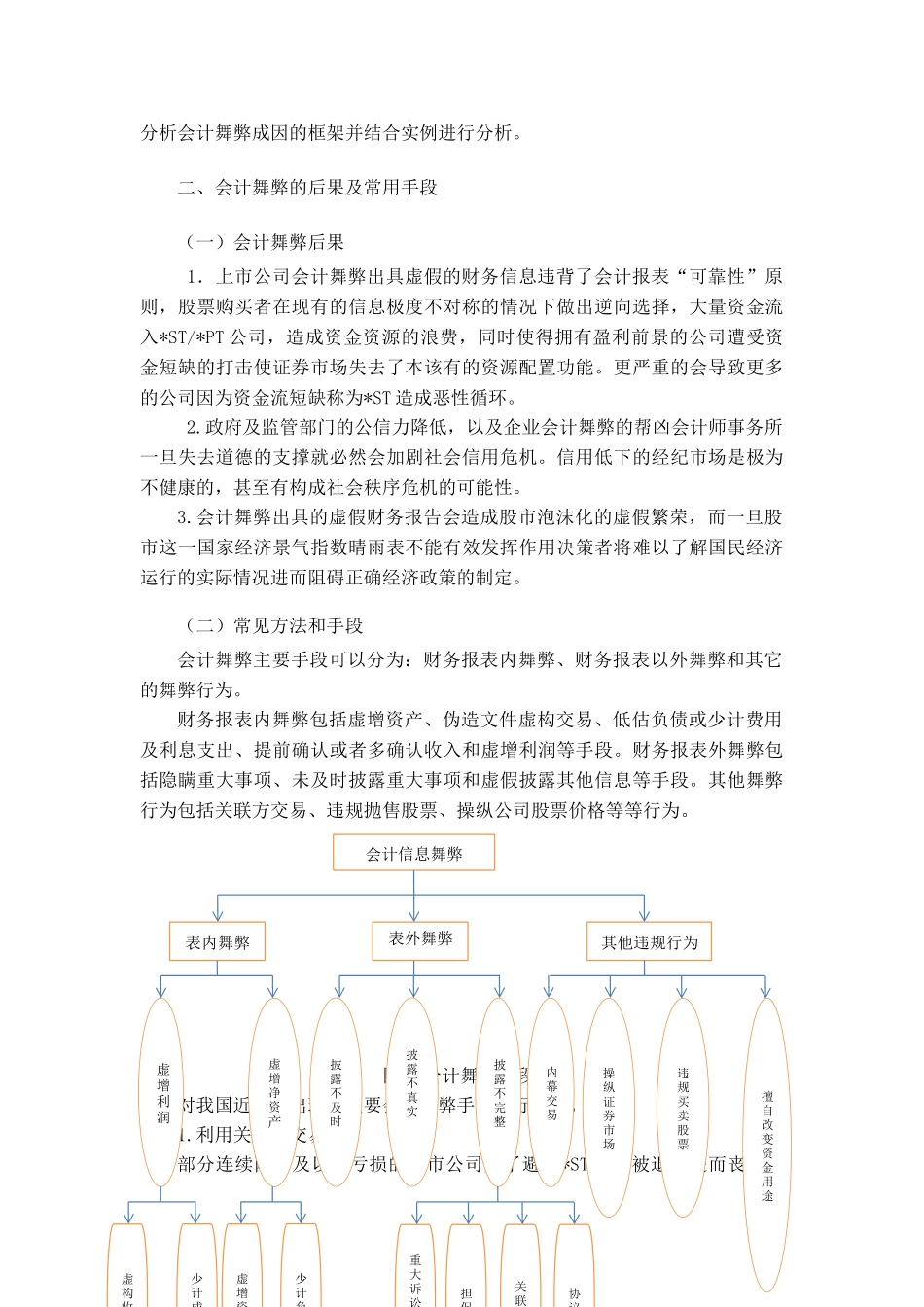

论文(设计)题目:我国上市公司会计舞弊及其治理探讨目录一、引言.......................................................2二、会计舞弊的后果及常用手段...................................3(一)会计舞弊后果.............................................................................................................................3(二)常见方法和手段.........................................................................................................................3三、会计舞弊的目的与动因.......................................5(一)内部原因.....................................................................................................................................5(二)外部原因.....................................................................................................................................7四、会计舞弊识别具体方法.......................................8(一)异常波动指标分析.....................................................................................................................9(二)从三大报表间的勾稽关系寻找端倪.......................................................................................11五、会计舞弊的防范与治理......................................11(一)完善公司治理结构...................................................................................................................12(二)完善会计准则、会计制度.......................................................................................................12(三)完善证券监管部门内部管理...................................................................................................13(四)完善司法介入机制...................................................................................................................13我国上市公司会计舞弊及其治理探讨【内容摘要】长久以来,证券市场充当着资本市场的的重要一环,它的存在对经济资源的合理有效分配有着深远作用。目前,我国证券行业高速发展同时受到制度缺陷和外部因素的影响,许多上市企业为了自身利益进行会计舞弊。从红光事件到蓝田事件再到绿大地事件,我国的上市公司会计舞弊事件屡禁不止,给社会带来巨大影响。因此,探究上市公司舞弊也成为社会关心的重要话题。本文通过研究我国上市公司会计舞弊的相关案例,结合西方国家对会计舞弊的研究,总结会计舞弊的起因、手段和特征,尝试建立有关的系统理论模型。最后基于构建的理论模型,结合所学的会计学知识和相关法律法规,探索治理我国上市公司会计舞弊的途径。【关键词】上市公司舞弊形式舞弊动因防范治理DiscussiononaccountingfraudanditsgovernanceofListedCompaniesinChinaAbstract:Foralongtime,thesecuritiesmarketactsasanimportantpartofthecapitalmarketandhavebeenmakingprofoundeffectontherationalandeffectiveallocationofeconomicresources.Atpresent,China'ssecuritiesindustrywhichhavebeendevelopingrapidlyisalsoaffectedbyinstitutionaldefectsandexternalfactors,Manylistedcompaniesconductaccountingfraudfortheirowninterests.FromHongguangincidenttoLantianincidenttogreenearthincident,accountingfraudcasesofListedCompaniesinChinahavebeenbannedrepeatedly,whichhasbroughtgreatdangertosociety.Therefore,exploringthefraudulentpracticesoflistedcompanieshasalsobecomeanimportanttopicofsocialconcern.BystudyingthecasesofaccountingfraudinChina'slistedcompaniesandcombiningtheresearchofaccountingfraudinthewesterncountries,thispapersumedupthecauses,meansandcharacteristicsofaccountingfraud,andtriestoestablishatheorymodelsystematically.Fin...