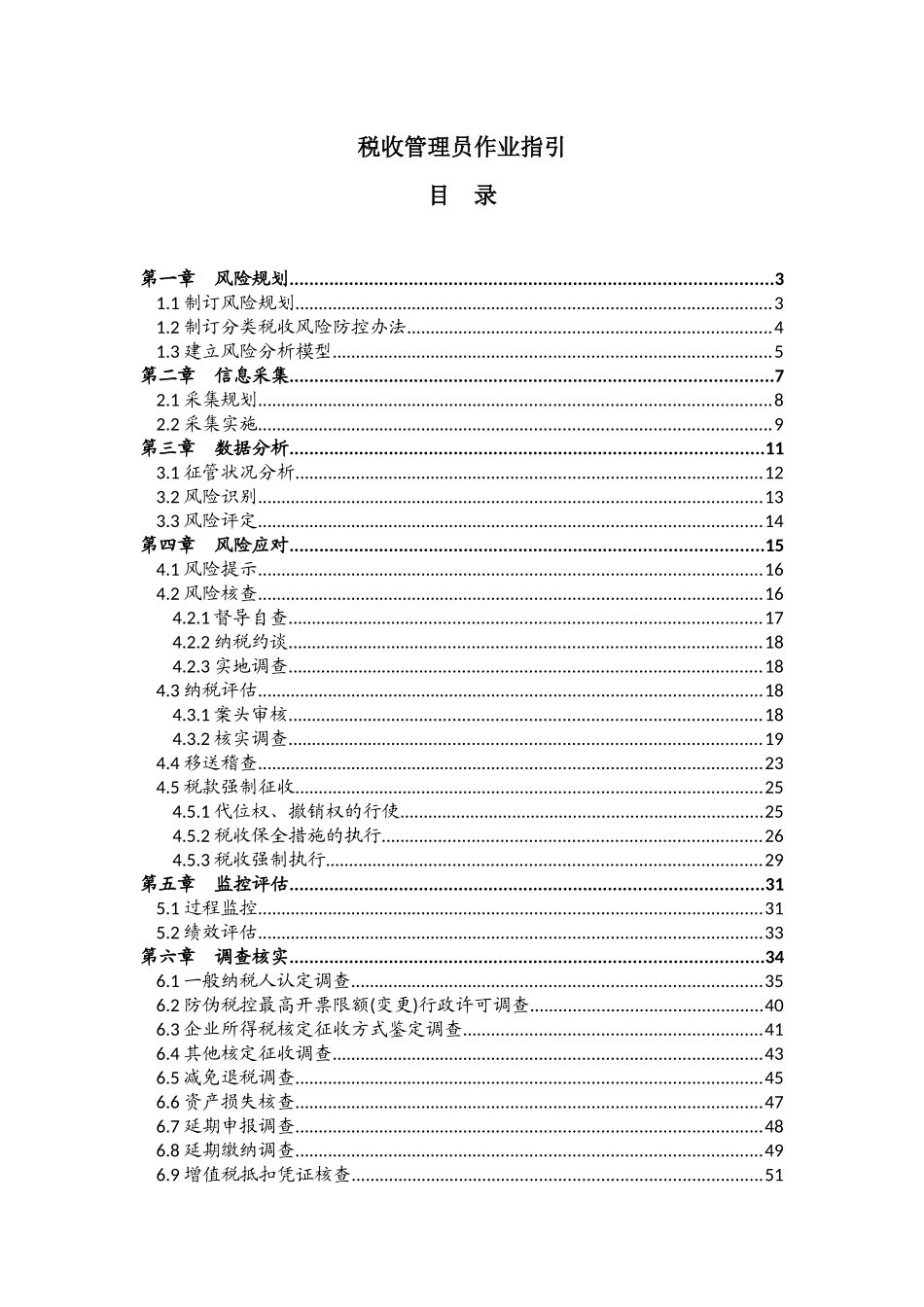

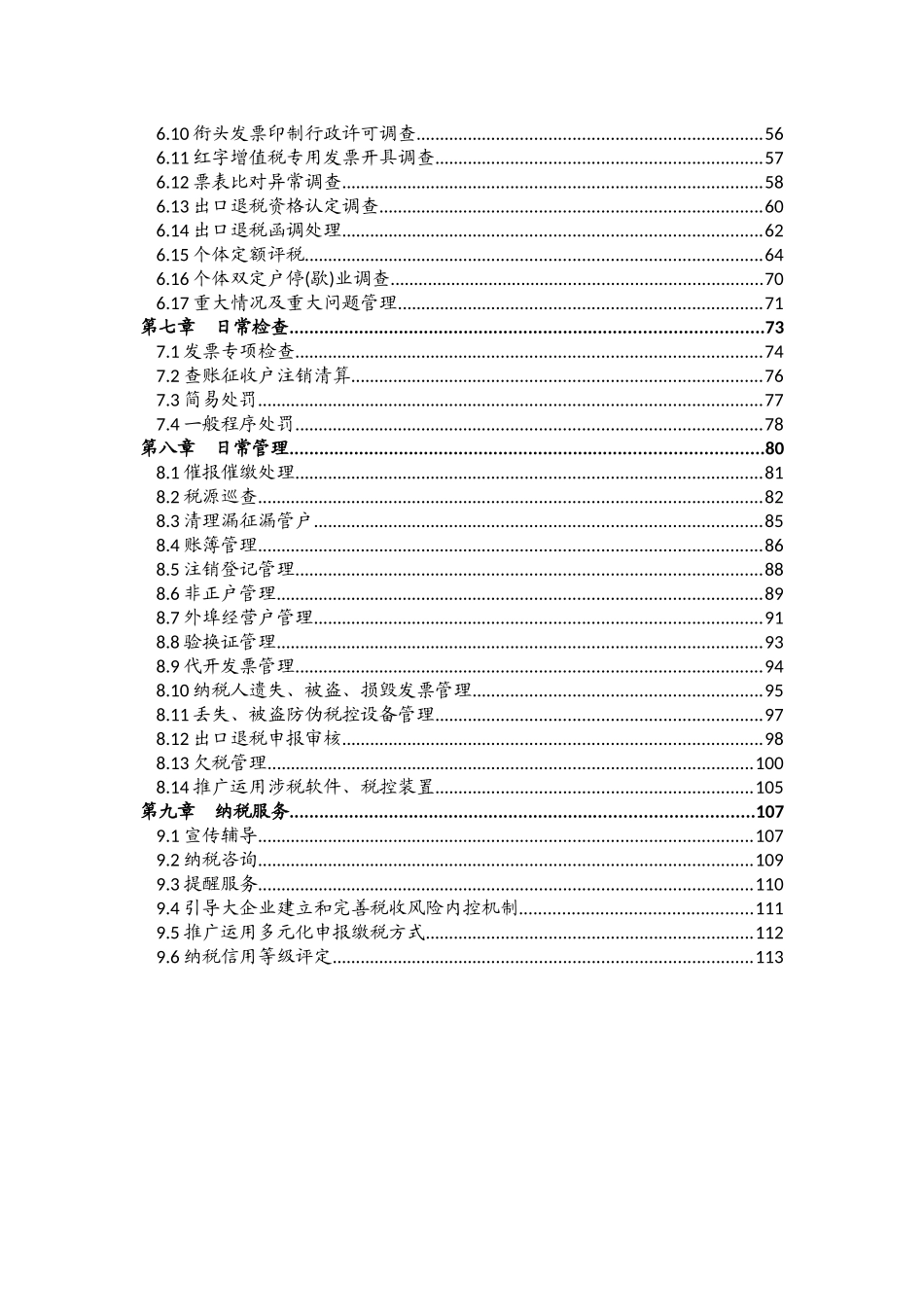

税收管理员作业指引目录第一章风险规划.................................................................................................31.1制订风险规划.....................................................................................................31.2制订分类税收风险防控办法.............................................................................41.3建立风险分析模型.............................................................................................5第二章信息采集.................................................................................................72.1采集规划.............................................................................................................82.2采集实施.............................................................................................................9第三章数据分析...............................................................................................113.1征管状况分析...................................................................................................123.2风险识别...........................................................................................................133.3风险评定...........................................................................................................14第四章风险应对...............................................................................................154.1风险提示...........................................................................................................164.2风险核查...........................................................................................................164.2.1督导自查....................................................................................................174.2.2纳税约谈....................................................................................................184.2.3实地调查....................................................................................................184.3纳税评估...........................................................................................................184.3.1案头审核....................................................................................................184.3.2核实调查....................................................................................................194.4移送稽查...........................................................................................................234.5税款强制征收...................................................................................................254.5.1代位权、撤销权的行使.............................................................................254.5.2税收保全措施的执行................................................................................264.5.3税收强制执行............................................................................................29第五章监控评估...............................................................................................315.1过程监控...........................................................................................................315.2绩效评估...........................................................................................................33第六章调查核实............................................................................