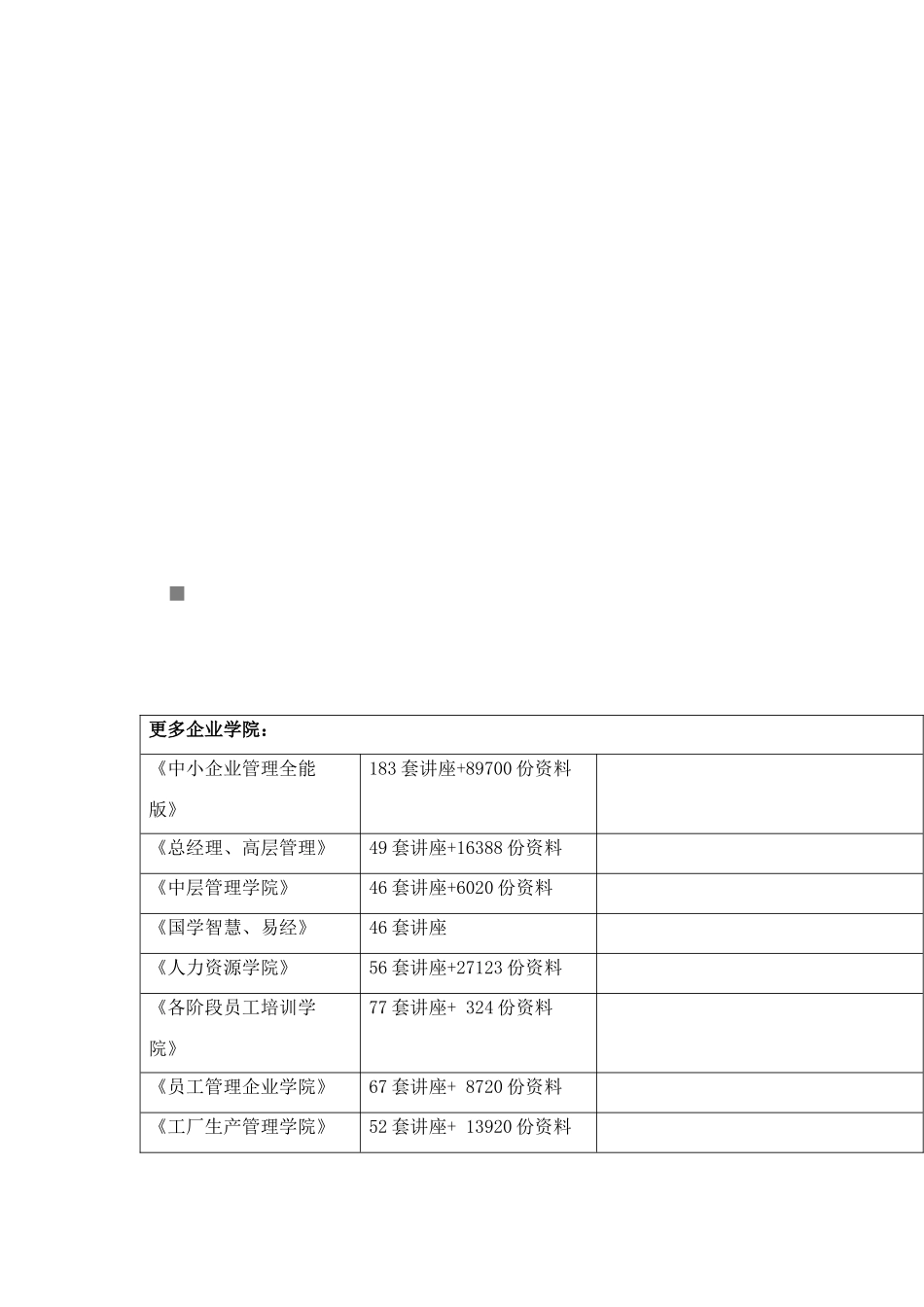

更多企业学院:《中小企业管理全能版》183套讲座+89700份资料《总经理、高层管理》49套讲座+16388份资料《中层管理学院》46套讲座+6020份资料《国学智慧、易经》46套讲座《人力资源学院》56套讲座+27123份资料《各阶段员工培训学院》77套讲座+324份资料《员工管理企业学院》67套讲座+8720份资料《工厂生产管理学院》52套讲座+13920份资料《财务管理学院》53套讲座+17945份资料《销售经理学院》56套讲座+14350份资料《销售人员培训学院》72套讲座+4879份资料IntroductionTricolplcacompanywhomakesarangeoffurnitureandkitchenware.Andoneofitsmostpopularproductsisthe‘Zupper’expandabletable.Thepurposeofwritingthisreportistodothevarianceanalysis,projectevaluationandtocomparethebudgetandactualdatabyusingthetechnique.FindingsPartAPossibleReasonforVariances1.MaterialDirectMaterial–Total-£2,400Fmadeup:DirectMaterialUsage–£20000F(Levelofsignificance–usage/totalbudgetedMaterialcosts=8,000/64,000=12.5%>3%,shouldbereviewed)2000kglessmaterialsareusedthanbudgetedfortheactuallevelofproduction.Possiblereasonmaybeusingthehigher-gradematerialwithlesswastage.Orthenewmachineryuselessmaterialsandincurslesswstage.DirectMaterialPrice–£5,600A(5,600/64,000=8.75%>3%)Itis£1perkgmoreexpensivethanplannedPossiblereason:Newmaterialsupplierdoesnotgivediscountsformaterials.Hither-gradematerialshavebeenusedwhichismoreexpensive.2.LabourDirectLabourTotal-£6,400ADirectLabourRate–£3,520A(3,520/28,800=12.2%>3%)Onaverage,theactuallabourrateis£1/hourhigherthanbudgetedPossiblereason:ThewagesettlementishigherthanexpectedThenewmachinerequirestrainingssothatovertimerequiredmorethanexpected.DirectlabourEfficiency-£2000A>3%)4.16%Actually,morethan200labourhourshavebeenusedthanbudgeted.Possiblereason:Newmachineryrequiresmorehoursfortraining..Humanresourceissues–theskilledoperativesisnotenough.3.TotalOverhead-£600FRateis4.70%UnpredictedincreaseininsuranceandAdministrationcostsPossiblereason:Newmachinerybringsmoreexpensiveinsurance,highermaintenanceandadditionaladministrativecosts.PartB1.Keyassumptionsmade:a)Thereisnotaxationandinflation.b)Assumedthatthereisnovarygivenreturnmarketrate.c)Thetotalcostoftheprojectwillbepayableatthestartd)Theexpectedrevenuefromtheinvestment–thisistheexpectedNetCashFlowafterdeductionofallrelevantcosts2.PaybackPaybackinthiscaseis4.125years(totalinvestment-returnperiodisfiveyears).Sothecompanycangetbacktheinvestment.TheNetPresentValueis£-64,800.Itindicatesthattheprojectdoesnotappeartobefinanciallyviable.ConclusionPartBThisprojectisavailablebecausethepaybackis4.125years.ButtheNetPresentValue(NPV)isnegative.Sotheprojectisnotavailable.However,weshouldusetheconclusionoftheNetPresentValuebecausetheNetPresentValue(NPV)consideredthetimevalueofmoney.RecommendationsPartARecommendationsformanagementaction:1.Allthevariancesshouldbeanalysisbecauseallofthemareabove3%,thelevelofsignificance.2.Particularly,thedirectlabourvariancesneedfurtherinvestigation–whyisthecompanypayingahigherwageratebutthelabourproductivityislowerthanplanned.PartB1.Toconsidertheeffectofthenewfacilitiesoncompany’sownstaff–intermsofemploymentandredeploymentopportunities.2.Toconsideranychangesinanyotherareas,likesocial,political,economic,legalandtechnologicalfactors.3.Whetheritispossibleforthecompanytoraisethesufficientfunds–toconsiderifthecurrentcashflowpositioncansupportsuchaninvestment.AppendixPartA1.Table1TricolplcFlexedBudgetforJuneTricolplcFlexedB...