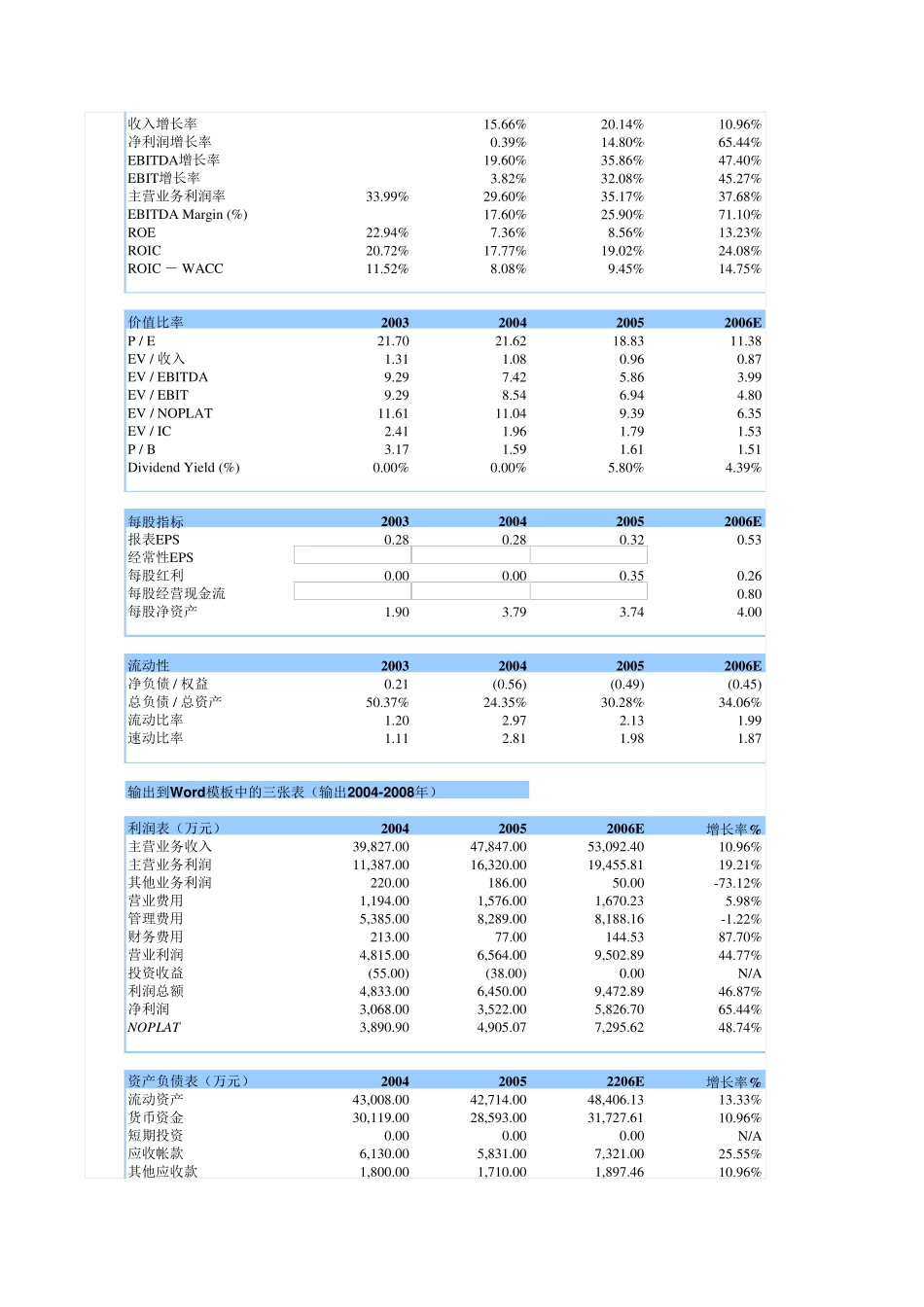

一般情景预测公司名称久联发展代码002037分析日期2006/05/29流通A股4,000.00流通B股总股本11,000.00A股股价6.03B股股价Word模板指标输出2004A2005A2006E2007E主营收入(万元)39,827.0047,847.0053,092.4062,408.39主营收入增长率15.66%20.14%10.96%17.55%EBITDA(万元)5,792.007,869.0011,598.7315,778.87EBITDA增长率19.60%35.86%47.40%36.04%净利润(万元)3,068.003,522.005,826.708,491.50净利润增长率0.39%14.80%65.44%45.73%ROE7.36%8.56%13.23%17.59%EPS(元)0.2790.3200.5300.772P/E21.6218.8311.387.81P/B1.591.611.511.37EV/EBITDA7.425.863.992.81估值结果汇总估值方法估值结果FCFF17.2015.55-21.29FCFE9.278.49-10.89DDM6.265.68-7.49APV15.7013.28-17.75AE9.879.31-11.04EVA13.2012.01-16.152003200420052006EEBIT4,843.005,028.006,641.009,647.42EBITDA4,843.005,792.007,869.0011,598.73所得税率20.01%22.62%26.14%24.38%NOPLAT3,873.713,890.904,905.077,295.62IC18,700.0021,897.0025,786.0030,293.13Ve42,210.0066,330.0066,330.0066,330.00Vd8,800.006,750.008,340.0011,721.45WACC9.20%9.69%9.57%9.34%EV44,977.0042,961.0046,077.0046,323.84业绩表现2003200420052006E 估 值 区 间0.005.0010.0015.0020.0025.00FCFFFCFEDDMAPVAEEVA收入增长率15.66%20.14%10.96%净利润增长率0.39%14.80%65.44%EBITDA增长率19.60%35.86%47.40%EBIT增长率3.82%32.08%45.27%主营业务利润率33.99%29.60%35.17%37.68%EBITDA Margin (%)17.60%25.90%71.10%ROE22.94%7.36%8.56%13.23%ROIC20.72%17.77%19.02%24.08%ROIC - WACC11.52%8.08%9.45%14.75%价值比率2003200420052006EP / E21.7021.6218.8311.38EV / 收入1.311.080.960.87EV / EBITDA9.297.425.863.99EV / EBIT9.298.546.944.80EV / NOPLAT11.6111.049.396.35EV / IC2.411.961.791.53P / B3.171.591.611.51Div idend Yield (%)0.00%0.00%5.80%4.39%每股指标2003200420052006E报表EPS0.280.280.320.53经常性EPS每股红利0.000.000.350.26每股经营现金流0.80每股净资产1.903.793.744.00流动性2003200420052006E净负债 / 权益0.21(0.56)(0.49)(0.45)总负债 / 总资产50.37%24.35%30.28%34.06%流动比率1.202.972.131.99速动比率1.112.811.981.87输出到Word模板中的三张表(输出2004-2008年)利润表(万元)200420052006E增长率%主营业务收入39,827.0047,8...