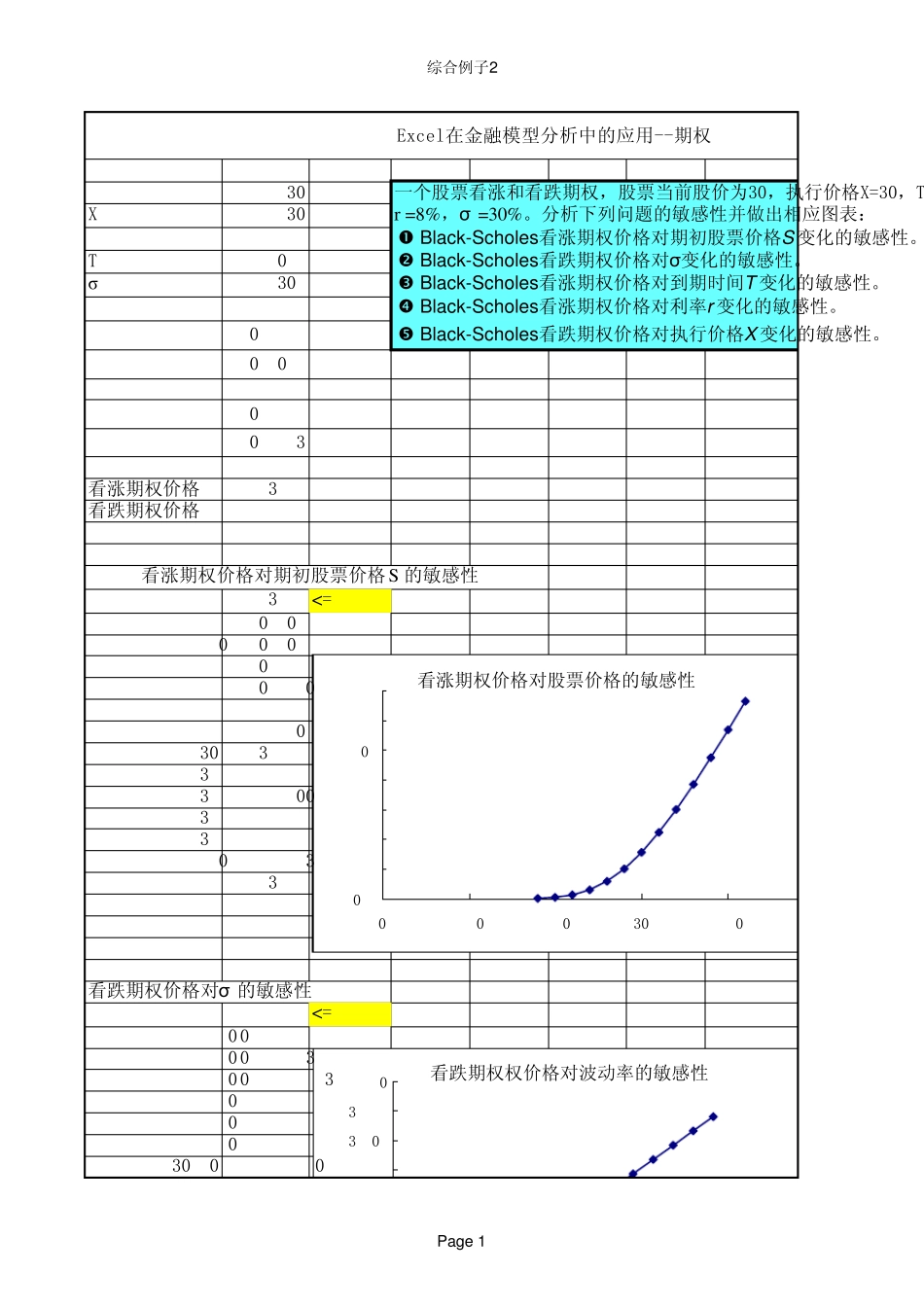

综合例子2S30一个股票看涨和看跌期权,股票当前股价为30,执行价格X=30,TX30r =8%,σ =30%。分析下列问题的敏感性并做出相应图表:r8% Black-Scholes看涨期权价格对期初股票价格S 变化的敏感性。T0.5 Black-Scholes看跌期权价格对σ变化的敏感性。σ30% Black-Scholes看涨期权价格对到期时间T 变化的敏感性。 Black-Scholes看涨期权价格对利率r变化的敏感性。d10.2946 Black-Scholes看跌期权价格对执行价格X 变化的敏感性。d20.0825N(d1)0.6159N(d2)0.5329看涨期权价格 3.12看跌期权价格 1.94 看涨期权价格对期初股票价格 S 的敏感性3.12<=B15180.02200.09220.26240.60261.17282.01303.12324.46346.00367.69389.494011.3742 13.29看跌期权价格对σ 的敏感性1.94<=B1612.0%0.515715.0%0.743118.0%0.977321.0%1.215224.0%1.455627.0%1.697430.0%1.9401Excel在金融模型分析中的应用--期权 0 2 4 6 8 10 12 14 0102030405看涨期权价格对股票价格的敏感性2.5 3.0 3.5 4.0 看跌期权权价格对波动率的敏感性Page 1综合例子233.0%2.183536.0%2.427239.0%2.671142.0%2.915045.0%3.158948.0%3.4026看涨期权价格对到期时间的敏感性3.12<=B150.21.84120.32.31740.42.73570.53.11640.63.47020.73.80330.84.11980.94.42241 4.71341.14.99421.25.26611.35.53001.45.7868看涨期权价格对利率的敏感性3.12<=B155%2.896%2.967%3.048%3.129%3.1910% 3.2711% 3.3512% 3.4313% 3.5114% 3.5915% 3.6816% 3.7617% 3.8418% 3.930.0 0.5 1.0 1.5 2.0 2.5 0.0%10.0%20.0%30.0%40.0%50.0%60.0%0.0000 1.0000 2.0000 3.0000 4.0000 5.0000 6.0000 7.0000 00.511.5看涨期权权价格对到期时间的敏感性2.80 3.00 3.20 3.40 3.60 3.80 4.00 5%7%9%11%13%15%17%看涨期权价格利率 r看涨期权价格对利率的敏感性Page 2综合例子2看跌期权价格对执行价格变化的敏感性1.94<=B16387.180043408.8616754210.624164412.442754614.299014816.179915018.0765352 19.9835421.895535623.811745825.7301660 27.649962 29.57046431.4913605101520253035384348535863看跌期权价格执行价格 (X)看跌期权价格对执行价格的敏感性Page 3综合例子2价为30,执行价格X=30,T=0.5,性并做出相应图表:股票价格S 变化的敏感性。化的敏感性。时间T 变化的敏感性。r变化的敏感性。价格X 变化的敏感性。50Page 4综合例子260.0%%19%Page 5综合例子268Page 6