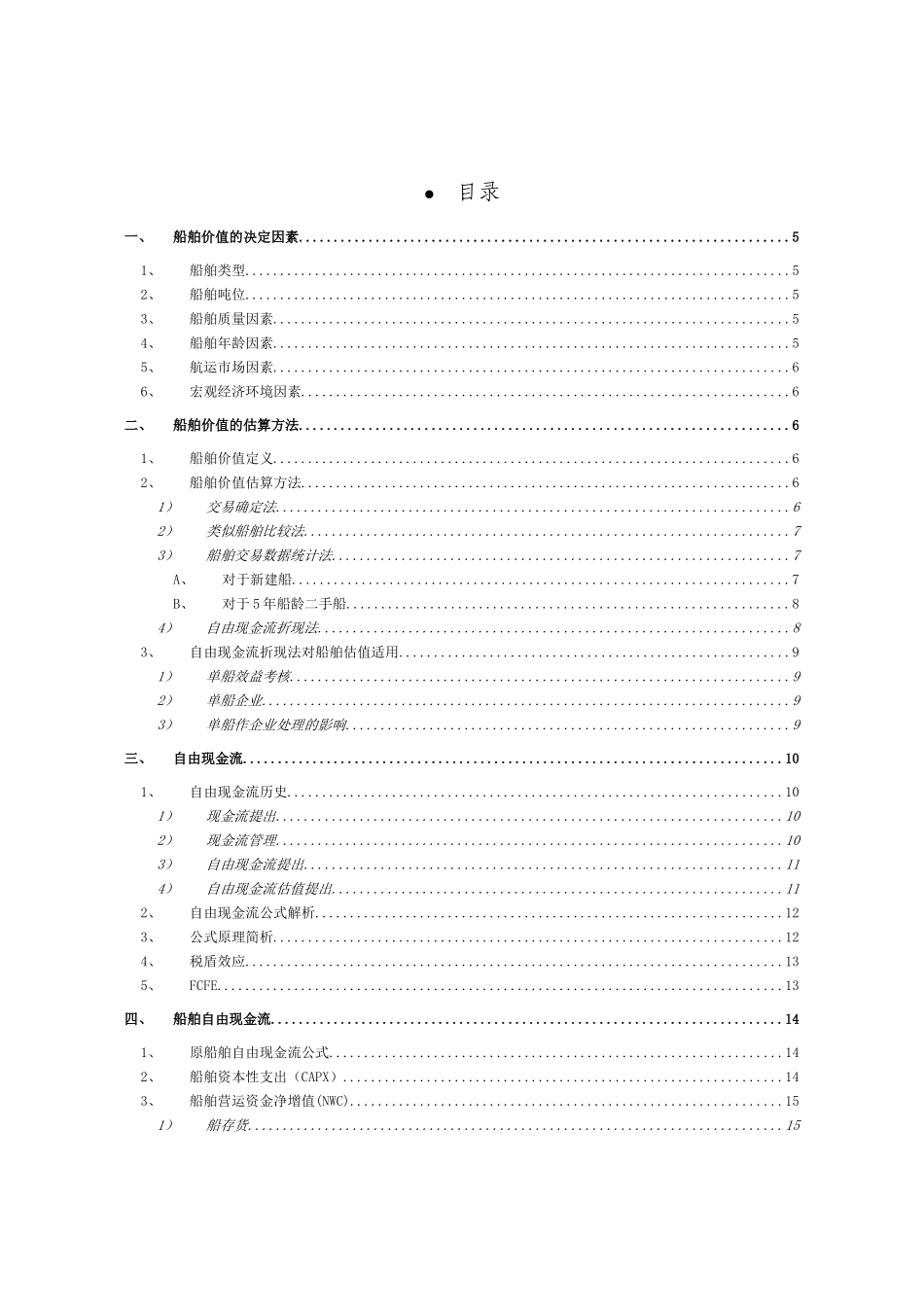

标题:船舶资产定价——自由现金流折现法作者:曹兴元2007年8月16日完稿于上海内容摘要本文主要目的是解决船舶资产定价的问题,主要介绍运用自由现金流折现法,对船舶资产进行价值评估。文中会涉及船舶资产估值方法、航运业特点、航运企业及船舶风险、折现率确定等的介绍,最后通过计算出船舶自由现金流和船舶折现率,通过折现公式:PVn=FCFF/(1+R)^n将各现值相加,得出船舶资产现值。关键词:船舶价值、自由现金流、折现率、风险。目录一、船舶价值的决定因素......................................................................51、船舶类型..............................................................................52、船舶吨位..............................................................................53、船舶质量因素..........................................................................54、船舶年龄因素..........................................................................55、航运市场因素..........................................................................66、宏观经济环境因素......................................................................6二、船舶价值的估算方法......................................................................61、船舶价值定义..........................................................................62、船舶价值估算方法......................................................................61)交易确定法.........................................................................62)类似船舶比较法.....................................................................73)船舶交易数据统计法.................................................................7A、对于新建船.......................................................................7B、对于5年船龄二手船...............................................................84)自由现金流折现法...................................................................83、自由现金流折现法对船舶估值适用........................................................91)单船效益考核.......................................................................92)单船企业...........................................................................93)单船作企业处理的影响...............................................................9三、自由现金流.............................................................................101、自由现金流历史.......................................................................101)现金流提出........................................................................102)现金流管理........................................................................103)自由现金流提出....................................................................114)自由现金流估值提出................................................................112、自由现金流公式解析...................................................................123、公式原理简析.........................................................................124、税盾效应.............................................................................135、FCFE.................................................................................13四、船舶自由现金流.........................................................................141、原船舶自由现金流公式.................................................................142、船舶资本性支出(CAPX)...............................................