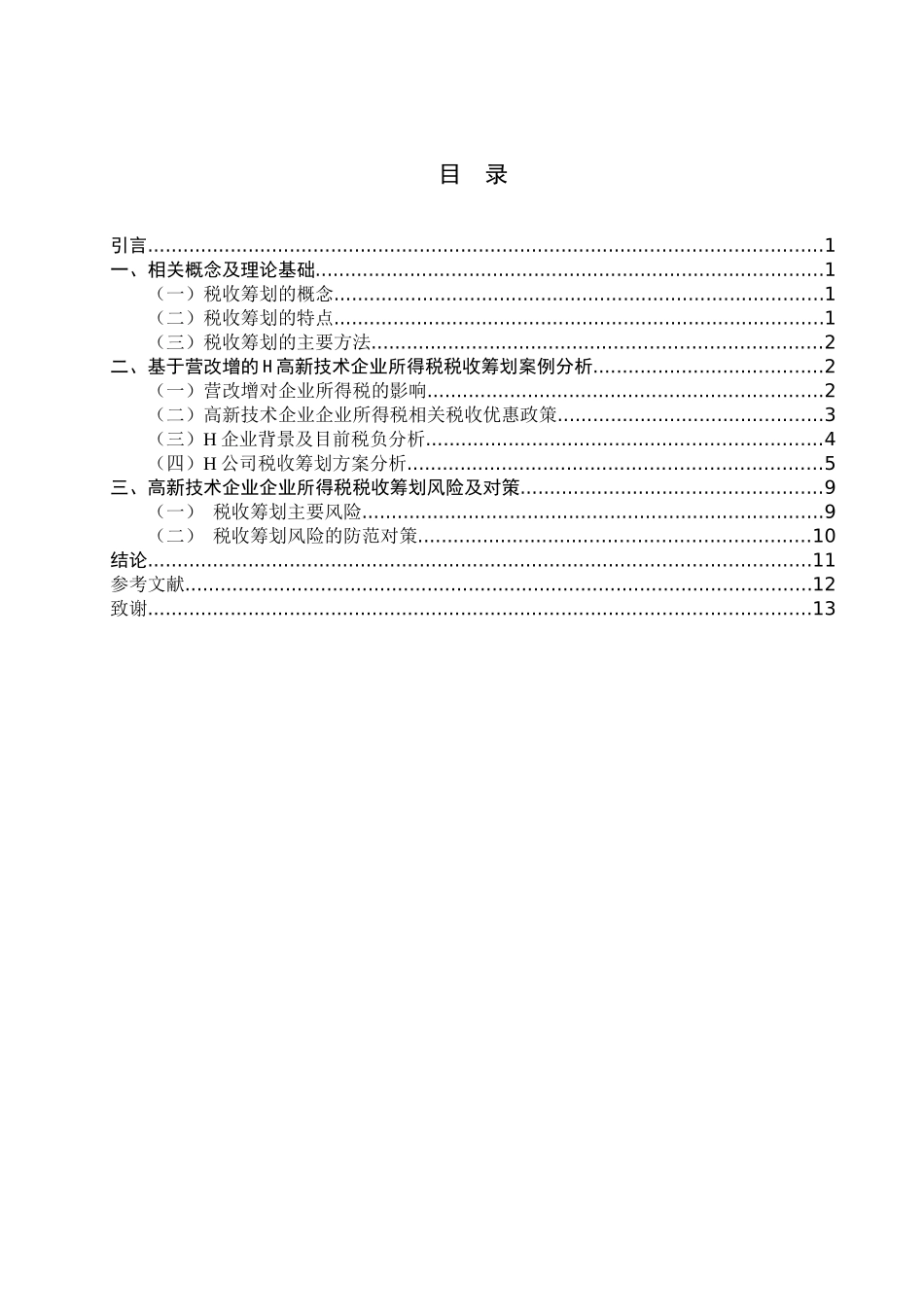

营改增下高新技术企业所得税税收筹划分析——以 H 企业为例摘 要税收筹划最初是起源自 19 世纪的意大利,距今已有 100 多年历史。自 20 世纪中期以来,为了追求自身价值最大化,各个纳税人逐渐加大了对税收筹划的关注与重视。伴随资本市场的发展,税收筹划逐渐被认可为纳税人的权利,并且成为企业发展战略中一个重要的影响因素。在如今科技强国的时代下,尤其是“营改增”背景下,我国针对高新技术企业的税收优惠政策力度逐渐加大,企业在发展的同时进行合理避税以满足企业价值最大化的目标成为一项重要工作。因此,本文在税收筹划与企业所得税税收优惠政策的基本理论基础上,将以 H 企业为例进行展开分析高新技术企业可能运用的税收筹划方法以及可能面临的风险及相应的保障措施。在此基础上,得出本文的结论并为高新技术企业在“营改增”后企业所得税税收筹划提供一些建议。关键词:税收筹划;营改增;高新技术企业;企业所得税A Brief Study of the Relationship between Tax Planning and Earnings ManagementAbstractTax planning which has over 100 years history is originated from Italy in 19th century. Since the mid of 20th century, each taxpayer has been gradually concentrate more on tax planning to pursue the maximum of self-valued. With the development of capital market, it is gradually to be accepted by public that tax planning is a right of taxpayers and becomes one of important factor on the development of strategies in companies. In today's era of science and technology, especially under the background of VAT reform, China's preferential taxation policies are more likely to pay attention to high-tech enterprises. Meanwhile, it has become an significant task for enterprises to reasonably avoid tax to meet the goal of maximizing enterprise value while developing. Therefore, based on the relative theory of tax planning and corporate income tax incentives, this paper will combine with the case study of H Company to analyze the means of tax planning in high-te...