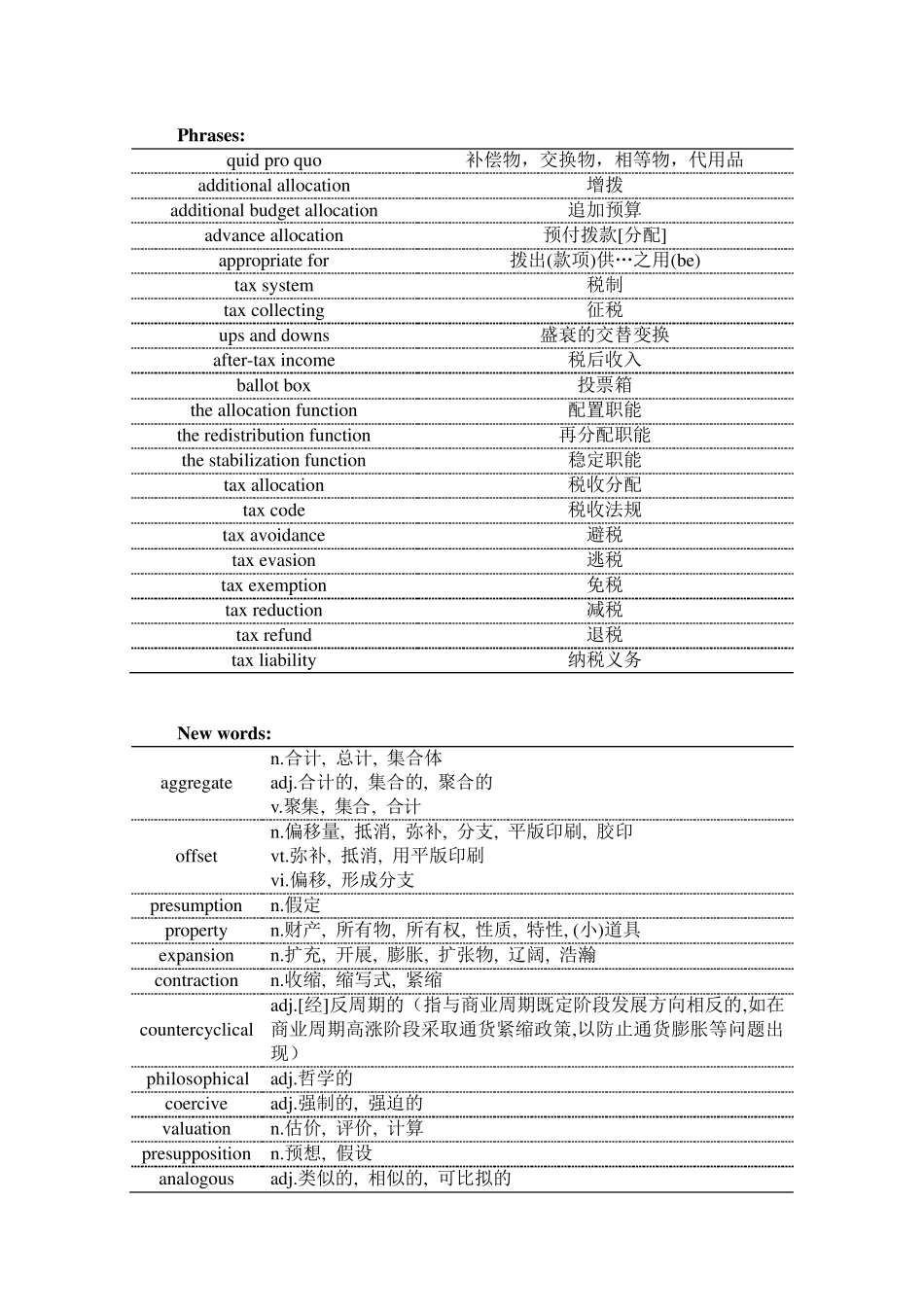

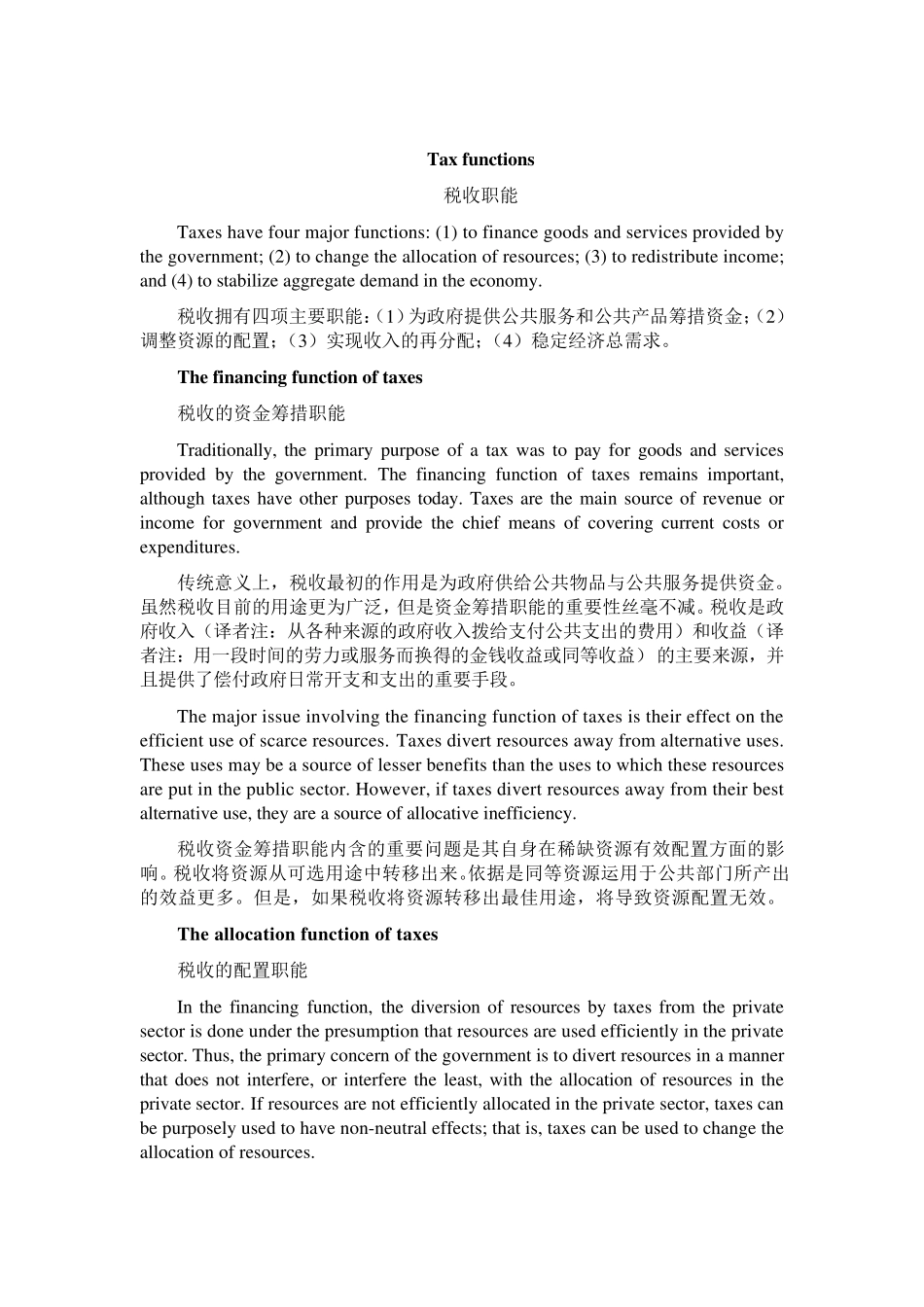

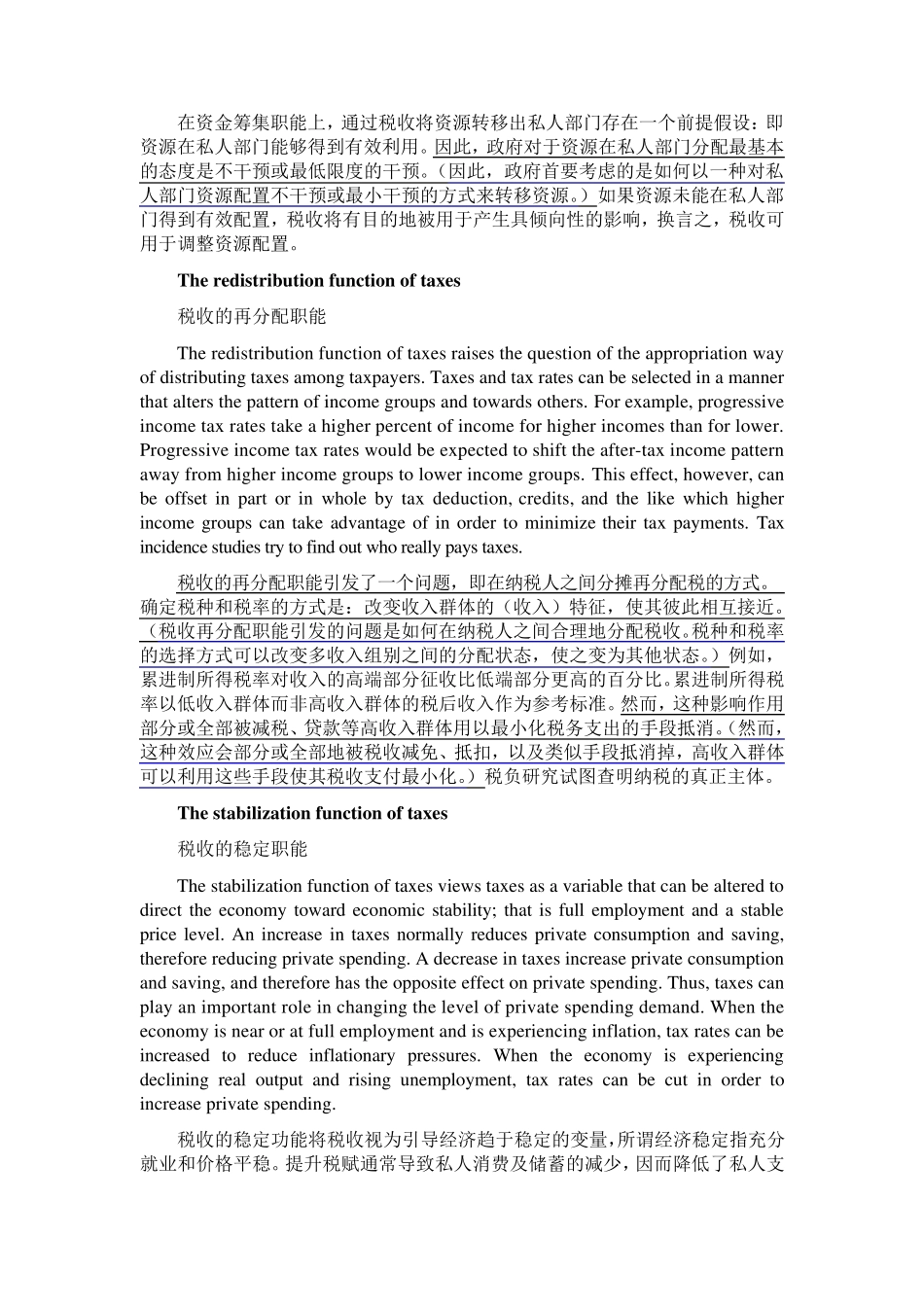

Phrases: quid pro quo 补偿物,交换物,相等物,代用品 additional allocation 增拨 additional budget allocation 追加预算 advance allocation 预付拨款[分配] appropriate for 拨出(款项)供…之用(be) tax system 税制 tax collecting 征税 ups and downs 盛衰的交替变换 after-tax income 税后收入 ballot box 投票箱 the allocation function 配置职能 the redistribution function 再分配职能 the stabilization function 稳定职能 tax allocation 税收分配 tax code 税收法规 tax avoidance 避税 tax evasion 逃税 tax exemption 免税 tax reduction 减税 tax refund 退税 tax liability 纳税义务 New w ords: aggregate n.合计, 总计, 集合体 adj.合计的, 集合的, 聚合的 v.聚集, 集合, 合计 offset n.偏移量, 抵消, 弥补, 分支, 平版印刷, 胶印 vt.弥补, 抵消, 用平版印刷 vi.偏移, 形成分支 presumption n.假定 property n.财产, 所有物, 所有权, 性质, 特性, (小)道具 expansion n.扩充, 开展, 膨胀, 扩张物, 辽阔, 浩瀚 contraction n.收缩, 缩写式, 紧缩 countercyclical adj.[经]反周期的(指与商业周期既定阶段发展方向相反的,如在商业周期高涨阶段采取通货紧缩政策,以防止通货膨胀等问题出现) philosophical adj.哲学的 coercive adj.强制的, 强迫的 valuation n.估价, 评价, 计算 presupposition n.预想, 假设 analogous adj.类似的, 相似的, 可比拟的 Tax functions 税收职能 Taxes have four major functions: (1) to finance goods and services provided by the government; (2) to change the allocation of resources; (3) to redistribute income; and (4) to stabilize aggregate demand in the economy. 税收拥有四项主要职能:(1)为政府提供公共服务和公共产品筹措资金;(2)调整资源的配置;(3)实现收入的再分配;(4)稳定经济总需求。 The financing function of taxes 税收的资金筹措职能 Traditionally, the primary purpose of a tax was to pay for goods and services provided by the government. The financing function of taxes remains important, although taxes have other...