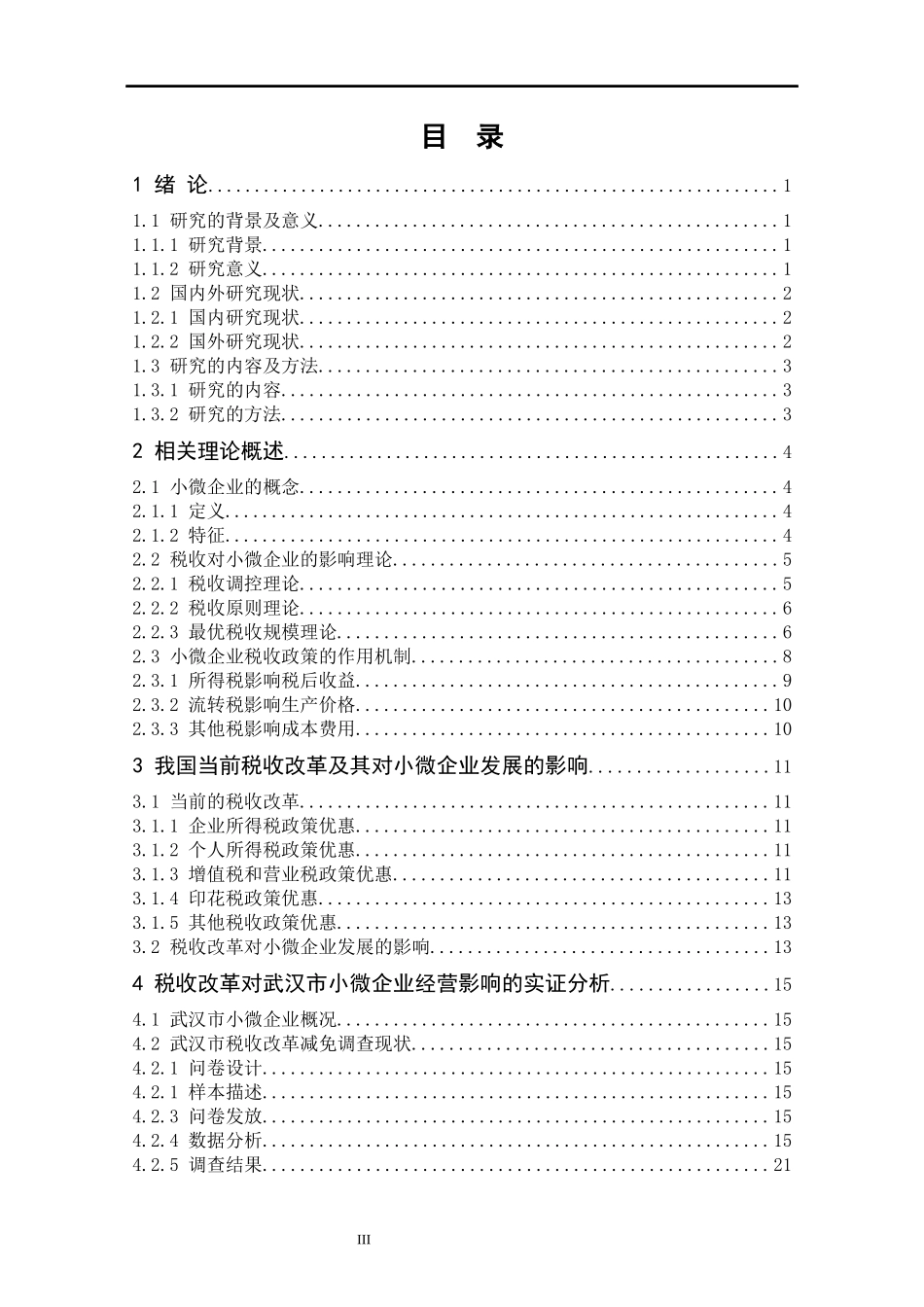

I税收改革对武汉市小微企业经营影响研究摘 要在国民经济中,小微企业的作用越来越突出,它是推动技术革新、经济增长、就业扩大的主体。不过随着经济危机的不断加深,通货膨胀是不断深化,使得人力和原材料成本等迅速上涨,加之可获得信用贷款资源十分有限,需要缴纳的税款过重,极大地威胁着小微企业的生存和发展环境。为此,政府出台了各项税收改革方案,以促进小微企业发展。本文关于税收改革如何影响小微企业发展的研究,主要分为以下五部分,首先是绪论,主要介绍选题的背景及意义;第二部分介绍税收对小微企业的影响理论和税收政策的作用机制;第三部分是关于我国当前税收政策的改革及小微企业发展情况的影响分析;第四部分以武汉市为例证,探讨税收改革对武汉市小微企业经营的影响,通过对武汉小微企业进行实地调研可以得知,税收改革将会严重影响小微企业发展,得出税收改革确实对小微企业发展有很大影响的结论;第五部分是文章结尾,从税收政策对小微企业发展的影响中,分析其中存在的问题并提出相应的改进方案。关键词:税收改革;武汉市;小微企业;经营影响IIA Study on the Impact of tax Reform on the Management of Small and Micro Enterprises in WuhanABSTRACTSmall and micro enterprises play a more and more important role in the national economy. They are the main promoters of technological innovation, economic growth and employment expansion. However, with the deepening of economic crisis and inflation, the cost of raw materials is increasing, and the available credit resources are limited, and under the background of excessive tax burden, the survival environment of small and micro enterprises is not optimistic. In response, the government issued a series of tax incentives to support the development of small and micro enterprises. This paper mainly through four parts to explain the impact of tax incentives to promote the development of small and micro enterprises. The first part is the introduction, which mainly introduces the characteristics of the definition of small and micro enterpris...