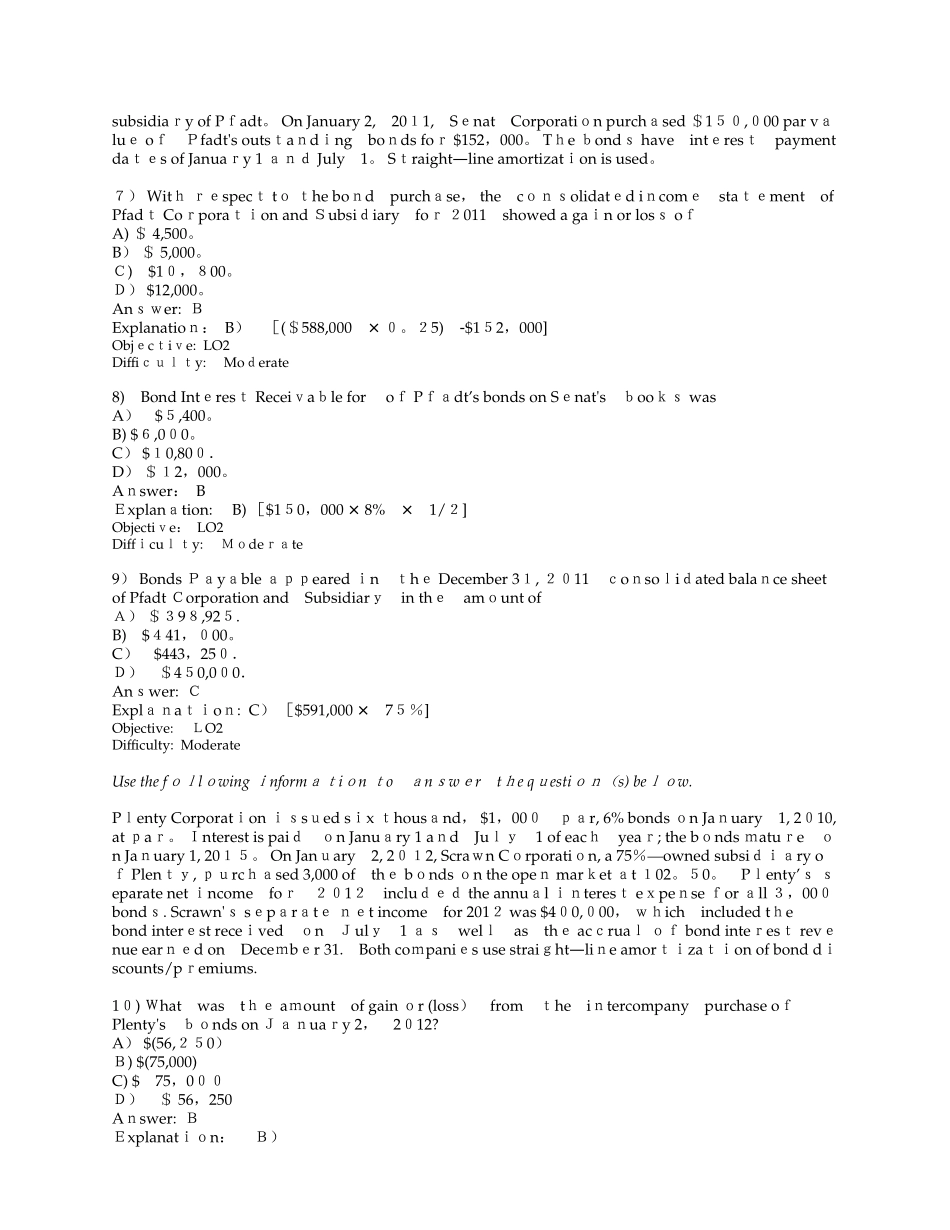

Advanced Accounting, 11e (Beams/Anthony/Bettinghaus/Smith)Chapter 7 Intercompany Profit Transactions - BondsMultiple Choice Questions1) If the price paid by a parent company to acquire the debt of a subsidiar yis greater than the book value of the liability ,a ________ occurs。A) realized loss on the retirement of debt from the viewpoint of the subsidiaryB) realized gain o nthe retirement of debt from the viewpoint of the subsidiaryC) constructive loss on the retirement of debt from the viewpoint of the consolidated entityD) constructive gain on the retirement of debt from the viewpoint of the consolidated entityAnswer: CObjective: LO1Difficulty: Easy2) If an affiliate purchases bonds in the open market ,the book value of the intercompany bond liability at the time of purchase isA) always assigned to the parent company because it has control.B) the par value of the bonds less the unamortized discount or plus the unamortized premium。C )par value。D) the par value of the bonds plus the unamortized discount or less the unamortiz edpremium。Answer: BObjective: LO1Difficulty: Easy3) Bonds issued by a company remai non their boo ksas a liability, but are considered constructively retired whenA) the company borrows money fro munaffiliated entities to re—purchase its own bonds at a gain。B) The company borrows money from an affiliat eto re-purchase its own bonds ata gain.C) The company’s parent or subsidiary purchases the bonds from outside ent...