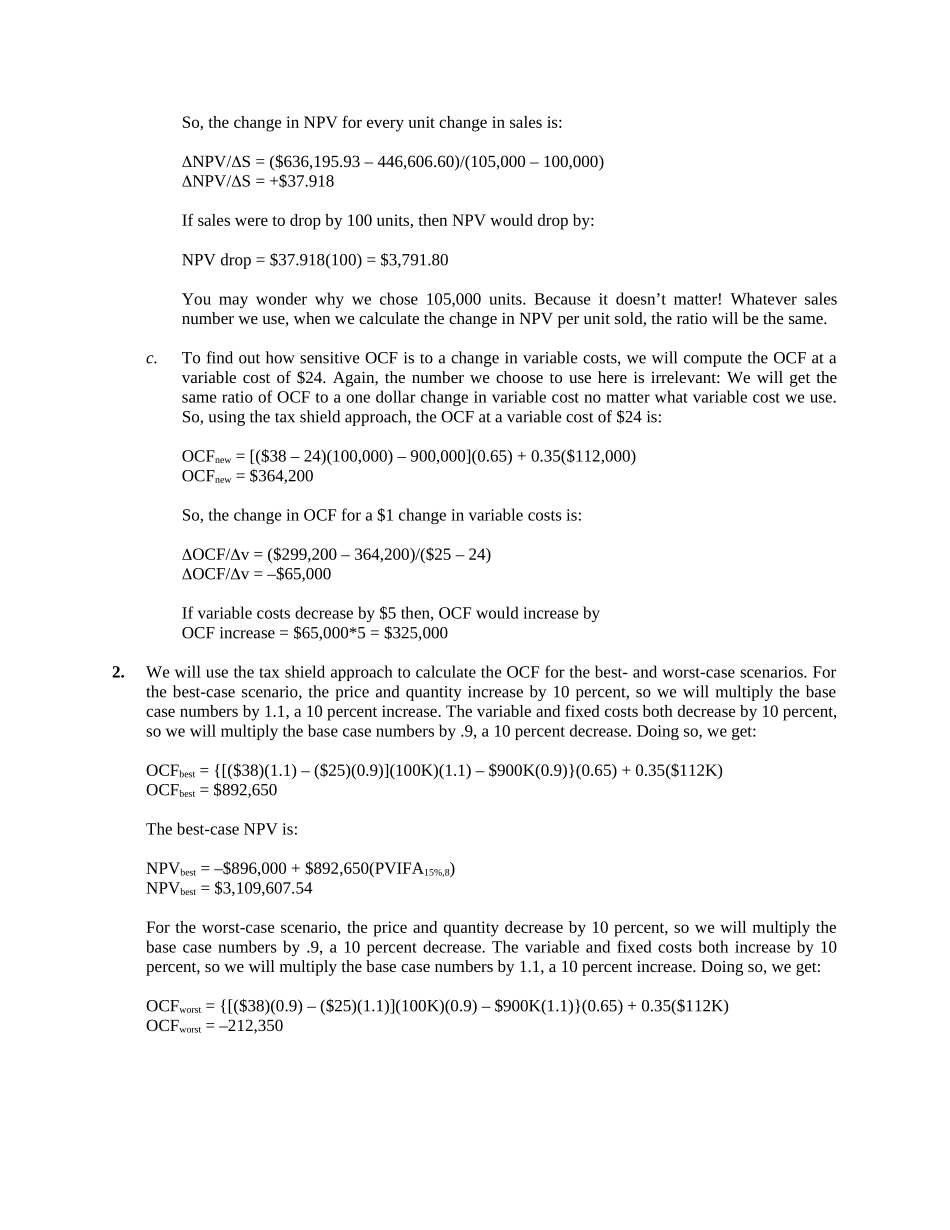

CHAPTER9RISKANALYSIS,REALOPTIONS,ANDCAPITALBUDGETINGAnswerstoConceptsReviewandCriticalThinkingQuestions1.Forecastingriskistheriskthatapoordecisionismadebecauseoferrorsinprojectedcashflows.Thedangerisgreatestwithanewproductbecausethecashflowsareprobablyhardertopredict.2.Withasensitivityanalysis,onevariableisexaminedoverabroadrangeofvalues.Withascenarioanalysis,allvariablesareexaminedforalimitedrangeofvalues.3.Itistruethatifaveragerevenueislessthanaveragecost,thefirmislosingmoney.Thismuchofthestatementisthereforecorrect.Atthemargin,however,acceptingaprojectwithmarginalrevenueinexcessofitsmarginalcostclearlyactstoincreaseoperatingcashflow.4.Fromtheshareholderperspective,thefinancialbreak-evenpointisthemostimportant.Aprojectcanexceedtheaccountingandcashbreak-evenpointsbutstillbebelowthefinancialbreak-evenpoint.Thiscausesareductioninshareholder(your)wealth.5.Theprojectwillreachthecashbreak-evenfirst,theaccountingbreak-evennextandfinallythefinancialbreak-even.Foraprojectwithaninitialinvestmentandsalesafter,thisorderingwillalwaysapply.Thecashbreak-evenisachievedfirstsinceitexcludesdepreciation.Theaccountingbreak-evenisnextsinceitincludesdepreciation.Finally,thefinancialbreak-even,whichincludesthetimevalueofmoney,isachieved.6.TraditionalNPVanalysisisoftentooconservativebecauseitignoresprofitableoptionssuchastheabilitytoexpandtheprojectifitisprofitable,orabandontheprojectifitisunprofitable.Theoptiontoalteraprojectwhenithasalreadybeenacceptedhasavalue,whichincreasestheNPVoftheproject.7.Thetypeofoptionmostlikelytoaffectthedecisionistheoptiontoexpand.Ifthecountryjustliberalizeditsmarkets,thereislikelythepotentialforgrowth.Firstentryintoamarket,whetheranentirelynewmarket,orwithanewproduct,cangiveacompanynamerecognitionandmarketshare.Thismaymakeitmoredifficultforcompetitorsenteringthemarket.8.Sensitivityanalysiscandeterminehowthefinancialbreak-evenpointchangeswhensomefactors(suchasfixedcosts,variablecosts,orrevenue)change.9.Therearetwosourcesofvaluewiththisdecisiontowait.Potentially,thepriceofthetimbercanpotentiallyincrease,andtheamountoftimberwillalmostdefinitelyincrease,barringanaturalcatastropheorforestfire.Theoptiontowaitforaloggingcompanyisquitevaluable,andcompaniesintheindustryhavemodelstoestimatethefuturegrowthofaforestdependingonitsage.10.WhentheadditionalanalysishasanegativeNPV.Sincetheadditionalanalysisislikelytooccuralmostimmediately,thismeanswhenthebenefitsoftheadditionalanalysisoutweighthecosts.Thebenefitsoftheadditionalanalysisarethereductioninthepossibilityofmakingabaddecision.Ofcourse,theadditionalbenefitsareoftendifficult,ifnotimpossible,tomeasure,somuchofthisdecisionisbasedonexperience.SolutionstoQuestionsandProblemsNOTE:Allendofchapterproblemsweresolvedusingaspreadsheet.Manyproblemsrequiremultiplesteps.Duetospaceandreadabilityconstraints,whentheseintermediatestepsareincludedinthissolutionsmanual,roundingmayappeartohaveoccurred.However,thefinalanswerforeachproblemisfoundwithoutroundingduringanystepintheproblem.Basic1.a.Tocalculatetheaccountingbreakeven,wefirstneedtofindthedepreciationforeachyear.Thedepreciationis:Depreciation=$896,000/8Depreciation=$112,000peryearAndtheaccountingbreakevenis:QA=($900,000+112,000)/($38–25)QA=77,846unitsb.WewillusethetaxshieldapproachtocalculatetheOCF.TheOCFis:OCFbase=[(P–v)Q–FC](1–tc)+tcDOCFbase=[($38–25)(100,000)–$900,000](0.65...