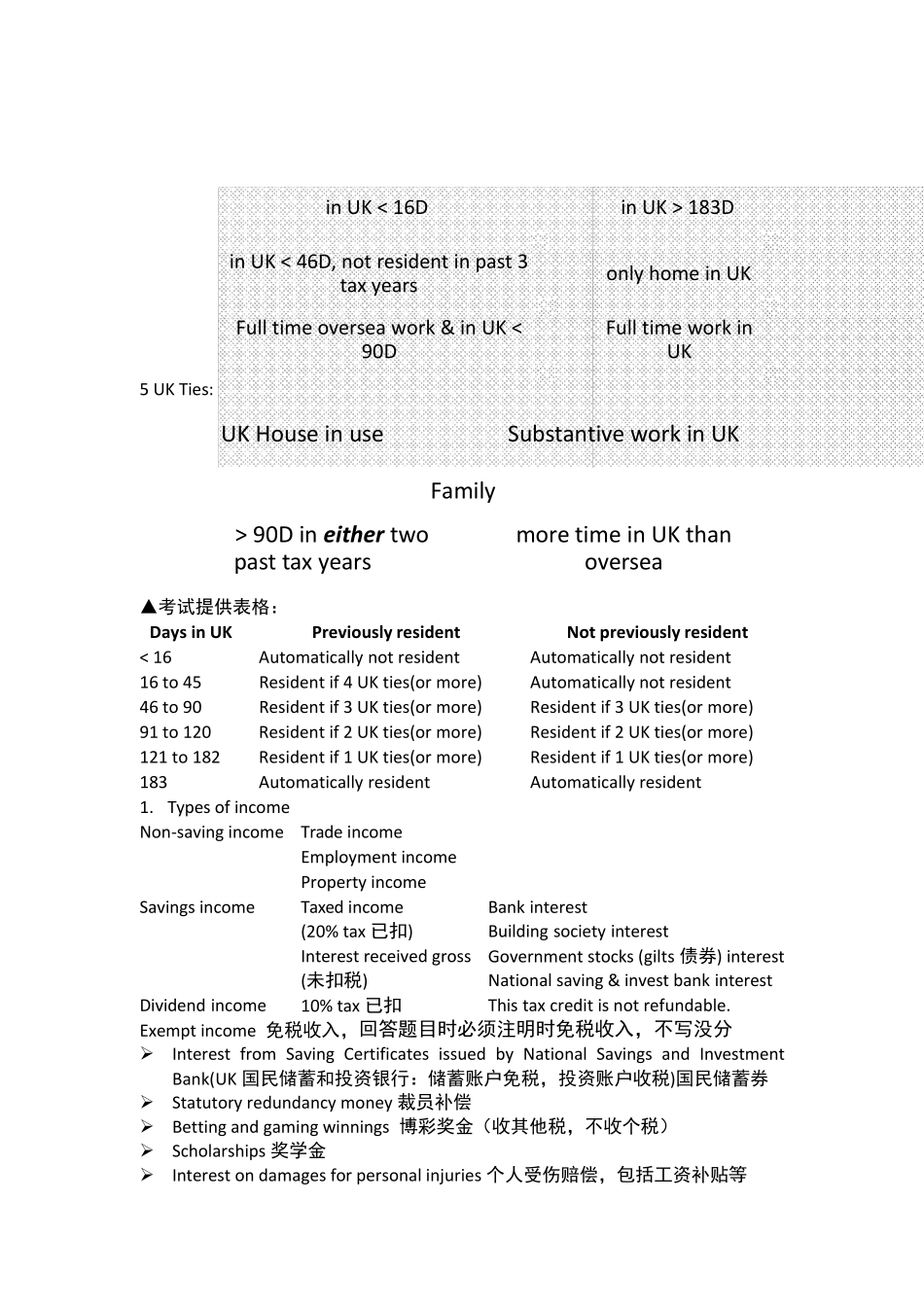

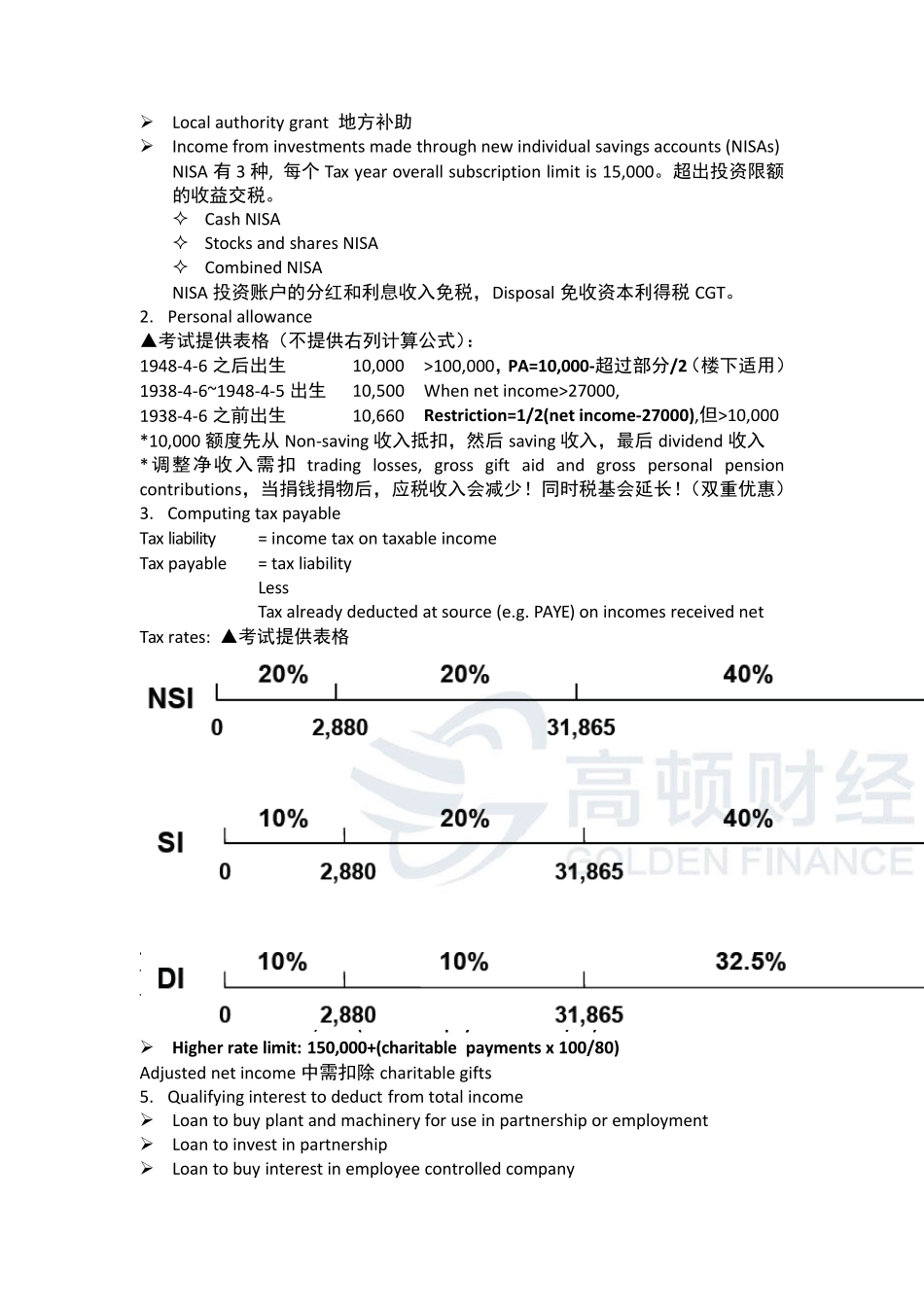

F6 知识点: 第一章 UK TAX SYSTEM Taxation function: encourage economic, social and environmental behaviour Structure: 税务由 HMRC 管理 Human revenue and customs 英国税务及海关总署 Source of law 立法 Finance Act 每年更新税率 Tax year: April 6th to April 5th Tax evasion is illegal 逃税非法 & Tax avoidance is legal 合理避税合法 第二章 Computation of taxable income and income tax liability 1. Resident 判定 UK resident individuals UK & oversea income 都交税 Non‐UK resident individuals 仅 UK income 交税 5 UK Ties: ▲考试提供表格: Days in UK Previously resident Not previously resident < 16 Automatically not resident Automatically not resident 16 to 45 Resident if 4 UK ties(or more) Automatically not resident 46 to 90 Resident if 3 UK ties(or more) Resident if 3 UK ties(or more) 91 to 120 Resident if 2 UK ties(or more) Resident if 2 UK ties(or more) 121 to 182 Resident if 1 UK ties(or more) Resident if 1 UK ties(or more) 183 Automatically resident Automatically resident 1. Types of income Non‐saving incomeTrade income Employment income Property income Savings income Taxed income (20% tax 已扣) Bank interest Building society interest Interest received gross(未扣税) Government stocks (gilts 债券) interestNational saving & invest bank interest Dividend income 10% tax 已扣 This tax credit is not refundable. Exempt income 免税收入,回答题目时必须注明时免税收入,不写没分 Interest from Saving Certificates issued by National Savings and Investment Bank(UK 国民储蓄和投资银行:储蓄账户免税,投资账户收税)国民储蓄券 Statutory redundancy money 裁员补偿 Betting and gaming winnings 博彩奖金(收其他税,不收个税) Scholarships 奖学金 Interest on damages for personal injuries 个人受伤赔偿,包括工资补贴等 in UK < 16Din UK < 46D,...