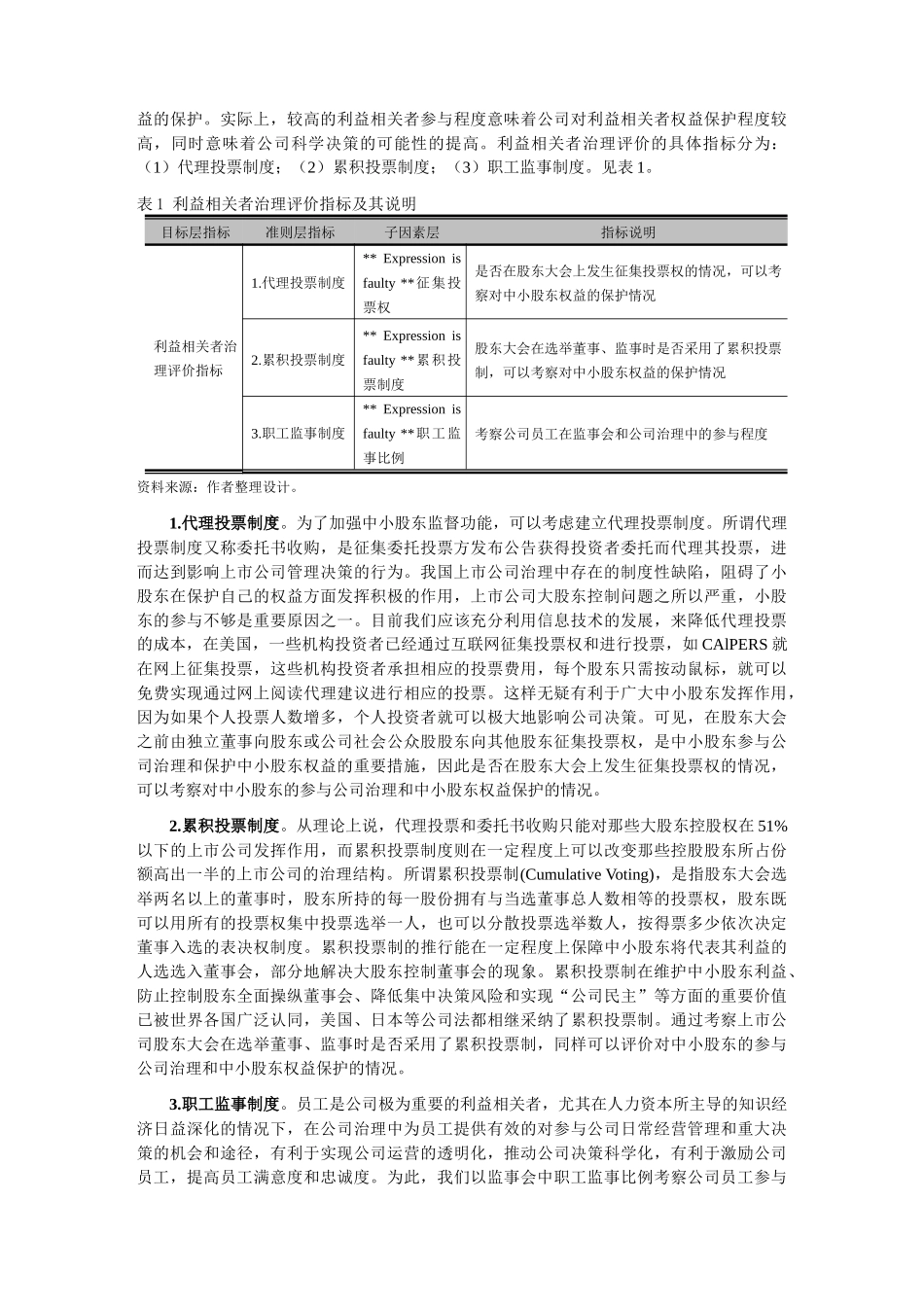

上市公司利益相关者治理评价及实证研究李维安 唐跃军摘 要:有鉴于利益相关者的相关问题已成为现行公司治理框架中不可或缺的一部分,本文设置代理投票制度、累积投票制度、职工监事制度三个利益相关者治理评价指标考察中国上市公司利益相关者参与公司治理和利益相关者权益的保护状况。评价结果显示,我国上市公司利益相关者治理水平很低,还处在建立健全的初步阶段,还不足以对企业业绩和企业价值产生显著影响。我国上市公司亟待建立和完善利益相关者治理机制,以便充分重视和解决利益相关者问题,提升整体公司治理绩效,最终达到提高公司业绩和价值的目的。关键词:利益相关者;治理评价;治理指数;公司治理作者简介:李维安,南开大学国际商学院教授,博士生导师,主要研究方向为公司治理和网络组织。唐跃军,南开大学国际商学院企业管理博士研究生。中图分类号:F276.6 文献标识码:AStakeholders Governance Appraisals and Empirical Researches of Listed CompaniesAbstract: In this paper, due to the importance of stakeholders problem in corporate governance, we set up three index, such as proxy voting, cumulative voting and employee supervisor to appraise state quo of stakeholders participation in corporate governance and stakeholders rights and interests protection of Chinese listed companies. The appraisal results show that stakeholders governance in Chinese listed companies is still in the initial stage and on the very low level, and they couldn’t influence on firm performance and value significantly. Chinese listed companies must construct and improve stakeholders governance mechanisms in order to pay more attention to and solve stakeholders problems, enhance whole corporate governance performance, and finally improve firm performance and value.Keywords: Stakeholders; Governance Appraisals; Governance Index;Corporate Governance引言在国外,在公司治理中考虑利益相关者的权益,鼓励利益相关者适当参与已经成为广为接受的观点。在 20 世纪 80 年代初,以 Freeman 为代表的一些经济学家和管理学家从公司战略...