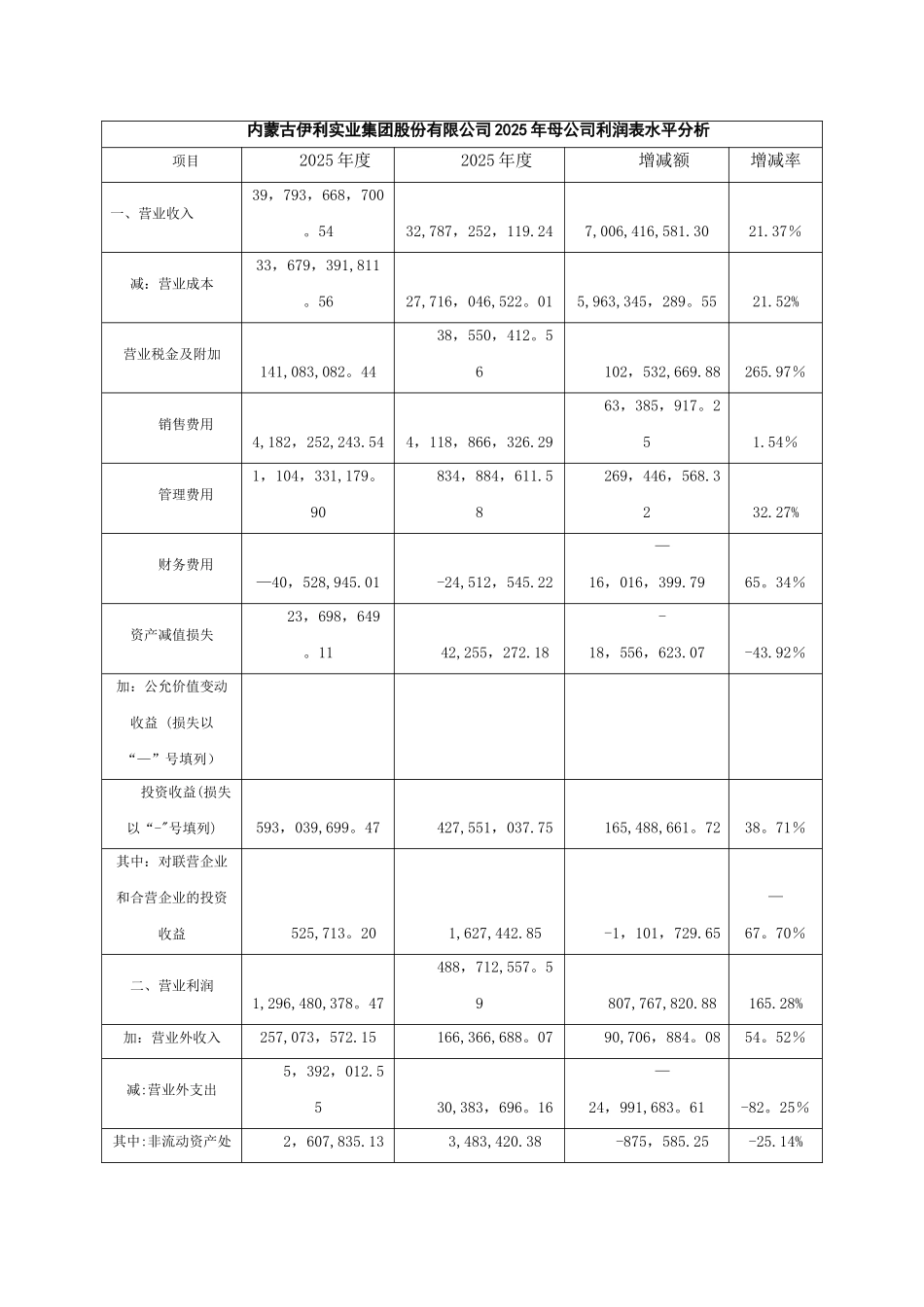

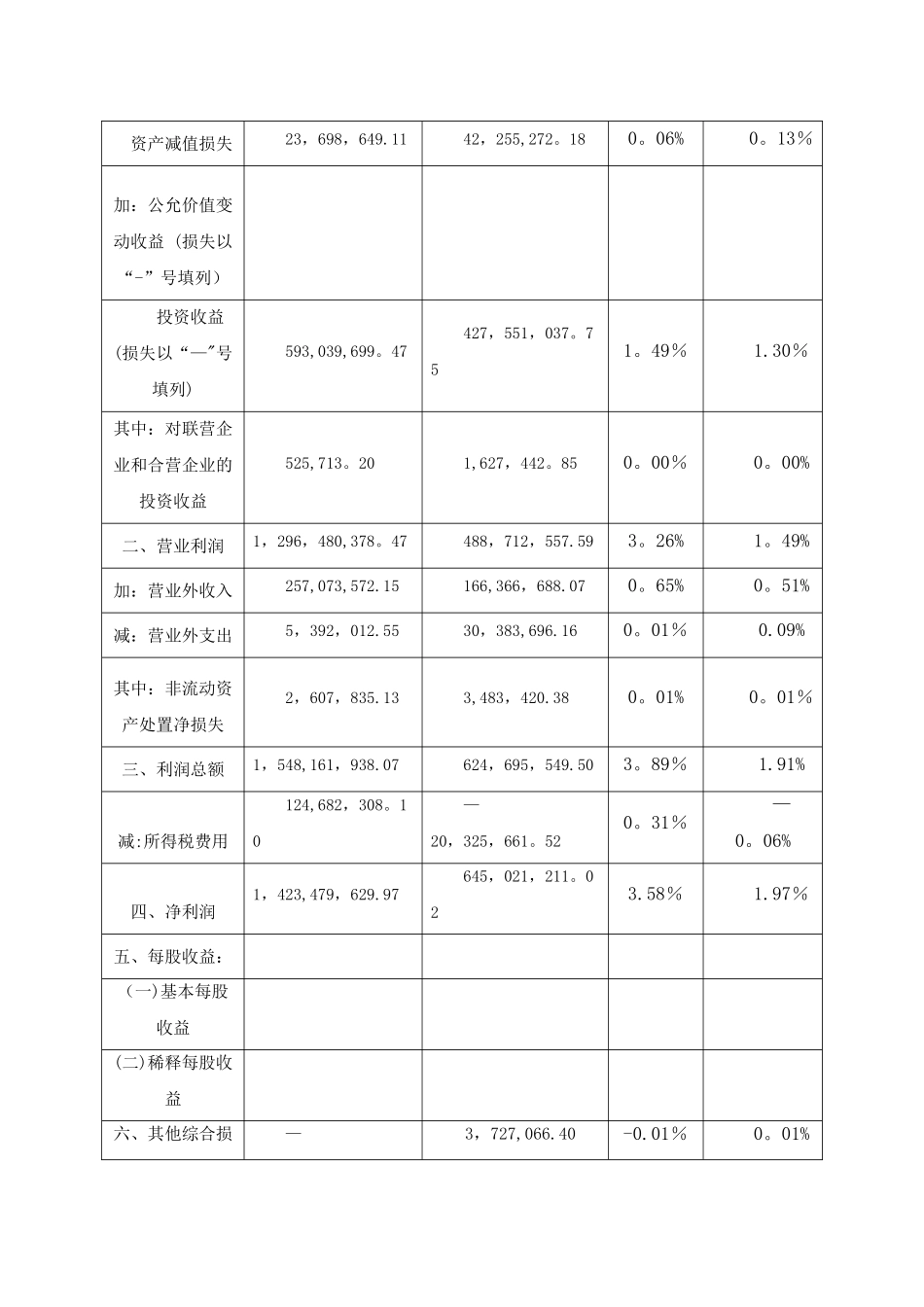

内蒙古伊利实业集团股份有限公司 2025 年母公司利润表水平分析项目2025 年度2025 年度增减额增减率一、营业收入39,793,668,700。5432,787,252,119.247,006,416,581.3021.37%减:营业成本33,679,391,811。5627,716,046,522。015,963,345,289。5521.52%营业税金及附加141,083,082。4438,550,412。56102,532,669.88265.97% 销售费用4,182,252,243.544,118,866,326.2963,385,917。251.54% 管理费用1,104,331,179。90834,884,611.58269,446,568.3232.27% 财务费用—40,528,945.01-24,512,545.22—16,016,399.7965。34%资产减值损失23,698,649。1142,255,272.18-18,556,623.07-43.92%加:公允价值变动收益 (损失以“—”号填列) 投资收益(损失以“-"号填列)593,039,699。47427,551,037.75165,488,661。7238。71%其中:对联营企业和合营企业的投资收益525,713。201,627,442.85-1,101,729.65—67。70%二、营业利润1,296,480,378。47488,712,557。59807,767,820.88165.28%加:营业外收入 257,073,572.15166,366,688。0790,706,884。0854。52%减:营业外支出5,392,012.5530,383,696。16—24,991,683。61-82。25%其中:非流动资产处2,607,835.133,483,420.38-875,585.25-25.14%置净损失三、利润总额1,548,161,938.07624,695,549.50923,466,388。57147.83%减:所得税费用124,682,308。10-20,325,661.52145,007,969.62-713。42%四、净利润1,423,479,629。97645,021,211.02778,458,418。95120。69%五、每股收益:(一)基本每股收益0.00(二)稀释每股收益0.00六、其他综合损失—2,906,211。203,727,066。40—6,633,277。60-177.98%七、综合收益总额1,420,573,418.77648,748,277.42771,825,141。35118。97%内蒙古伊利实业集团股份有限公司 2025 年母公司利润表水平分析内蒙古伊利实业集团股份有限公司 2025 年母公司利润表水平分析项目2025 年度2025 年度结构20252025一、营业收入39,793,668,700.5432,787,252,119.24100。00%100。00%减:营业成本33,679,391,811.5627,716,046,522。0184。64%84.53% 营业税金及附加141,083,082。4438,550,412。560.35%0。12% 销售费用4,182,252,243。544,118,866,326.2910。51%12。56% 管理费用1,104,331,179。90834,884,611。582.78%2.55% 财务费用-40,528,945。01—24,512,545。22-0.10%-0.07% 资产减值损失2...