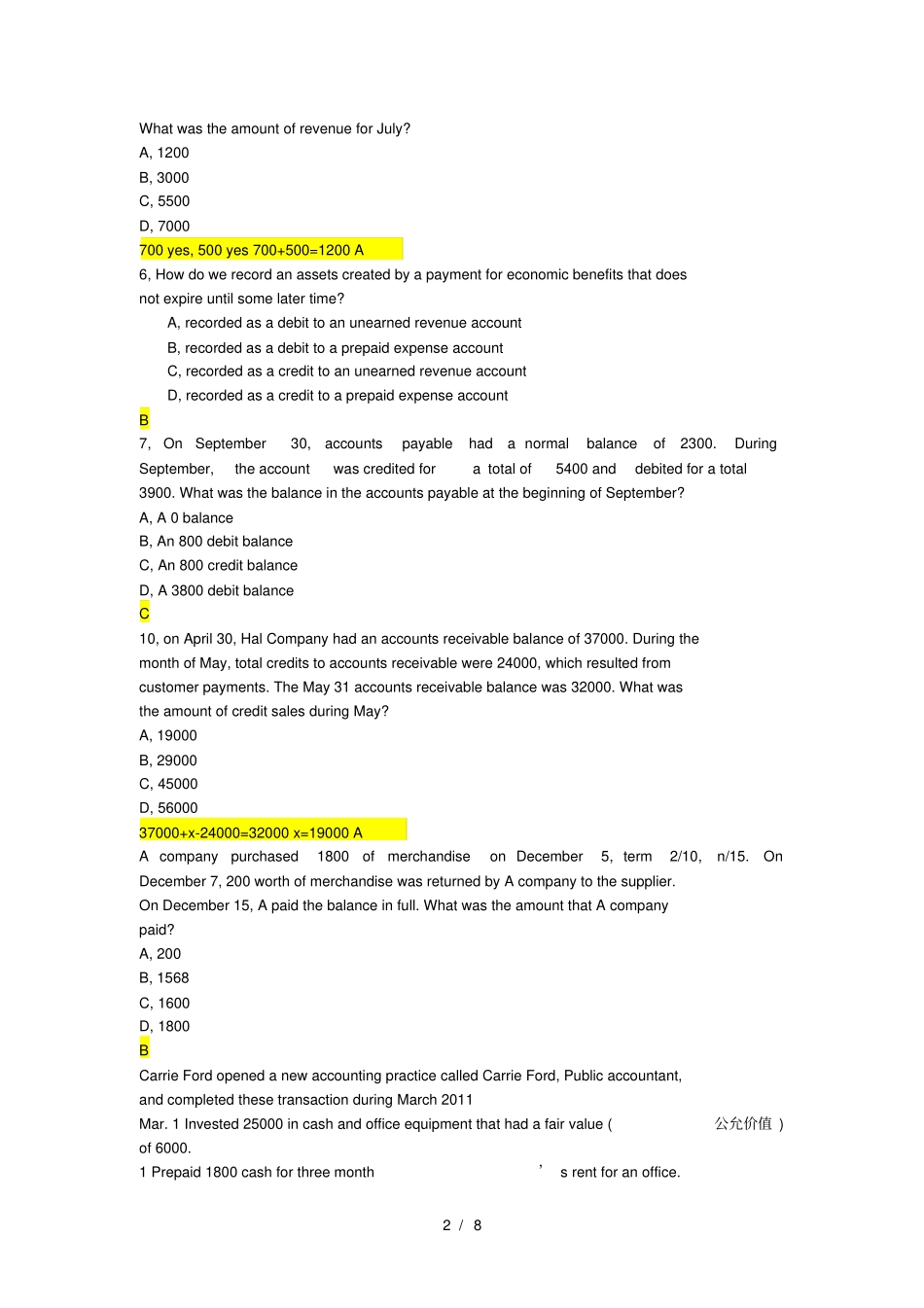

1/81,Howdowerecordedaliabilitycreatedbythereceiptofcashfromcustomersinpaymentforproductsorservicesthathavenotyetbeendeliveredtothecustomers?A,recordedasadebittoanunearnedrevenueaccountB,recordedasadebittoaprepaidexpenseaccountC,recordedasacredittoanunearnedrevenueaccountD,recordedasacredittoaprepaidexpenseaccount.c3,duringthemonthofFebruary,HalCompanyhadcashreceiptof6500andcashdisbursementof8000.TheFebruary28cashbalancewas4300.Whatwasthebeginning(February1)cashbalance?A,1500B,2800C,5800D,7300X+6500-8000=4300X=5800C4,Aimesopenedanewbusinessbyinvestingthefollowingassets:cash4000;land20000;building80000.Also,thebusinesswillassumeresponsibilityforanotepayableof32000.Aimessignedthenoteaspartofhispaymentforthelandandbuilding.WhichjournalentryshouldbeusedonthebooksofthenewbusinesstorecordtheinvestmentbyAimes?A,Dr.Asserts104000Cr.Capital104000B,Dr.Asserts104000Cr.Liability32000Capital72000C,Dr.Cash4000Land20000Building80000Cr.Capital104000D,Dr.Cash4000Land20000Building80000Cr.Notespayable32000Capital72000D5,thefollowingtransactionoccurredduringJuly:--received700cashforphotographyserviceprovidedtocustomerduringthemonth--received1500cashfromBarbara,theownerofthebusiness--received800fromacustomerinpartialpaymentofhisaccountreceivablewhicharoseasaresultofsalesduringJune--renderedphotographyservicestoacustomeroncredit.500--borrowed2500frombank--received1000fromacustomerinpaymentforservicestobeperformednextyear2/8WhatwastheamountofrevenueforJuly?A,1200B,3000C,5500D,7000700yes,500yes700+500=1200A6,Howdowerecordanassetscreatedbyapaymentforeconomicbenefitsthatdoesnotexpireuntilsomelatertime?A,recordedasadebittoanunearnedrevenueaccountB,recordedasadebittoaprepaidexpenseaccountC,recordedasacredittoanunearnedrevenueaccountD,recordedasacredittoaprepaidexpenseaccountB7,OnSeptember30,accountspayablehadanormalbalanceof2300.DuringSeptember,theaccountwascreditedforatotalof5400anddebitedforatotal3900.WhatwasthebalanceintheaccountspayableatthebeginningofSeptember?A,A0balanceB,An800debitbalanceC,An800creditbalanceD,A3800debitbalanceC10,onApril30,HalCompanyhadanaccountsreceivablebalanceof37000.DuringthemonthofMay,totalcreditstoaccountsreceivablewere24000,whichresultedfromcustomerpayments.TheMay31accountsreceivablebalancewas32000.WhatwastheamountofcreditsalesduringMay?A,19000B,29000C,45000D,5600037000+x-24000=32000x=19000AAcompanypurchased1800ofmerchandiseonDecember5,term2/10,n/15.OnDecember7,200worthofmerchandisewasreturnedbyAcompanytothesupplier.OnDecember15,Apaidthebalanceinfull.WhatwastheamountthatAcompanypaid?A,200B,1568C,1600D,1800BCarrieFordopenedanewaccountingpracticecalledCarrieFord,Publicaccountant,andcompletedthesetransactionduringMarch2011Mar.1Invested25000incashandofficeequipmentthathadafairvalue(公允价值)of6000.1Prepaid1800cashforthreemonth’srentforanoffice.3/83Madecreditpurchaseofofficeequipmentfor3000andofficesuppliesfor600.5Completedworkforaclientandimmediatelyreceived500cash9Completeda2000projectforaclient,whowillpaywithin30days11PaidtheaccountpayablecreatedonMarch315Paid1500cashfortheannualpremiumonaninsurancepolicy.20Received1600aspartialpaymentfortheworkcompletedonMatch923Completedworkforanotherclientfor660oncredit27CarrieFordwithdrew1800cashfromthebusinesstopaysomepersonalexpense30Purchased200ofadditionalofficesuppliesoncredit31Paid175forthemonth’sutilitybill.(1)Preparejournal...