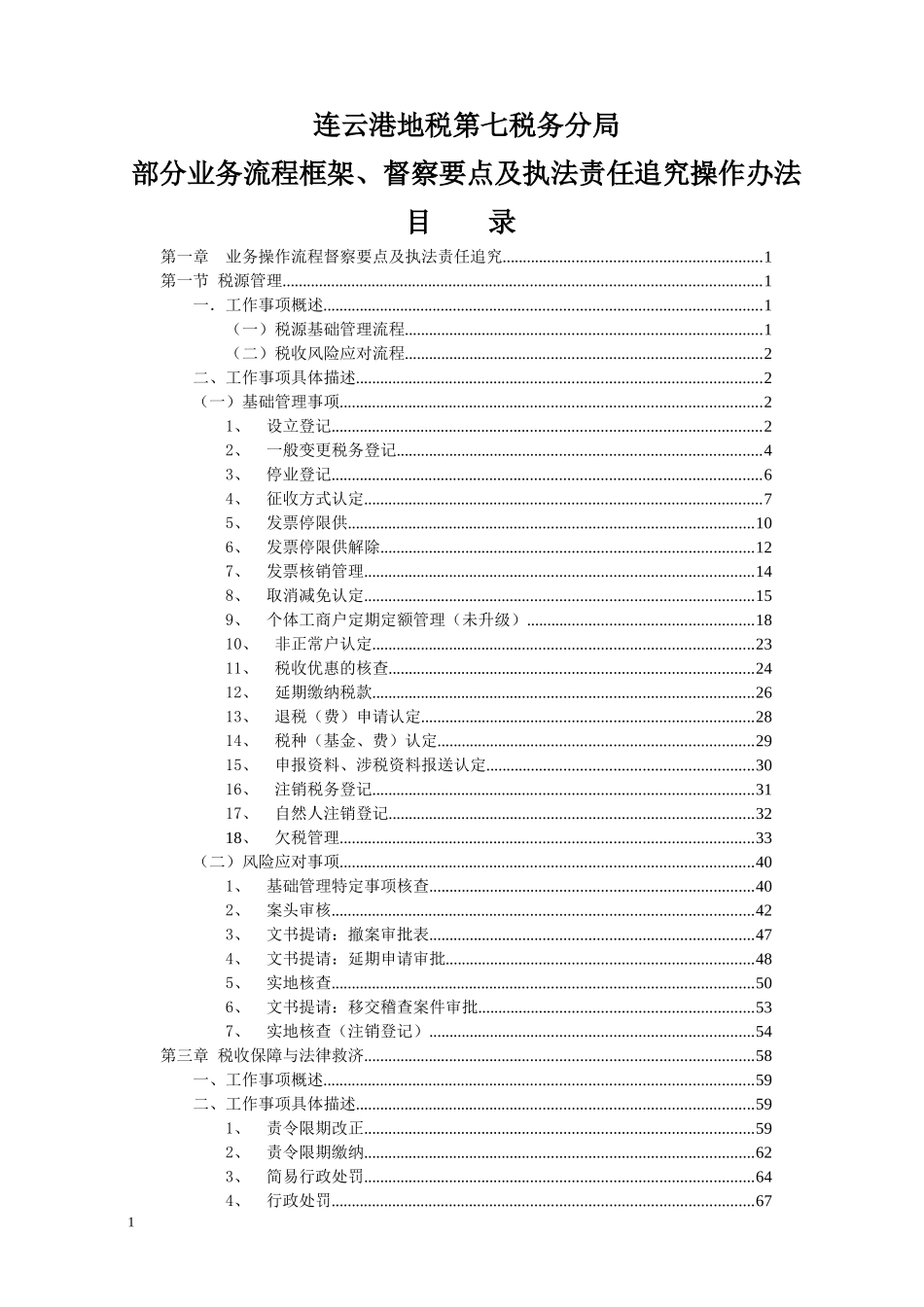

连云港地税第七税务分局部分业务流程框架、督察要点及执法责任追究操作办法目录第一章业务操作流程督察要点及执法责任追究...............................................................1第一节税源管理.....................................................................................................................1一.工作事项概述...........................................................................................................1(一)税源基础管理流程.......................................................................................1(二)税收风险应对流程.......................................................................................2二、工作事项具体描述...................................................................................................2(一)基础管理事项.......................................................................................................21、设立登记.........................................................................................................22、一般变更税务登记.........................................................................................43、停业登记.........................................................................................................64、征收方式认定.................................................................................................75、发票停限供...................................................................................................106、发票停限供解除...........................................................................................127、发票核销管理...............................................................................................148、取消减免认定...............................................................................................159、个体工商户定期定额管理(未升级).......................................................1810、非正常户认定.............................................................................................2311、税收优惠的核查.........................................................................................2412、延期缴纳税款.............................................................................................2613、退税(费)申请认定.................................................................................2814、税种(基金、费)认定.............................................................................2915、申报资料、涉税资料报送认定.................................................................3016、注销税务登记.............................................................................................3117、自然人注销登记.........................................................................................3218、欠税管理.....................................................................................................33(二)风险应对事项.....................................................................................................401、基础管理特定事项核查...............................................................................402、案头审核.......................................................................................................423、文书提请:撤案审批表...............................................................................474、文书提请:延期申请...