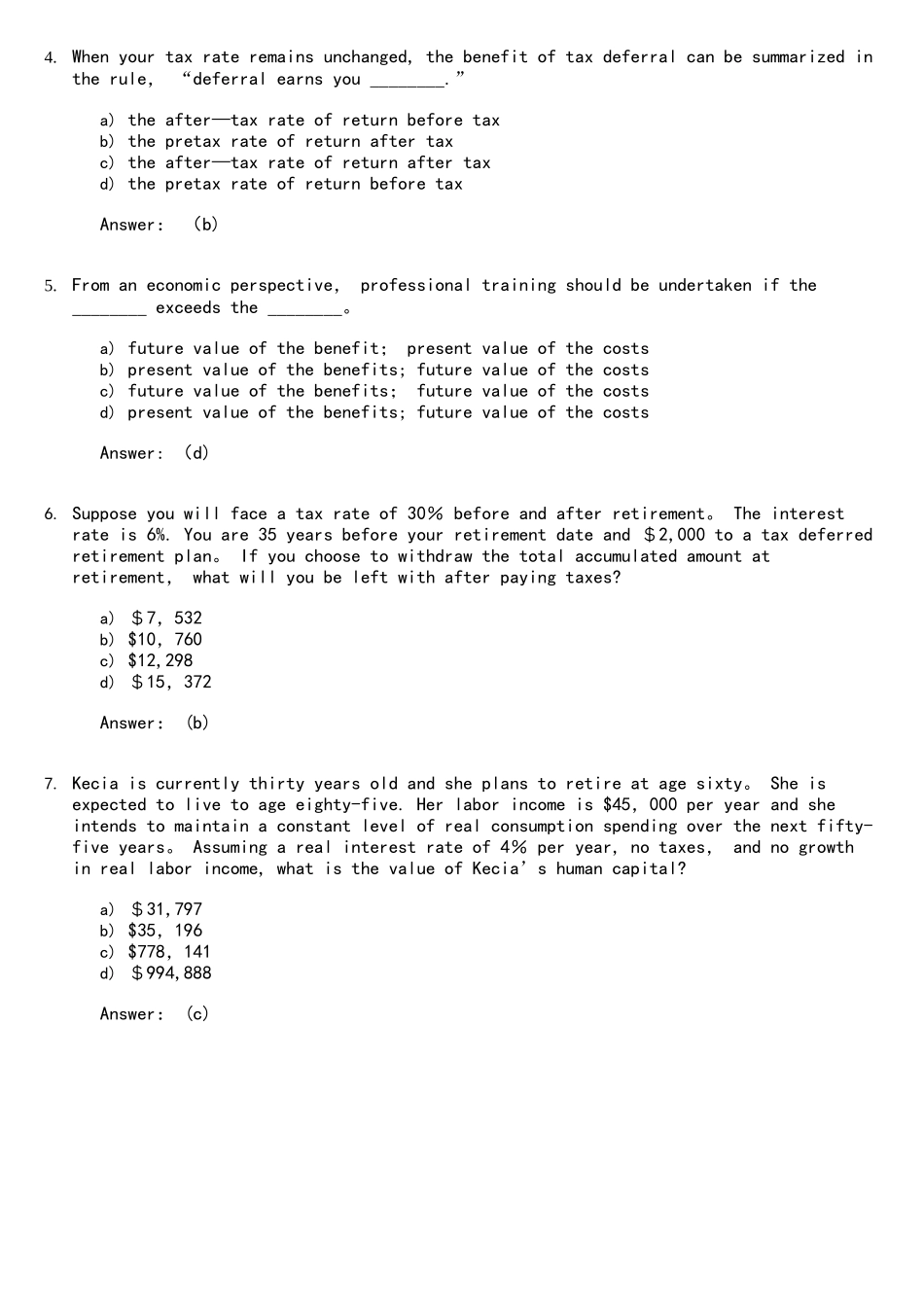

Chapter FiveHousehold Savings and Investment DecisionsThis chapter contains 28 multiple choice questions, 10 short problems, and 9 longer problems。Multiple Choice1.Getting a professional degree can be evaluated as ________.a) a social security decisionb) an investment in human capitalc) an investment in a consumer durabled) a tax exempt decisionAnswer: (b)2. Suppose you will face a tax rate of 20% before and after retirement. The interest rate is 8%。 You are 30 years before your retirement date and invest $10,000 to a tax deferred retirement plan. If you choose to withdraw the total accumulated amount at retirement, what will you be left with after paying taxes?a) $51,445b) $64,000c) $80,501d) $100,627Answer: (c)3. Suppose you will face a tax rate of 20% before and after retirement。 The interest rate is 8%. You are 30 years before your retirement date and have $10,000 to invest。 If you invest this in an ordinary savings plan instead of a tax deferred retirement plan, what amount will you have accumulated at retirement? a) $51,445b) $64,000c) $80,501d) $100,627Answer: (a)4.When your tax rate remains unchanged, the benefit of tax deferral can be summarized in the rule, “deferral earns you ________.”a) the after—tax rate of return before taxb) the pretax rate of return after taxc) the after—tax rate of return after taxd) the pretax rate of return before taxAnswer: (b)5.From an economic perspective, professional training should be undertaken if the ________ exceeds the ________。a) future value of the benefit; present value of the costsb) present value of the benefits; future value of the costsc) future value of the benefits; future value of the costsd) present value of th...