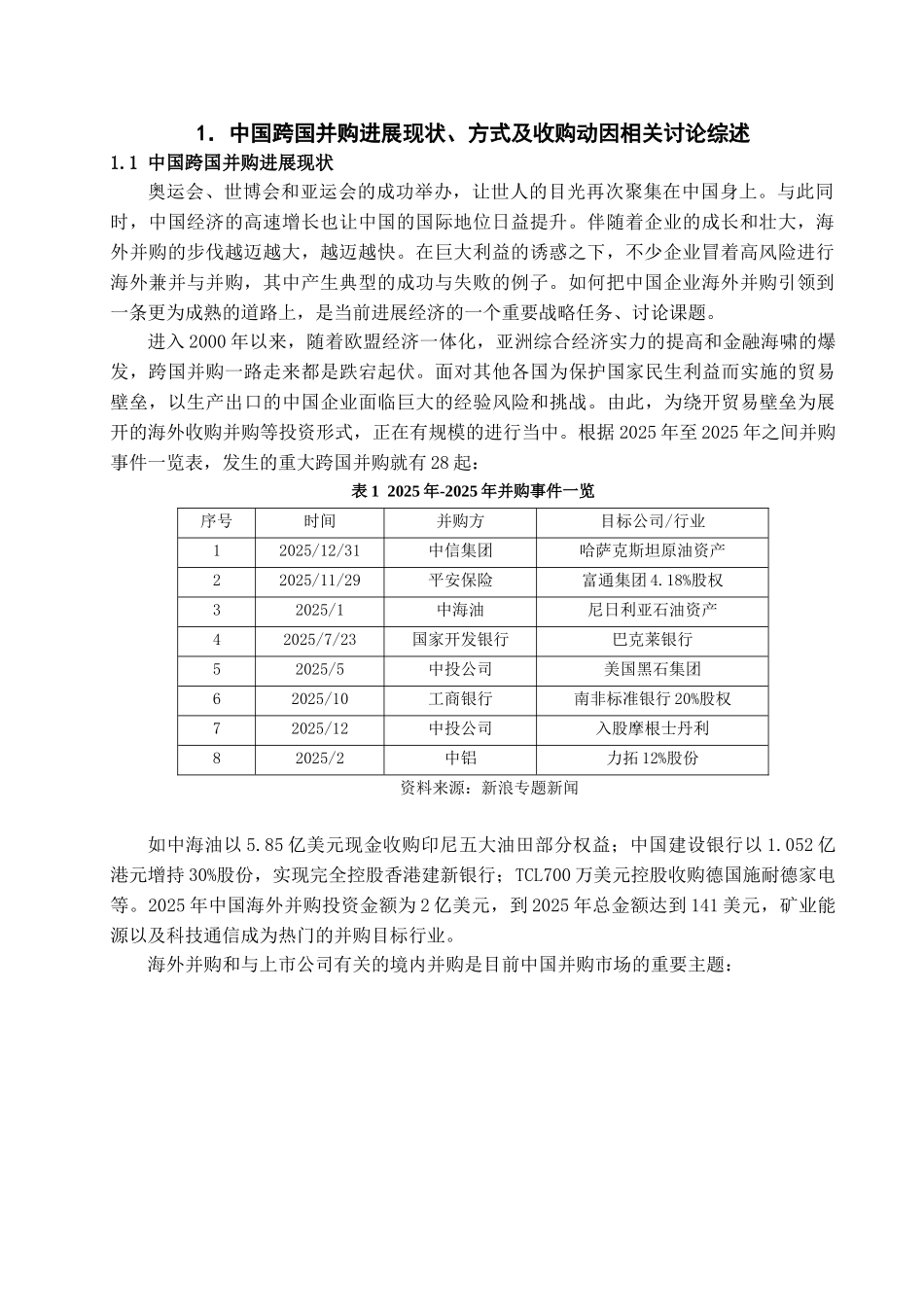

中文摘要全球经济的高速进展正在不断整合各行业之间的业务及升级自身产业链,国内并购海外收购的进展逐渐扩大,海外并购活动对整体并购市场的走向起到越来越重要的作用。拓展企业业务、开发自身缺乏的资源、提高企业核心竞争力和企业形象成为中国公司海外收购的基本动机。本文将从中海油收购优尼科及明基收购西门子等经典案例入手,深化浅出地分析国际间跨国并购的失败原因,并用印度与中国进行比较,结合各种不同因素去了解中国跨国并购的有利条件和阻碍要素。综合现实实际情况讨论如何把中国跨国并购带到更为有效率和成熟的道路上。关键字: 跨国并购,收购案例,中印对比,进展方向AbstractOlympic Games, World Expo and Asian Games success, so that the eyes of the world gathered once again on China. At the same time, China's rapid economic growth so that China's rising international status. With business growth and expansion, the pace of overseas acquisitions more step, the more the faster step. Under the temptation of huge profits, many firms risk high-risk overseas mergers and acquisitions, many of which have a typical example of success and failure. China's Overseas M & A how to guide to a more mature way, is the current economic development is an important strategic task of research. This article from the CNOOC bid for Unocal and the classic case of Siemens, BenQ to start the acquisition, and easy analysis of international cross-border M & A failure and to compare with India and China, combined with a variety of different factors to understand China's favorable conditions for cross-border M & A factors and obstacles. Comprehensive reality of how the actual situation of China to the more efficient cross-border mergers and acquisitions and mature way. Key Words: Status of cross-border M & A,COSL acquisition of Norway AWO, contrast China and India, direction of overseas acquisitions1.中国跨国并购进展现状、方式...