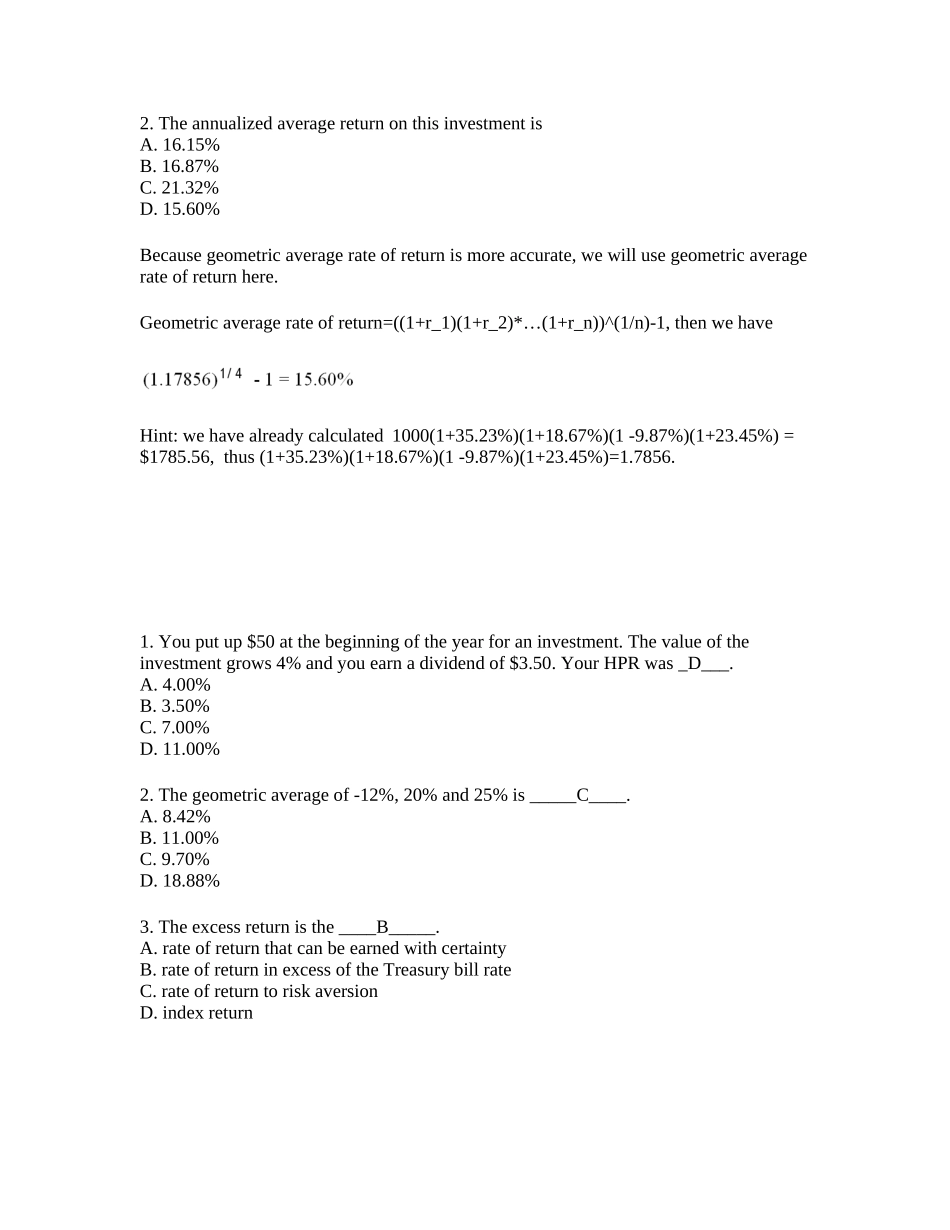

Samplequestion:Youhavethefollowingratesofreturnforariskyportfolioforseveralrecentyears:1.Ifyouinvested$1,000atthebeginningof2005yourinvestmentattheendof2008wouldbeworth___________.A.$2,176.60B.$1,785.56C.$1,645.53D.$1,247.87Ifyouinvest1,000,attheendofyearone,youwillhave1000*(1+35.23%),Attheendofyear2,youwillhave1000*(1+35.23%)*(1+18.67%),dothesameworkforyear3and4,then$1000(1+35.23%)(1+18.67%)(1-9.87%)(1+23.45%)=$1785.562.TheannualizedaveragereturnonthisinvestmentisA.16.15%B.16.87%C.21.32%D.15.60%Becausegeometricaveragerateofreturnismoreaccurate,wewillusegeometricaveragerateofreturnhere.Geometricaveragerateofreturn=((1+r_1)(1+r_2)*…(1+r_n))^(1/n)-1,thenwehaveHint:wehavealreadycalculated1000(1+35.23%)(1+18.67%)(1-9.87%)(1+23.45%)=$1785.56,thus(1+35.23%)(1+18.67%)(1-9.87%)(1+23.45%)=1.7856.1.Youputup$50atthebeginningoftheyearforaninvestment.Thevalueoftheinvestmentgrows4%andyouearnadividendof$3.50.YourHPRwas_D___.A.4.00%B.3.50%C.7.00%D.11.00%2.Thegeometricaverageof-12%,20%and25%is_____C____.A.8.42%B.11.00%C.9.70%D.18.88%3.Theexcessreturnisthe____B_____.A.rateofreturnthatcanbeearnedwithcertaintyB.rateofreturninexcessoftheTreasurybillrateC.rateofreturntoriskaversionD.indexreturn4.Yourinvestmenthasa20%chanceofearninga30%rateofreturn,a50%chanceofearninga10%rateofreturnanda30%chanceoflosing6%.WhatisyourexpectedDreturnonthisinvestment?DA.12.8%B.11.0%C.8.9%D.9.2%5.Yourinvestmenthasa40%chanceofearninga15%rateofreturn,a50%chanceofearninga10%rateofreturnanda10%chanceoflosing3%.Whatisthestandarddeviationofthisinvestment?10.7%AA.5.14%B.7.59%C.9.29%D.8.43%6.Bothinvestorsandgamblerstakeonrisk.Thedifferencebetweenaninvestorandagambleristhataninvestor____B___.A.isnormallyriskneutralB.requiresariskpremiumtotakeontheriskC.knowsheorshewillnotlosemoneyD.knowstheoutcomesatthebeginningoftheholdingperiod7.Treasurybillsarepayinga4%rateofreturn.AriskaverseinvestorwithariskaversionofA=3shouldinvestinariskyportfoliowithastandarddeviationof24%onlyiftheriskyportfolio'sexpectedreturnisatleast__C____.A.8.67%B.9.84%C.12.64%D.14.68%8.Twoassetshavethefollowingexpectedreturnsandstandarddeviationswhentherisk-freerateis5%:1115.9AninvestorwithariskaversionofA=3wouldfindthat________C_________onariskreturnbasis.A.onlyAssetAisacceptableB.onlyAssetBisacceptableC.neitherAssetAnorAssetBisacceptableD.bothAssetAandAssetBareacceptable9.Youpurchasedashareofstockfor$29.Oneyearlateryoureceived$2.25asdividendandsoldthesharefor$28.Yourholding-periodreturnwas______C___.A.-3.57%B.-3.45%C.4.31%D.8.03%10.Theholdingperiodreturnonastockwas25%.Itsendingpricewas$18anditsbeginningpricewas$16.Itscashdividendmusthavebeen___C______.A.$0.25B.$1.00C.$2.00D.$4.0011.Aninvestorinvests70%ofherwealthinariskyassetwithanexpectedrateofreturnof15%andavarianceof5%andsheputs30%inaTreasurybillthatpays5%.Herportfolio'sexpectedrateofreturnandstandarddeviationare_______C___and__________respectively.A.10.0%,6.7%B.12.0%,22.4%C.12.0%,15.7%D.10.0%,35.0%12.Considerthefollowingtwoinvestmentalternatives.First,ariskyportfoliothatpays15%rateofreturnwithaprobabilityof40%or5%withaprobabilityof60%.Second,atreasurybillthatpays6%.Theriskpremiumontheriskyinvestmentis____B_____.A.1%B.3%C.6%D.9%13.Whatisthegeometricaveragereturnofthefollowingquarterlyreturns:3%,5%,4%,and7%,respectively?CA.3.72%B.4.23%C.4.74%D.4.90%Youhavethefollowingratesofreturnforariskyportfolioforseveralrecentyears.Assumethatthestockpaysnodividends14.Whatisthegeometricaveragereturnfortheperiod?CA.2.87%B.0.74%C.2.60%D.2.21%15.Whatisthedollarweightedreturnovertheentiretimeperiod?BA.2.87%B.0.74%C.2.60%D.2.21%