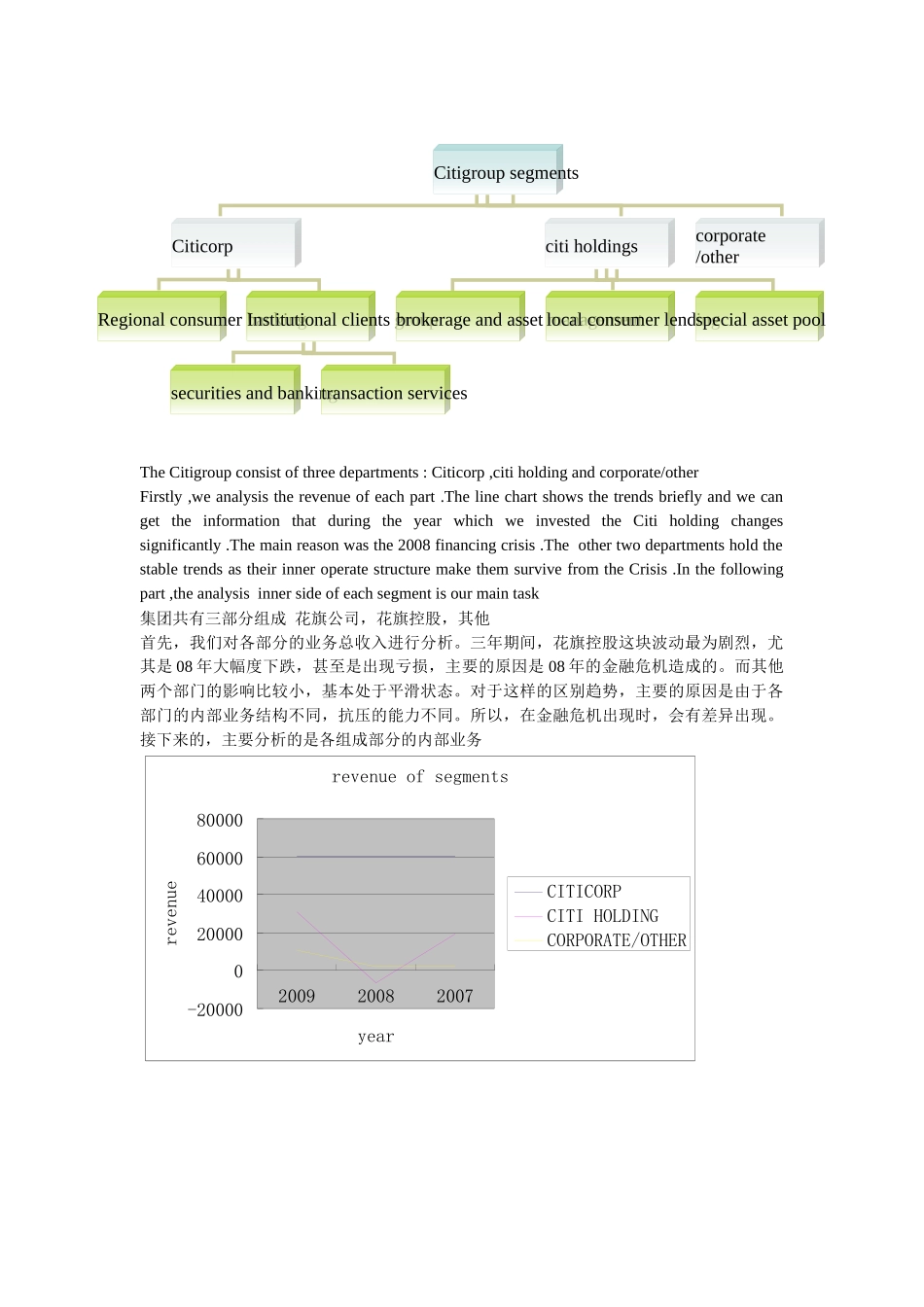

CitigroupsegmentsCiticorpcitiholdingscorporate/otherRegionalconsumerbankingInstitutionalclientsgroupsecuritiesandbankingtransactionservicesbrokerageandassetmanagementlocalconsumerlendingspecialassetpoolTheCitigroupconsistofthreedepartments:Citicorp,citiholdingandcorporate/otherFirstly,weanalysistherevenueofeachpart.ThelinechartshowsthetrendsbrieflyandwecangettheinformationthatduringtheyearwhichweinvestedtheCitiholdingchangessignificantly.Themainreasonwasthe2008financingcrisis.TheothertwodepartmentsholdthestabletrendsastheirinneroperatestructuremakethemsurvivefromtheCrisis.Inthefollowingpart,theanalysisinnersideofeachsegmentisourmaintask集团共有三部分组成花旗公司,花旗控股,其他首先,我们对各部分的业务总收入进行分析。三年期间,花旗控股这块波动最为剧烈,尤其是08年大幅度下跌,甚至是出现亏损,主要的原因是08年的金融危机造成的。而其他两个部门的影响比较小,基本处于平滑状态。对于这样的区别趋势,主要的原因是由于各部门的内部业务结构不同,抗压的能力不同。所以,在金融危机出现时,会有差异出现。接下来的,主要分析的是各组成部分的内部业务revenueofsegments-20000020000400006000080000200920082007yearrevenueCITICORPCITIHOLDINGCORPORATE/OTHERSecondly,weshouldshowouttheinnersideofeachdepartment.PART1CITICORPCiticorpconsistsofthefollowingbusinesses:RegionalConsumerBankingandInstitutionalClientsGroup(whichincludesSecuritiesandBankingandTransactionServices).RegionalConsumerBanking(RCB)consistsofCitigroup’sfourregionalconsumerbanksthatprovidetraditionalbankingservicestoretailcustomers.RCBalsocontainsCitigroup’sbrandedcardsbusinessandsmallcommercialbankingbusiness.RCBisagloballydiversifiedbusinesswithnearly4,000branchesin39countriesaroundtheworld.InstitutionalClientsGroup(ICG)includesSecuritiesandBankingandTransactionServices.ICGprovidescorporate,institutionalandhigh-net-worthclientswithafullrangeofproductsandservices,includingcashmanagement,trading,underwriting,lendingandadvisoryservices,aroundtheworld.ICG’sinternationalpresenceissupportedbytradingfloorsinapproximately75countriesandaproprietarynetworkwithinTransactionServicesinover90countries.20092008200760206306351055660555-6698225860097195132310-20%0%20%40%60%80%100%200920082007CORPORATE/OTHERCITIHOLDINGCITICORP业务管理部门主要由两部分构成全球消费银行业务和集团机构客户业务。其中区域消费银行主要是四大区域的消费银行,集团机构客户业务另外由证券和银行业以及交易服务业务组成。具体业务分析如下图。1全球消费银行业务CITICORP010000200003000040000500006000070000200920082007YEARREVENUEREGIONALCONSUMERBANKINGINSTITUTIONALCLIENTGROUP2277137435256746055526643600970100002000030000400005000060000700008000090000200920082007CITICORPINSTITUTIONALCLIENTGROUPREGIONALCONSUMERBANKING在北美和拉丁美洲的,08年的业务最低。在亚洲的趋势是总体呈上升趋势。其中的原因是因为美国的华尔街的金融危机对美洲经济造成的影响是巨大的。2集团机构客户业务A:证券和银行业务证券和银行业务:主要由投资银行业,贷款业务,股市业务,固定收益市场业务,私人银行业务,其他业务。其中固定收益市场业务每年均处于收入最高的业务,投行业务的业绩也较好,除了其他类别的证券和银行业务在三年中均处于负值外。B交易服务业务交易服务业务主要是由现金管理业务,贸易服务业务,托管和基金服务,票据交换业务,代理/信托服务。REGIONALCONSUMERBANKING-4,000-3,000-2,000-1,00001,0002,0003,000NORTHAMERICAEMEALATINAMERICAASIAAREANETINCOME200920082007-5,00005,00010,00015,00020,00025,000investmentbankingLendingEquitymarketsFixedincomemark...