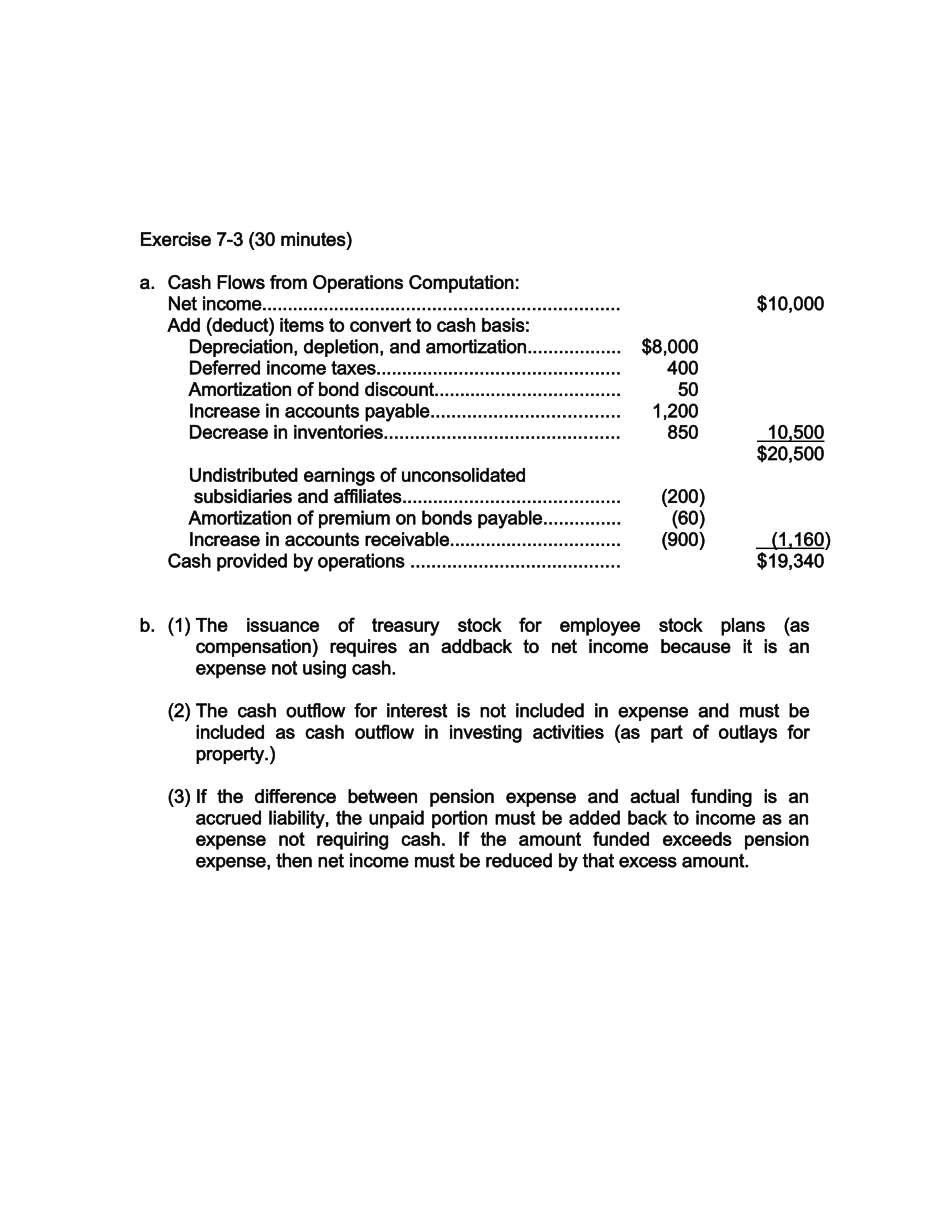

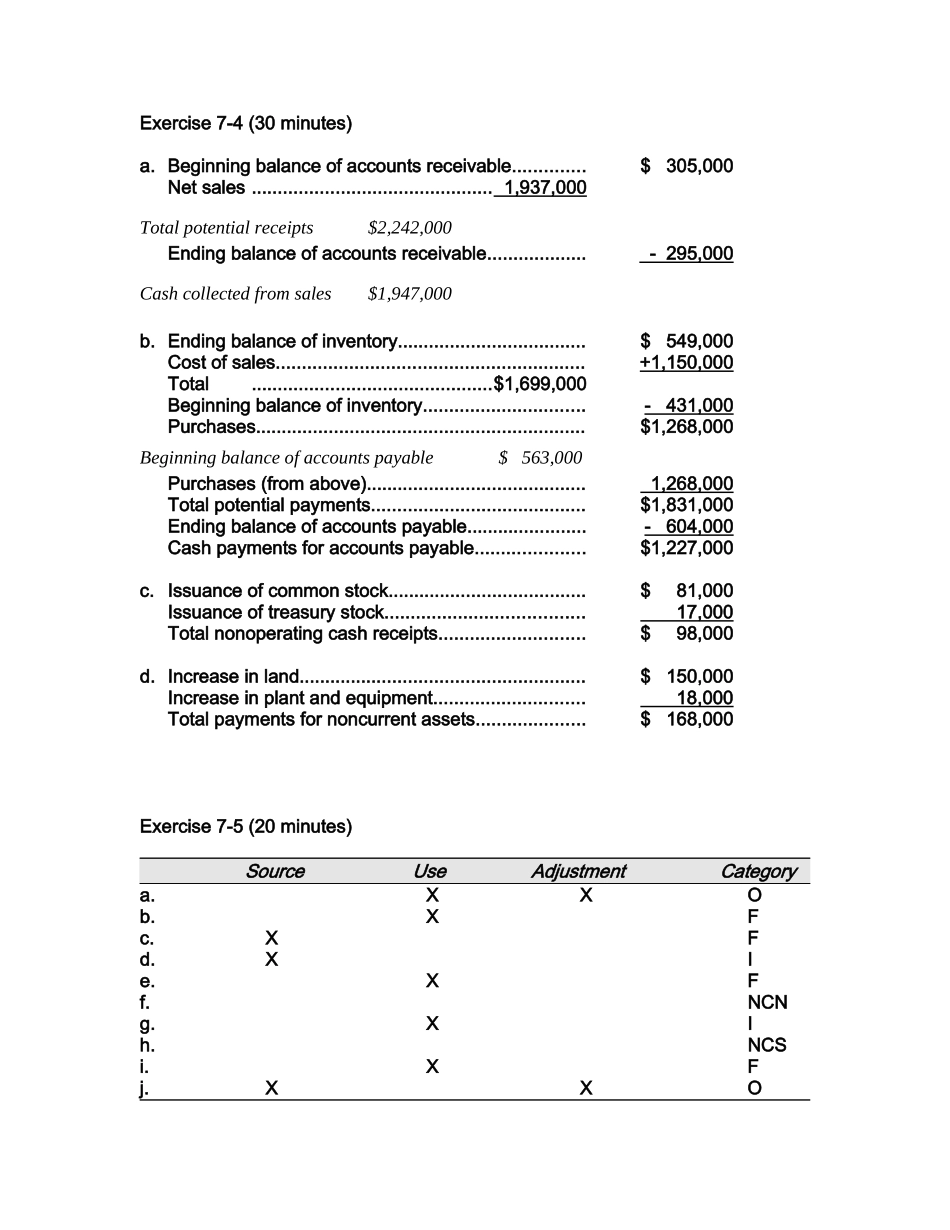

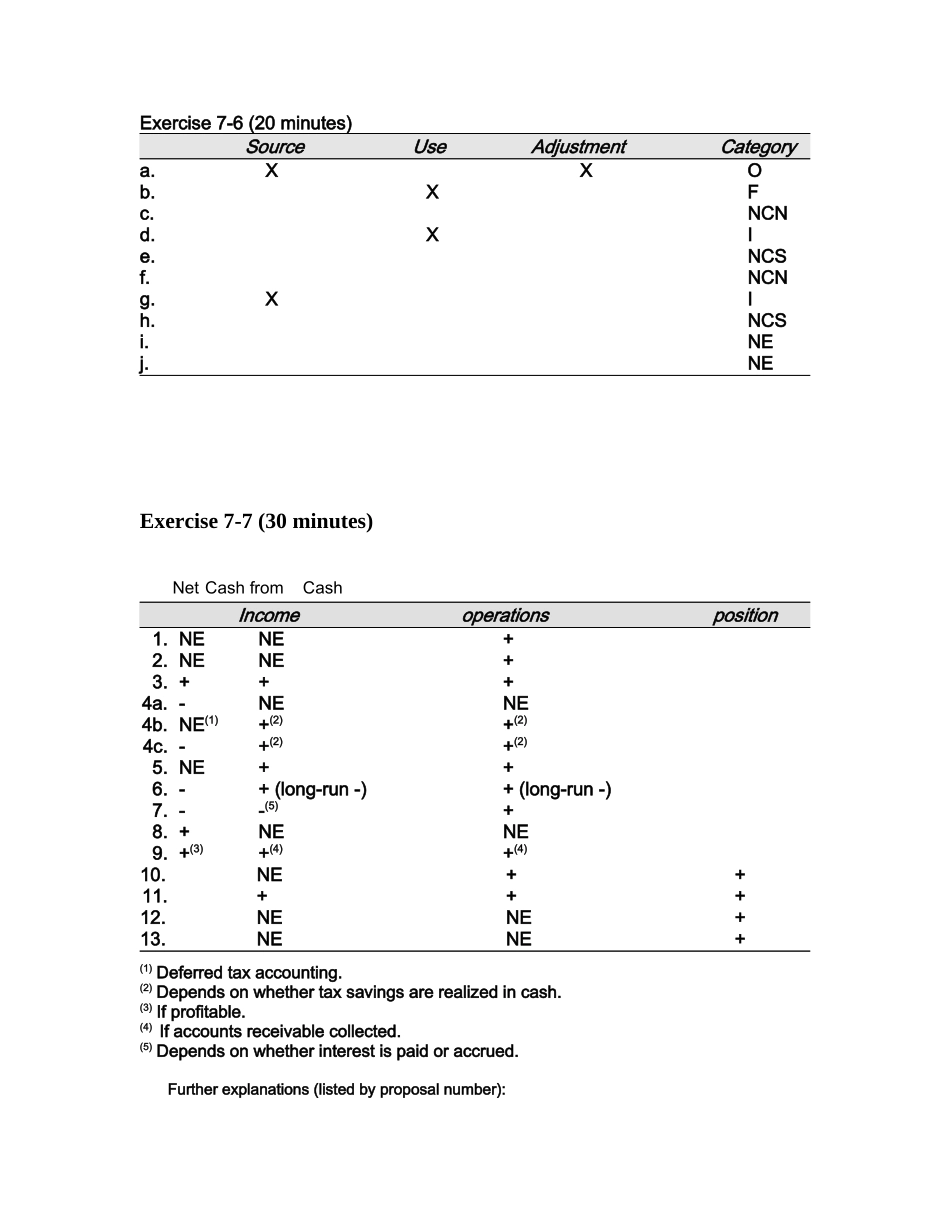

Exercise7-3(30minutes)a.CashFlowsfromOperationsComputation:Netincome.....................................................................$10,000Add(deduct)itemstoconverttocashbasis:Depreciation,depletion,andamortization..................$8,000Deferredincometaxes...............................................400Amortizationofbonddiscount....................................50Increaseinaccountspayable....................................1,200Decreaseininventories.............................................85010,500$20,500Undistributedearningsofunconsolidatedsubsidiariesandaffiliates..........................................(200)Amortizationofpremiumonbondspayable...............(60)Increaseinaccountsreceivable.................................(900)(1,160)Cashprovidedbyoperations........................................$19,340b.(1)Theissuanceoftreasurystockforemployeestockplans(ascompensation)requiresanaddbacktonetincomebecauseitisanexpensenotusingcash.(2)Thecashoutflowforinterestisnotincludedinexpenseandmustbeincludedascashoutflowininvestingactivities(aspartofoutlaysforproperty.)(3)Ifthedifferencebetweenpensionexpenseandactualfundingisanaccruedliability,theunpaidportionmustbeaddedbacktoincomeasanexpensenotrequiringcash.Iftheamountfundedexceedspensionexpense,thennetincomemustbereducedbythatexcessamount.Exercise7-4(30minutes)a.Beginningbalanceofaccountsreceivable..............$305,000Netsales..............................................1,937,000Totalpotentialreceipts$2,242,000Endingbalanceofaccountsreceivable...................-295,000Cashcollectedfromsales$1,947,000b.Endingbalanceofinventory....................................$549,000Costofsales...........................................................+1,150,000Total..............................................$1,699,000Beginningbalanceofinventory...............................-431,000Purchases...............................................................$1,268,000Beginningbalanceofaccountspayable$563,000Purchases(fromabove)..........................................1,268,000Totalpotentialpayments.........................................$1,831,000Endingbalanceofaccountspayable.......................-604,000Cashpaymentsforaccountspayable.....................$1,227,000c.Issuanceofcommonstock......................................$81,000Issuanceoftreasurystock......................................17,000Totalnonoperatingcashreceipts............................$98,000d.Increaseinland.......................................................$150,000Increaseinplantandequipment.............................18,000Totalpaymentsfornoncurrentassets.....................$168,000Exercise7-5(20minutes)SourceUseAdjustmentCategorya.XXOb.XFc.XFd.XIe.XFf.NCNg.XIh.NCSi.XFj.XXOExercise7-6(20minutes)SourceUseAdjustmentCategorya.XXOb.XFc.NCNd.XIe.NCSf.NCNg.XIh.NCSi.NEj.NEExercise7-7(30minutes)NetCashfromCashIncomeoperationsposition1.NENE+2.NENE+3.+++4a.-NENE4b.NE(1)+(2)+(2)4c.-+(2)+(2)5.NE++6.-+(long-run-)+(long-run-)7.--(5)+8.+NENE9.+(3)+(4)+(4)10.NE++11.+++12.NENE+13.NENE+(1)Deferredtaxaccounting.(2)Dependsonwhethertaxsavingsarerealizedincash.(3)Ifprofitable.(4)Ifaccountsreceivablecollected.(5)Dependsonwhetherinterestispaidoraccrued.Furtherexplanations(listedbyproposalnumber):1.Substitutingpaymentinstockforpaymentincashforitsdividendswillnotaffectinc...