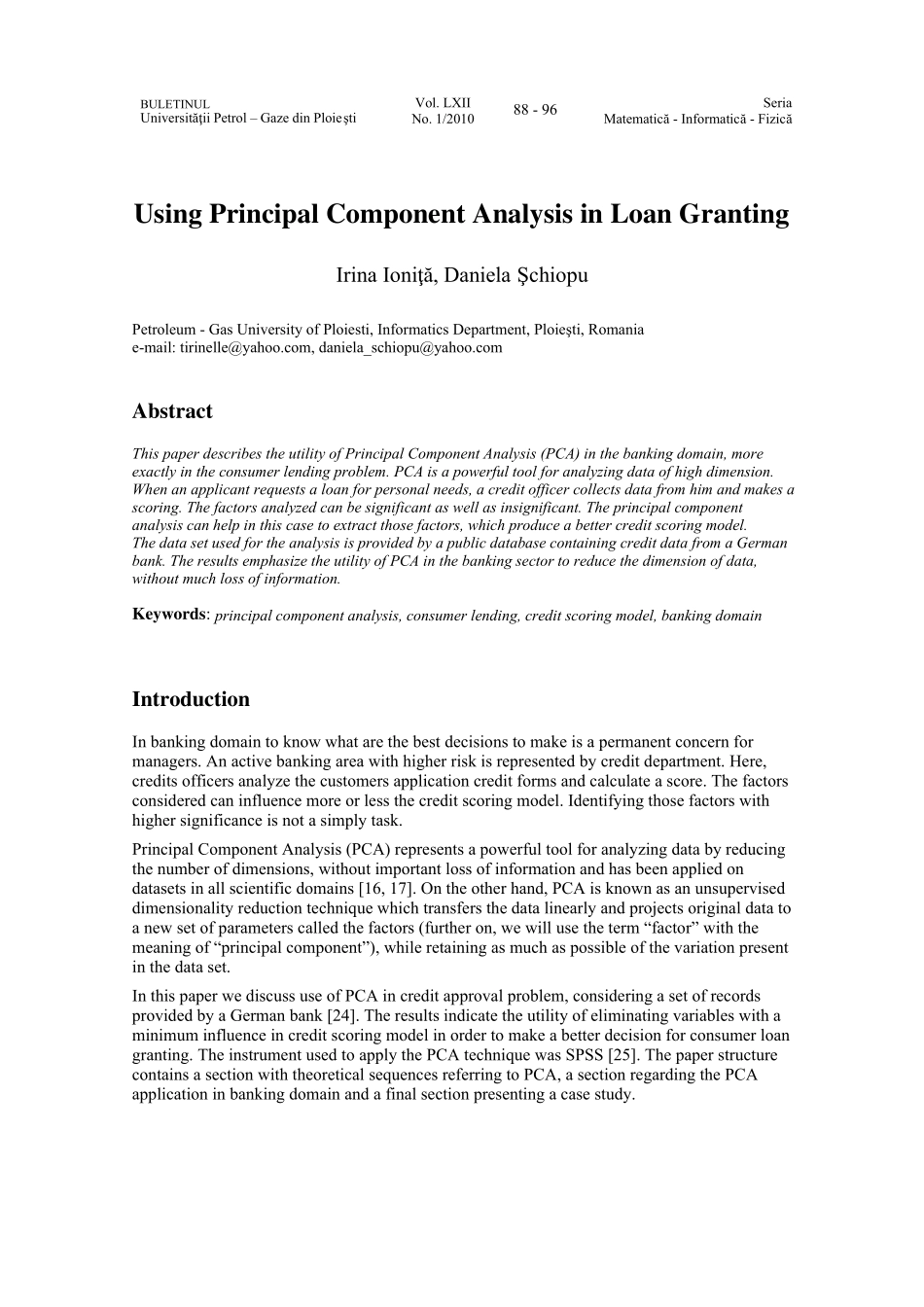

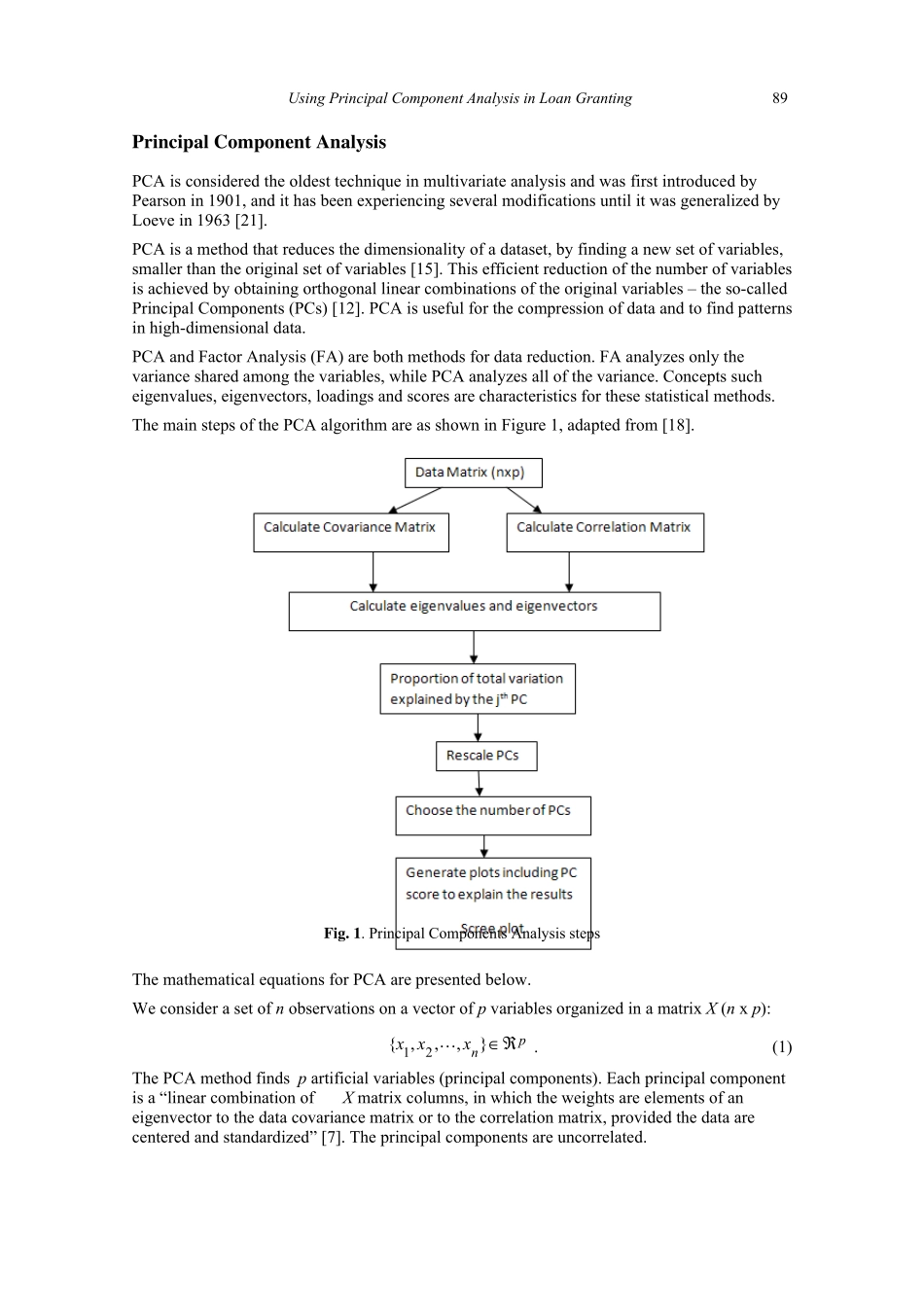

BULETINUL Universităţii Petrol – Gaze din Ploieşti Vol. LXII No. 1/2010 88 - 96 Seria Matematică - Informatică - Fizică Using Principal Component Analysis in Loan Granting Irina Ioniţă, Daniela Ş chiopu Petroleum - Gas University of Ploiesti, Informatics Department, Ploieşti, Romania e-mail: tirinelle@yahoo.com, daniela_schiopu@yahoo.com Abstract This paper describes the utility of Principal Component Analysis (PCA) in the banking domain, more exactly in the consumer lending problem. PCA is a powerful tool for analyzing data of high dimension. When an applicant requests a loan for personal needs, a credit officer collects data from him and makes a scoring. The factors analyzed can be significant as well as insignificant. The principal component analysis can help in this case to extract those factors, which produce a better credit scoring model. The data set used for the analysis is provided by a public database containing credit data from a German bank. The results emphasize the utility of PCA in the banking sector to reduce the dimension of data, without much loss of information. Keywords: principal component analysis, consumer lending, credit scoring model, banking domain Introduction In banking domain to know what are the best decisions to make is a permanent concern for managers. An active banking area with higher risk is represented by credit department. Here, credits officers analyze the customers application credit forms and calculate a score. The factors considered can influence more or less the credit scoring model. Identifying those factors with higher significance is not a simply task. Principal Component Analysis (PCA) represents a powerful tool for analyzing data by reducing the num...