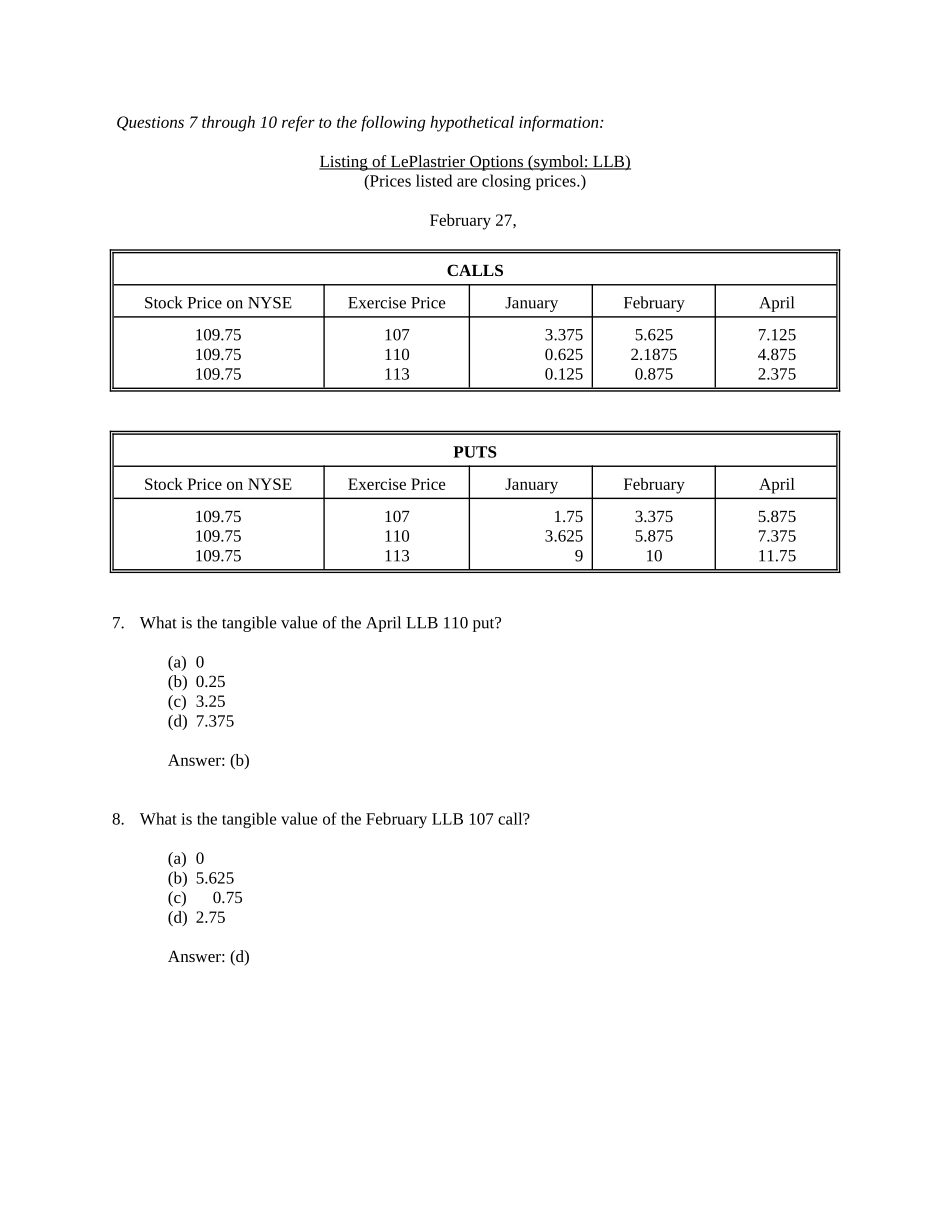

Chapter FifteenMarkets for Options and Contingent ClaimsThis chapter contains 50 multiple choice questions, 15 short problems, and 9 longer problems.Multiple Choice1.An option to buy a specified item at a fixed price is a(n) ________; an option to sell is a ________.(a) put; call(b) spot option, call(c) call; put(d) put; spot optionAnswer: (c)2.A(n) ________ option can be exercised up to and on the expiration date, whereas a(n) ________ option can only be exercised on the expiration date.(a) American-type; Bermudan-type(b) American-type; European-type(c) European-type; American-type(d) Bermudan-type; European-typeAnswer: (b)3.The difference between exercise price and current stock price is the tangible value of an ________, and the difference between the current stock price and exercise price is the tangible value of an ________.(a) out of the money put option; in the money call option(b) in the money put option; out of the money call option(c) in the put money option; at the money call option(d) at the money put option; in the money put optionAnswer: (b)4.A call option is said to be out of the money if its ________.(a) exercise price is equal to the price of the underlying stock(b) current stock price is greater than its strike price(c) strike price is greater than the current stock price(d) strike price is less than its current stock priceAnswer: (c)5.The time value of an option is ________.(a) the difference between an options stock price and its tangible value(b) the difference between the current stock price and exercise price(c) the difference between the exercise price and the stock price(d) the difference between an options market price and its tangible valueAnswer: (d)6.The prices of pu...