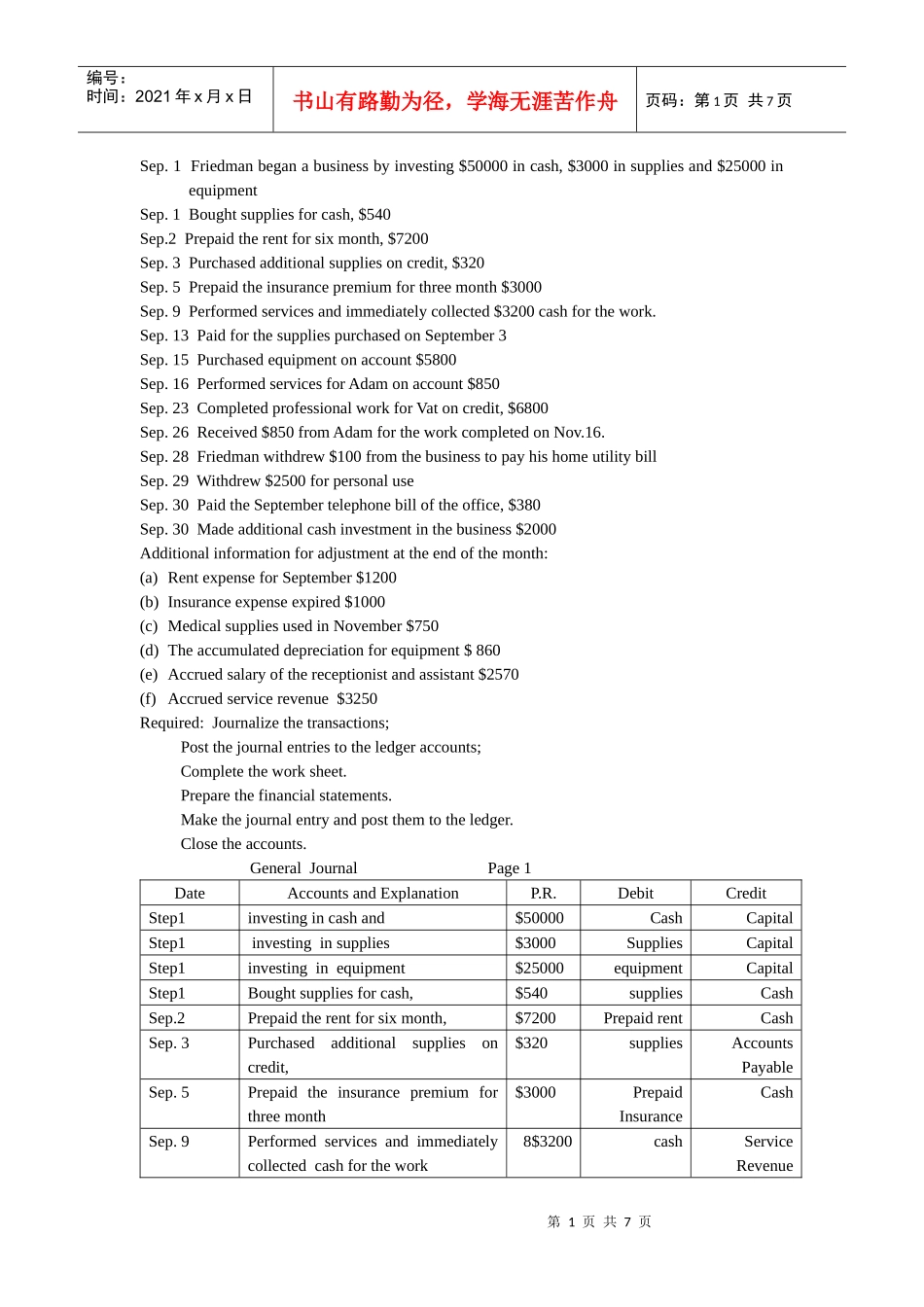

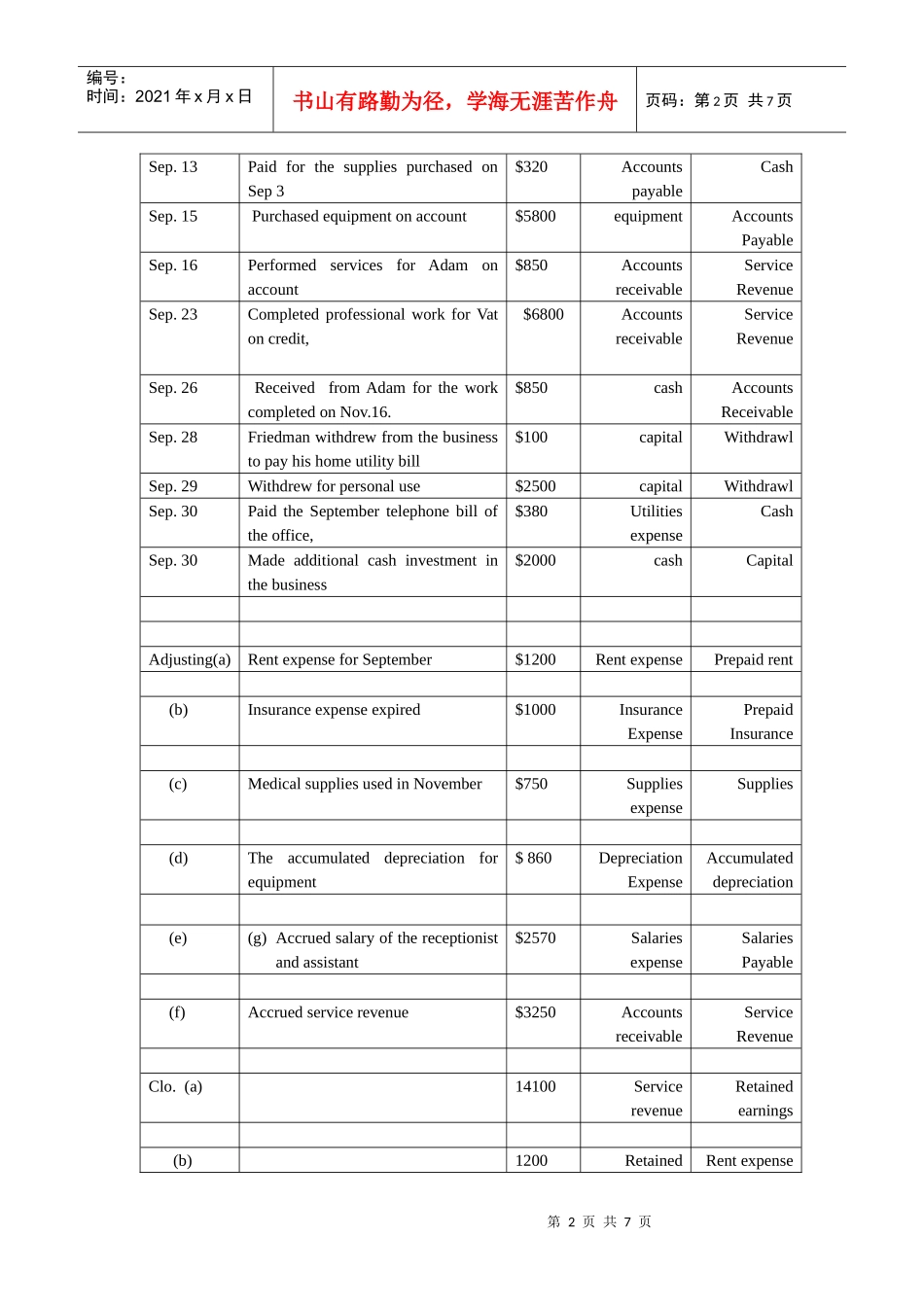

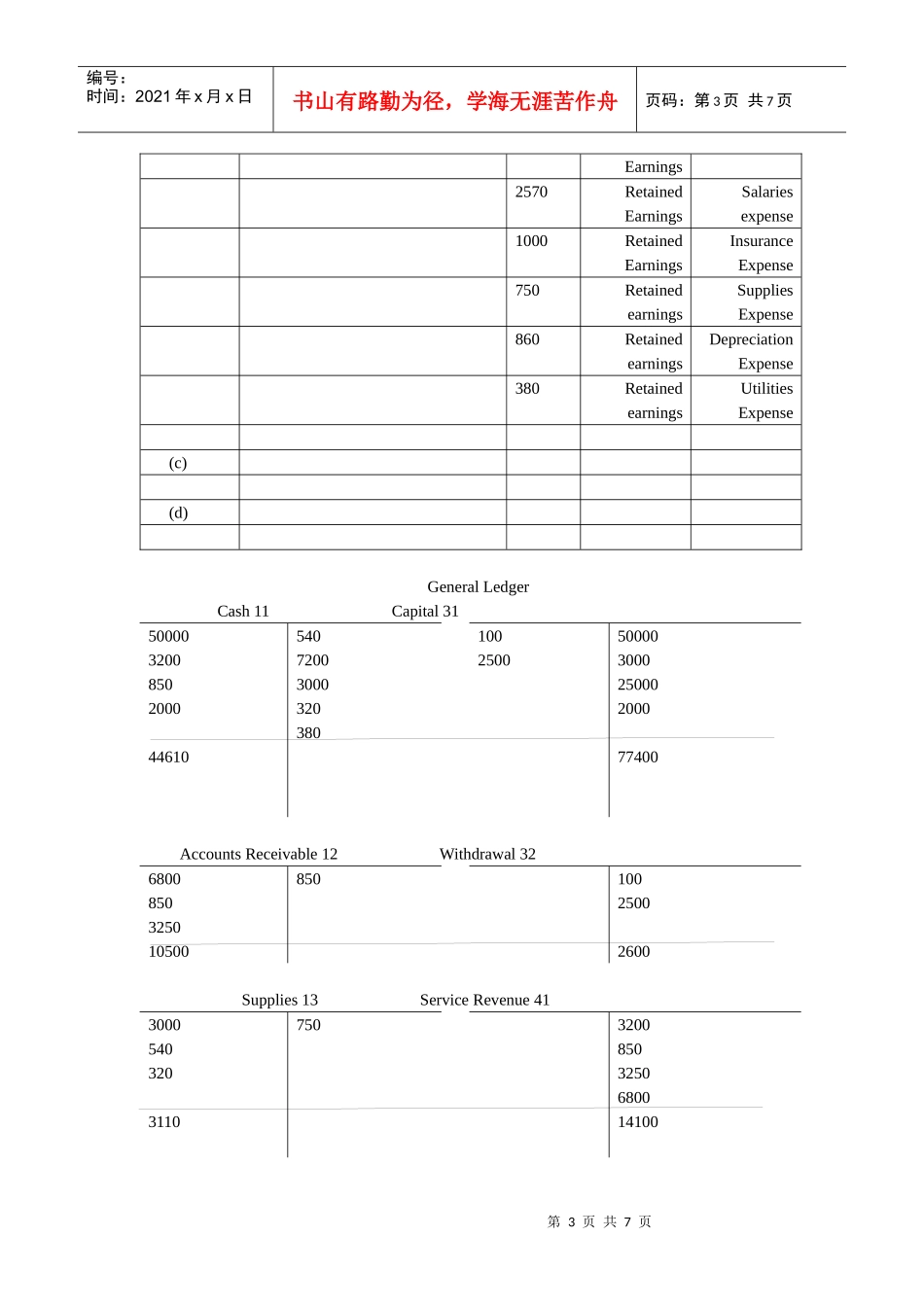

第1页共7页编号:时间:2021年x月x日书山有路勤为径,学海无涯苦作舟页码:第1页共7页Sep.1Friedmanbeganabusinessbyinvesting$50000incash,$3000insuppliesand$25000inequipmentSep.1Boughtsuppliesforcash,$540Sep.2Prepaidtherentforsixmonth,$7200Sep.3Purchasedadditionalsuppliesoncredit,$320Sep.5Prepaidtheinsurancepremiumforthreemonth$3000Sep.9Performedservicesandimmediatelycollected$3200cashforthework.Sep.13PaidforthesuppliespurchasedonSeptember3Sep.15Purchasedequipmentonaccount$5800Sep.16PerformedservicesforAdamonaccount$850Sep.23CompletedprofessionalworkforVatoncredit,$6800Sep.26Received$850fromAdamfortheworkcompletedonNov.16.Sep.28Friedmanwithdrew$100fromthebusinesstopayhishomeutilitybillSep.29Withdrew$2500forpersonaluseSep.30PaidtheSeptembertelephonebilloftheoffice,$380Sep.30Madeadditionalcashinvestmentinthebusiness$2000Additionalinformationforadjustmentattheendofthemonth:(a)RentexpenseforSeptember$1200(b)Insuranceexpenseexpired$1000(c)MedicalsuppliesusedinNovember$750(d)Theaccumulateddepreciationforequipment$860(e)Accruedsalaryofthereceptionistandassistant$2570(f)Accruedservicerevenue$3250Required:Journalizethetransactions;Postthejournalentriestotheledgeraccounts;Completetheworksheet.Preparethefinancialstatements.Makethejournalentryandpostthemtotheledger.Closetheaccounts.GeneralJournalPage1DateAccountsandExplanationP.R.DebitCreditStep1investingincashand$50000CashCapitalStep1investinginsupplies$3000SuppliesCapitalStep1investinginequipment$25000equipmentCapitalStep1Boughtsuppliesforcash,$540suppliesCashSep.2Prepaidtherentforsixmonth,$7200PrepaidrentCashSep.3Purchasedadditionalsuppliesoncredit,$320suppliesAccountsPayableSep.5Prepaidtheinsurancepremiumforthreemonth$3000PrepaidInsuranceCashSep.9Performedservicesandimmediatelycollectedcashforthework8$3200cashServiceRevenue第2页共7页第1页共7页编号:时间:2021年x月x日书山有路勤为径,学海无涯苦作舟页码:第2页共7页Sep.13PaidforthesuppliespurchasedonSep3$320AccountspayableCashSep.15Purchasedequipmentonaccount$5800equipmentAccountsPayableSep.16PerformedservicesforAdamonaccount$850AccountsreceivableServiceRevenueSep.23CompletedprofessionalworkforVatoncredit,$6800AccountsreceivableServiceRevenueSep.26ReceivedfromAdamfortheworkcompletedonNov.16.$850cashAccountsReceivableSep.28Friedmanwithdrewfromthebusinesstopayhishomeutilitybill$100capitalWithdrawlSep.29Withdrewforpersonaluse$2500capitalWithdrawlSep.30PaidtheSeptembertelephonebilloftheoffice,$380UtilitiesexpenseCashSep.30Madeadditionalcashinvestmentinthebusiness$2000cashCapitalAdjusting(a)RentexpenseforSeptember$1200RentexpensePrepaidrent(b)Insuranceexpenseexpired$1000InsuranceExpensePrepaidInsurance(c)MedicalsuppliesusedinNovember$750SuppliesexpenseSupplies(d)Theaccumulateddepreciationforequipment$860DepreciationExpenseAccumulateddepreciation(e)(g)Accruedsalaryofthereceptionistandassistant$2570SalariesexpenseSalariesPayable(f)Accruedservicerevenue$3250AccountsreceivableServiceRevenueClo.(a)14100ServicerevenueRetainedearnings(b)1200RetainedRentexpense第3页共7页第2页共7页编号:时间:2021年x月x日书山有路勤为径,学海无涯苦作舟页码:第3页共7页Earnings2570RetainedEarningsSalariesexpense1000RetainedEarningsInsuranceExpense750RetainedearningsSuppliesExpense860RetainedearningsDepreciationExpense380RetainedearningsUtilitiesExpense(c)(d)GeneralLedgerCash11Capital315000032008502000446105407200300032038...