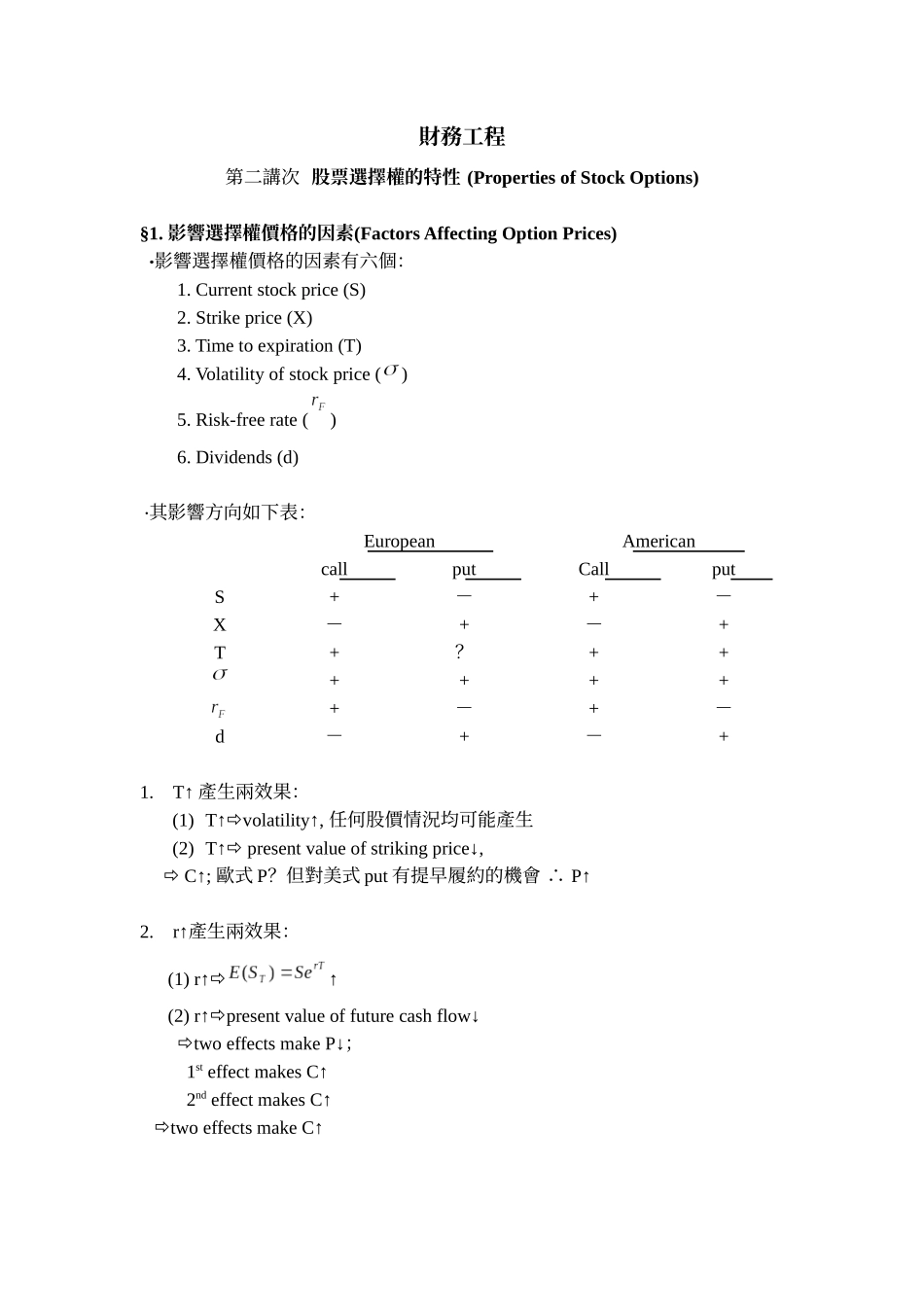

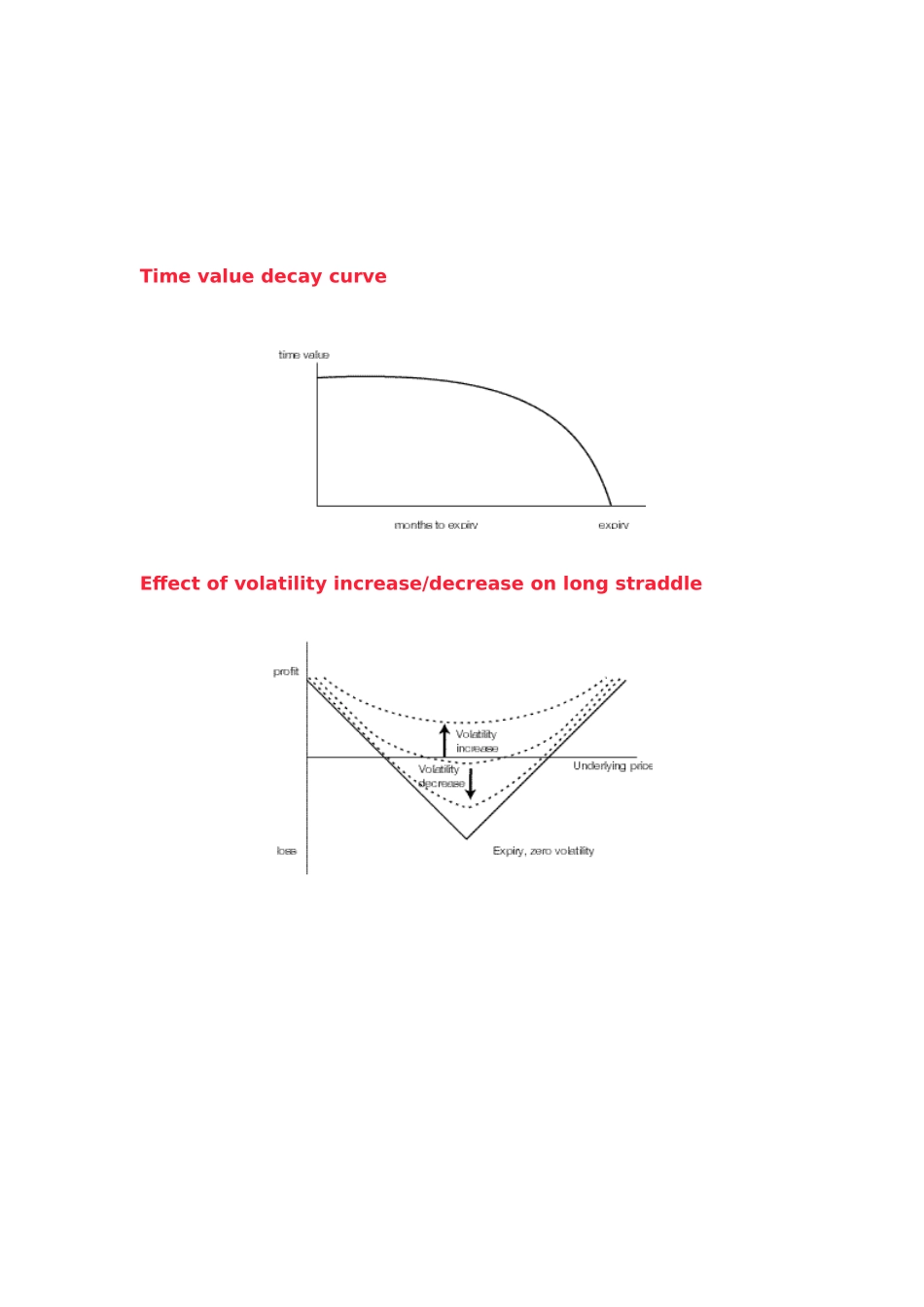

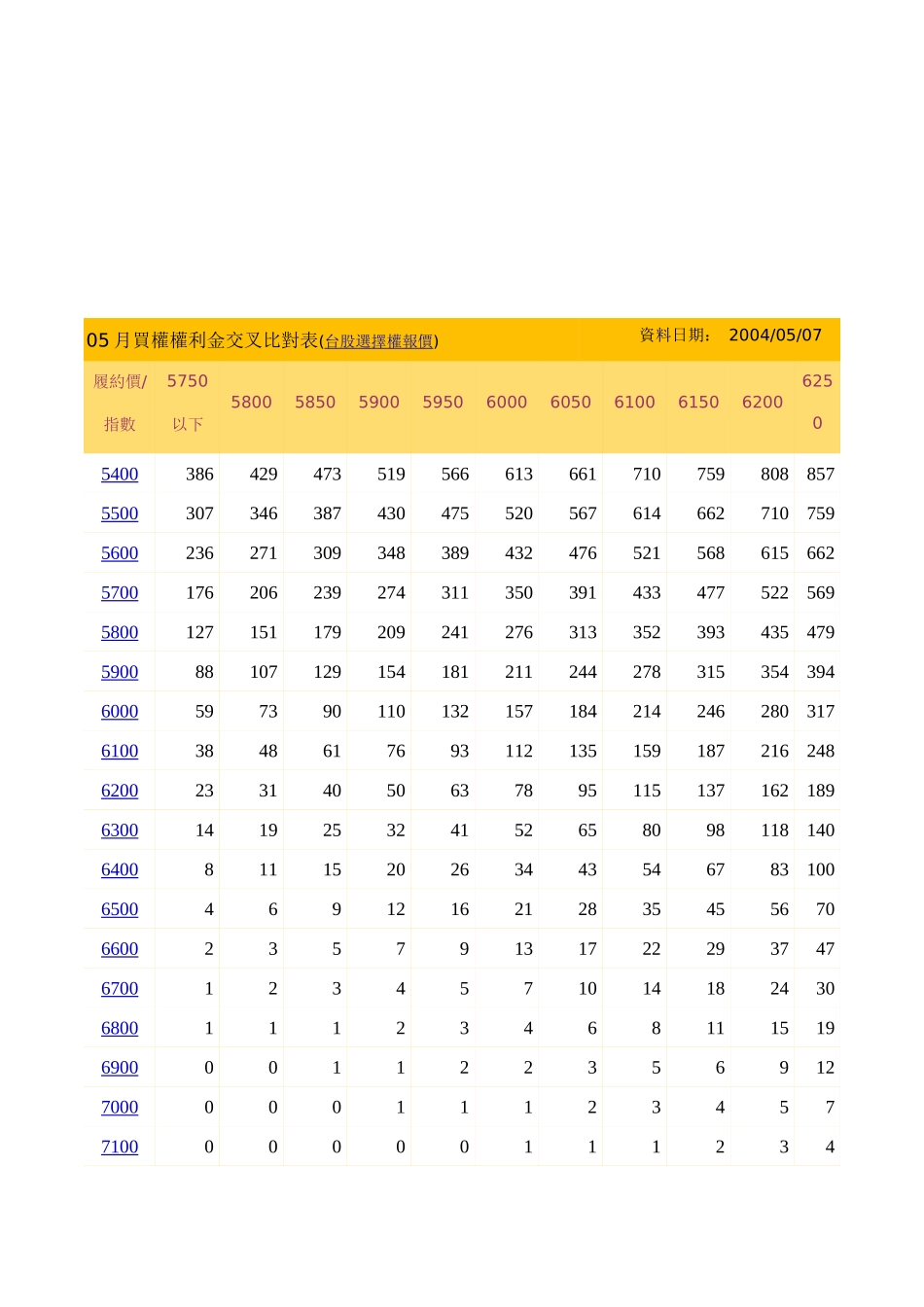

財務工程第二講次股票選擇權的特性(PropertiesofStockOptions)§1.影響選擇權價格的因素(FactorsAffectingOptionPrices)‧影響選擇權價格的因素有六個:1.Currentstockprice(S)2.Strikeprice(X)3.Timetoexpiration(T)4.Volatilityofstockprice()5.Risk-freerate()6.Dividends(d)‧其影響方向如下表:EuropeanAmericancallputCallputS+-+-X-+-+T+?+++++++-+-d-+-+1.T↑產生兩效果:(1)T↑volatility↑,任何股價情況均可能產生(2)T↑presentvalueofstrikingprice↓,C↑;歐式P?但對美式put有提早履約的機會∴P↑2.r↑產生兩效果:(1)r↑↑(2)r↑presentvalueoffuturecashflow↓twoeffectsmakeP↓;1steffectmakesC↑2ndeffectmakesC↑twoeffectsmakeC↑TimevaluedecaycurveEffectofvolatilityincrease/decreaseonlongstraddle05月買權權利金交叉比對表(台股選擇權報價)資料日期:2004/05/07履約價/指數5750以下5800585059005950600060506100615062006250540038642947351956661366171075980885755003073463874304755205676146627107595600236271309348389432476521568615662570017620623927431135039143347752256958001271511792092412763133523934354795900881071291541812112442783153543946000597390110132157184214246280317610038486176931121351591872162486200233140506378951151371621896300141925324152658098118140640081115202634435467831006500469121621283545567066002357913172229374767001234571014182430680011123468111519690000112235691270000001112345771000000011123472000000000112273000000000011105月賣權權利金交叉比對表(台股選擇權報價)資料日期:2004/05/07履約價/指數5750以下5800585059005950600060506100615062006250540030231813107543215500514032251914118643560080655342332620151296570012010083685544352721161258001711451231038570574636292359002322011731481251058772594738600030226723420417615012810790746161003813423042692362061781531301109262004674243833443062712392081811551336300557512468425385346308274241211183640065160455851346942738634731127624365007476996526055595144714283883493136600845796748700652606560515472430390670094489584579774870065360656151647368001,04399494489584679774970165460756269001,1431,0931,04399494489584679774970165470001,2431,1931,1431,0931,04399494489584679874971001,3421,2931,2431,1931,1431,0931,04399494489584672001,4421,3921,3421,2921,2421,1931,1431,0931,04399494473001,5421,4921,4421,3921,3421,2921,2421,1931,1431,0931,043資料來源:元富證券,http://tw.stock.yahoo.com/future/q/fmoney.php‧以數學式表示這些效果:§2.選擇權部位的利潤圖(ProfitDiagrams)與向量表示(VectorNotationPrices)1.BuyCall:syntheticlong:2.SellCall:syntheticshort:00利潤利潤-c+cXXSTSTA.longacallB.shortacall00利潤利潤-p+pXXSTSTC.longaputD.shortaput3.BuyPut:longcall:4.ShortPut:sellingput:★四種基本選擇權部位的利潤圖§3.選擇權價格(權利金)的上下界(UpperandlowerboundsforoptionPrices)選擇權之價格有其界限範圍,若選擇權之價格高於上界或低於下界,則會有獲利性的套利機會。茲分述如下:‧符號CE=歐式買權價格CA=美式買權價格PE=歐式賣權價格PA=美式賣權價格1.上界(UpperBounds)2.不支付股利股票買權之下界(LowerBoundforCallsonnon-dividend-payingStocks)andCE≥0[證明]考慮下列兩投資組合:PortfolioA:OneEuropeanCallOptions+Cash(=$)PortfolioB:OneShareThevalueofportfolioAattimeT:1Call0$XXTotalXattimeT,portfolioAisworthMax attimeT,portfolioBisworth Max,i.e.,ValueofportfolioA¿ValueofportfolioBAssumethatallinvestmentvehiclesaredefault-free.Thus,attimet,PresentvalueofportfolioA¿PresentvalueofportfolioBThatis,3.不支付股利股票歐式賣權之下界(LowerBoundforEuropeanputsonnon-dividend-payingstocks)...