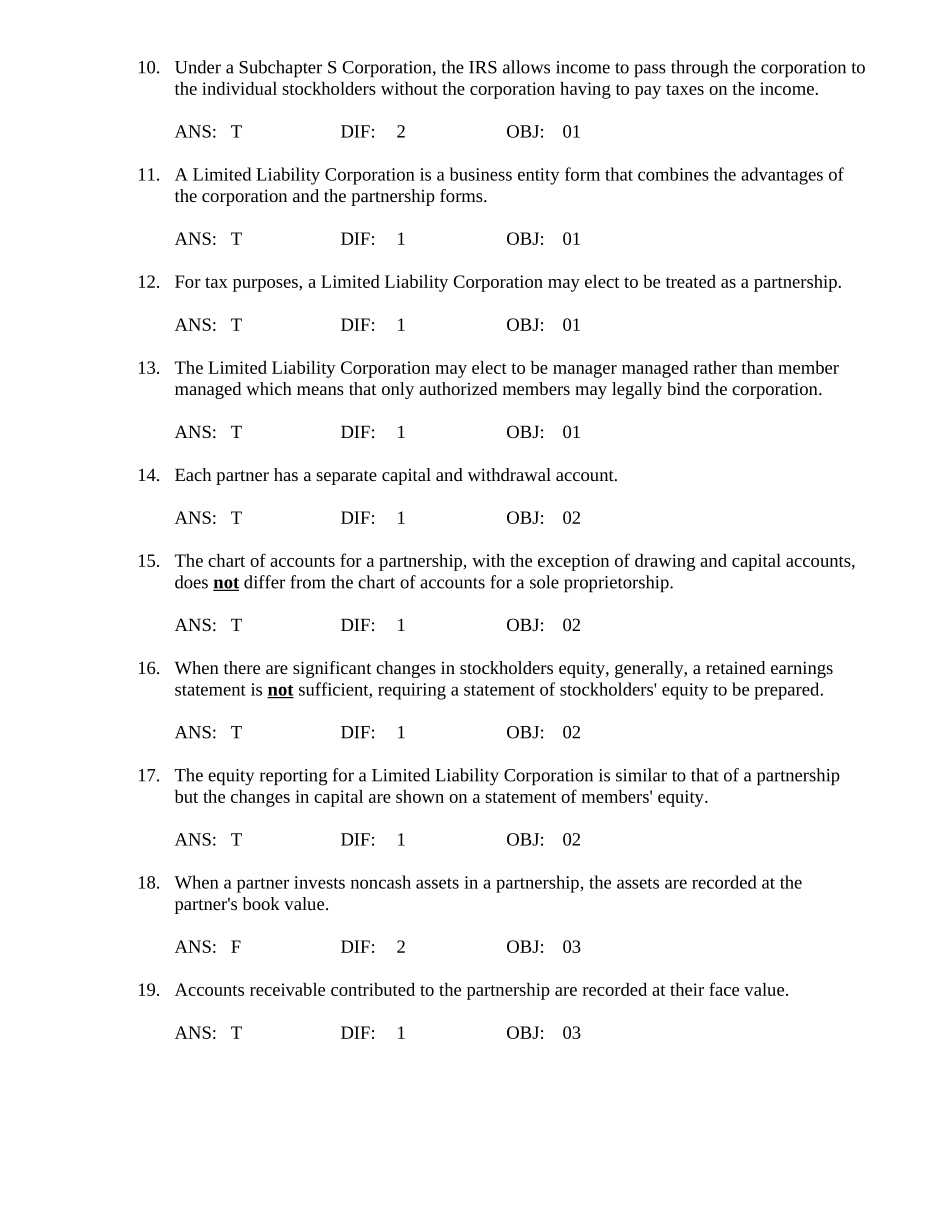

CHAPTER13ACCOUNTINGFORPARTNERSHIPSANDLIMITEDLIABILITYCORPORATIONSChapter13—AccountingforPartnershipsandLimitedLiabilityCorporationsTRUE/FALSE1.Thereareonlyfourlegalstructurestoformandoperateabusiness.ANS:FDIF:1OBJ:012.Inageneralpartnership,eachpartnerisindividuallyliabletocreditorsfordebtsincurredbythepartnership,totheextentofthepartner'scapitalbalance.ANS:FDIF:1OBJ:013.Apartnershipisalegalentityseparatefromitsowners.ANS:FDIF:1OBJ:014.Apartnershipissubjecttofederalincometaxes.ANS:FDIF:1OBJ:015.Adisadvantageofpartnershipsisthemutualagencyofallpartners.ANS:TDIF:1OBJ:016.Eachpartnershipmusthaveawrittenpartnershipagreement.ANS:TDIF:1OBJ:017.Eachpartnermaywithdrawtheassetsheorshecontributedtothepartnershipatanytime.ANS:FDIF:2OBJ:018.Whencomparedtoacorporation,oneofthemajordisadvantagesofthepartnershipisitslimitedlife.ANS:TDIF:1OBJ:019.Whencomparedtoacorporation,oneofthemajoradvantagesofapartnershipisitseaseofformation.ANS:TDIF:1OBJ:0110.UnderaSubchapterSCorporation,theIRSallowsincometopassthroughthecorporationtotheindividualstockholderswithoutthecorporationhavingtopaytaxesontheincome.ANS:TDIF:2OBJ:0111.ALimitedLiabilityCorporationisabusinessentityformthatcombinestheadvantagesofthecorporationandthepartnershipforms.ANS:TDIF:1OBJ:0112.Fortaxpurposes,aLimitedLiabilityCorporationmayelecttobetreatedasapartnership.ANS:TDIF:1OBJ:0113.TheLimitedLiabilityCorporationmayelecttobemanagermanagedratherthanmembermanagedwhichmeansthatonlyauthorizedmembersmaylegallybindthecorporation.ANS:TDIF:1OBJ:0114.Eachpartnerhasaseparatecapitalandwithdrawalaccount.ANS:TDIF:1OBJ:0215.Thechartofaccountsforapartnership,withtheexceptionofdrawingandcapitalaccounts,doesnotdifferfromthechartofaccountsforasoleproprietorship.ANS:TDIF:1OBJ:0216.Whentherearesignificantchangesinstockholdersequity,generally,aretainedearningsstatementisnotsufficient,requiringastatementofstockholders'equitytobeprepared.ANS:TDIF:1OBJ:0217.TheequityreportingforaLimitedLiabilityCorporationissimilartothatofapartnershipbutthechangesincapitalareshownonastatementofmembers'equity.ANS:TDIF:1OBJ:0218.Whenapartnerinvestsnoncashassetsinapartnership,theassetsarerecordedatthepartner'sbookvalue.ANS:FDIF:2OBJ:0319.Accountsreceivablecontributedtothepartnershiparerecordedattheirfacevalue.ANS:TDIF:1OBJ:0320.Anewpartnercontributesaccountsreceivabletoapartnershipwhichappearintheledgerofhissoleproprietorshipat$20,500andtherewasanallowancefordoubtfulaccountsof$750.If$600oftheaccountsreceivablesarecompletelyworthless,thepartnershipaccountsreceivableshouldbedebitedfor$19,900.ANS:TDIF:2OBJ:0321.Onereasonthatdistributionsofincomeandlossarepreparedistoobtaintheinformationtorecordaclosingentry.ANS:TDIF:1OBJ:0422.Ifnothingisstated,partnershipincomeisdividedinproportiontotheindividualpartner'scapitalbalance.ANS:FDIF:2OBJ:0423.Thesalaryallocationtopartnersusedindividingnetincomewouldalsoappearassalaryexpenseonthepartnershipincomestatement.ANS:FDIF:2OBJ:0424.Ifthearticlesofpartnershipprovideforannualsalaryallowancesof$36,000and$18,000toXandYrespectivelyandnetincomeis$30,000,X'sshareofnetincomeis$20,000.ANS:FDIF:2OBJ:0425.Ifthenetincomeofapartnershipislessthanthetotaloftheallowancesprovidedbythepartnershipagreement,thedifferencemustbedividedamongthepartnersintheincome-sharingratio.ANS:FDIF:2OBJ:0426.Theamountthatapartnerwithdrawsasamonthlysalaryallowancedoesnotaffectt...