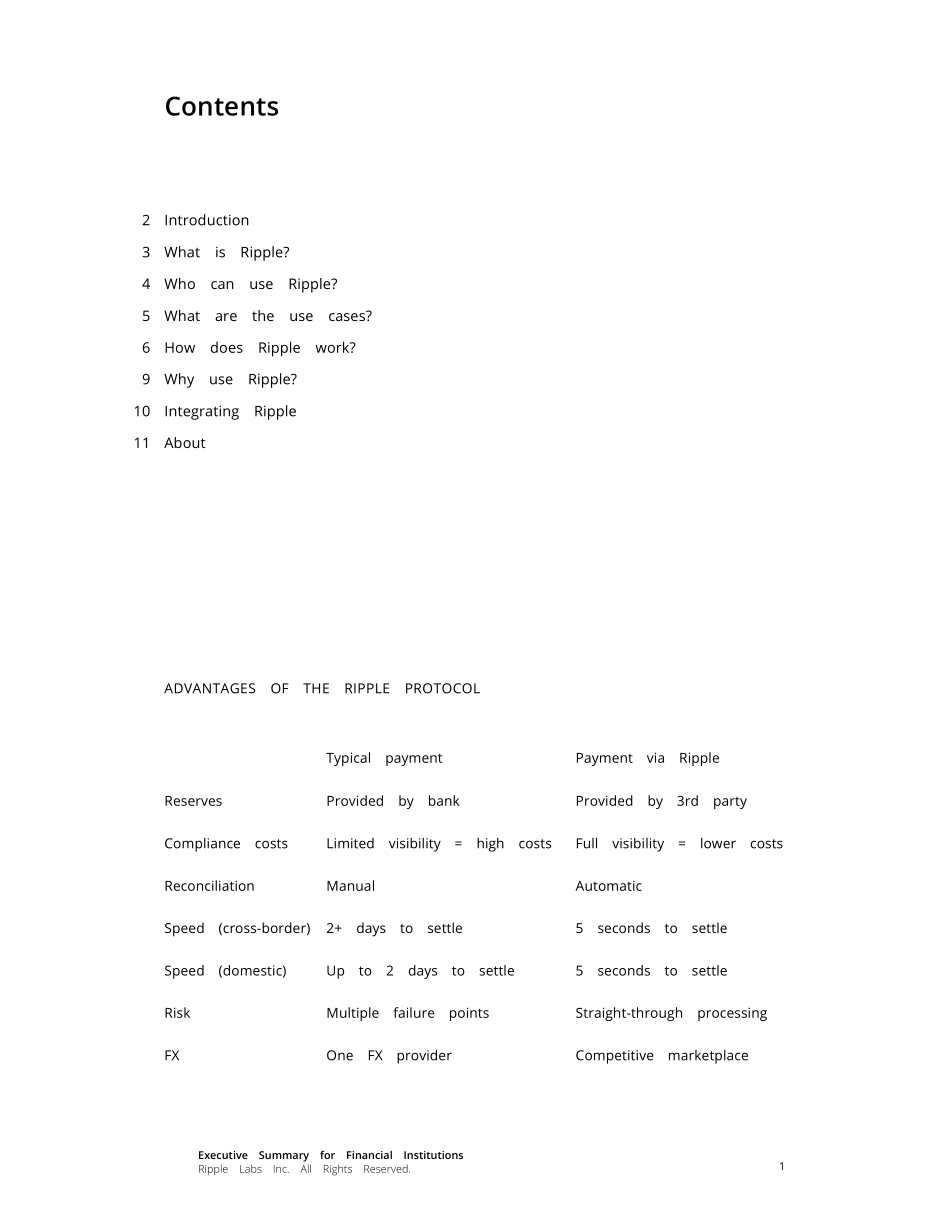

Executive Summary for Financial Institutions Ripple: Internet protocol for interbank payments January 2015 - Version 1.2 1 Executive Summary for Financial Institutions Ripple Labs Inc. All Rights Reserved. Contents 2 Introduction 3 What is Ripple? 4 Who can use Ripple? 5 What are the use cases? 6 How does Ripple work? 9 Why use Ripple? 10 Integrating Ripple 11 About ADVANTAGES OF THE RIPPLE PROTOCOL Typical payment Payment via Ripple Reserves Provided by bank Provided by 3rd party Compliance costs Limited visibility = high costs Full visibility = lower costs Reconciliation Manual Automatic Speed (cross-border) 2+ days to settle 5 seconds to settle Speed (domestic) Up to 2 days to settle 5 seconds to settle Risk Multiple failure points Straight-through processing FX One FX provider Competitive marketplace 2 Executive Summary for Financial Institutions Ripple Labs Inc. All Rights Reserved. Introduction Ripple is the first open-standard, Internet Protocol (IP)-based technology for banks to clear and settle transactions in real-time via a distributed network. Banks can use Ripple to make faster payments in more currencies to more markets - all with lower risks and costs than is possible today. There is a clear opportunity to improve the infrastructure for interbank payments Banks largely rely on intermediaries (clearinghouses, correspondents) to settle payments. As a result, banks incur material costs and risks that can be prohibitively expensive - especially for cross-border and real-time payments. One solution for addressing this structural problem is Ripple. Ripple is basic infrastructure that optimizes the payment process Ripple is a neutral (i.e. non-government, non-corporate public good) Internet-based proto...