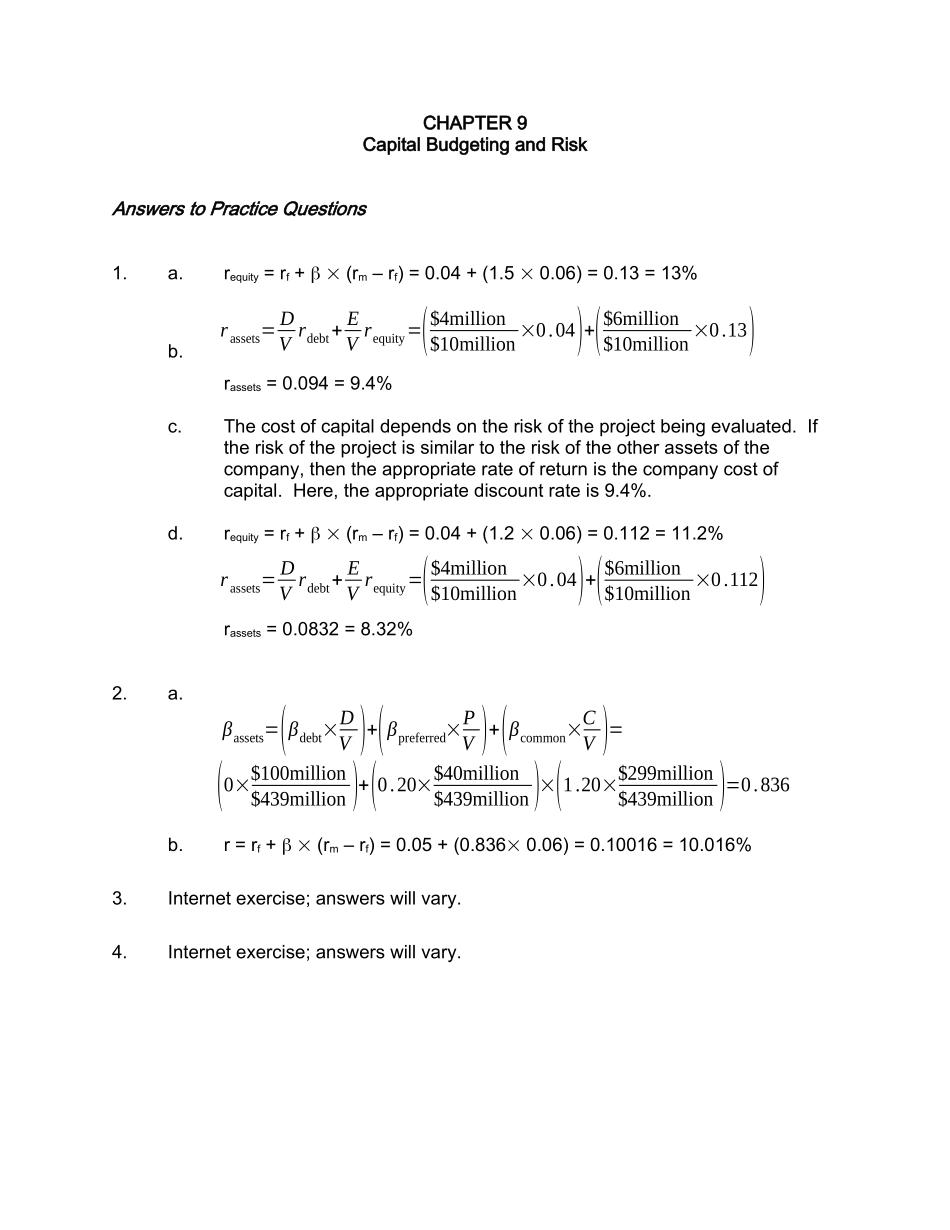

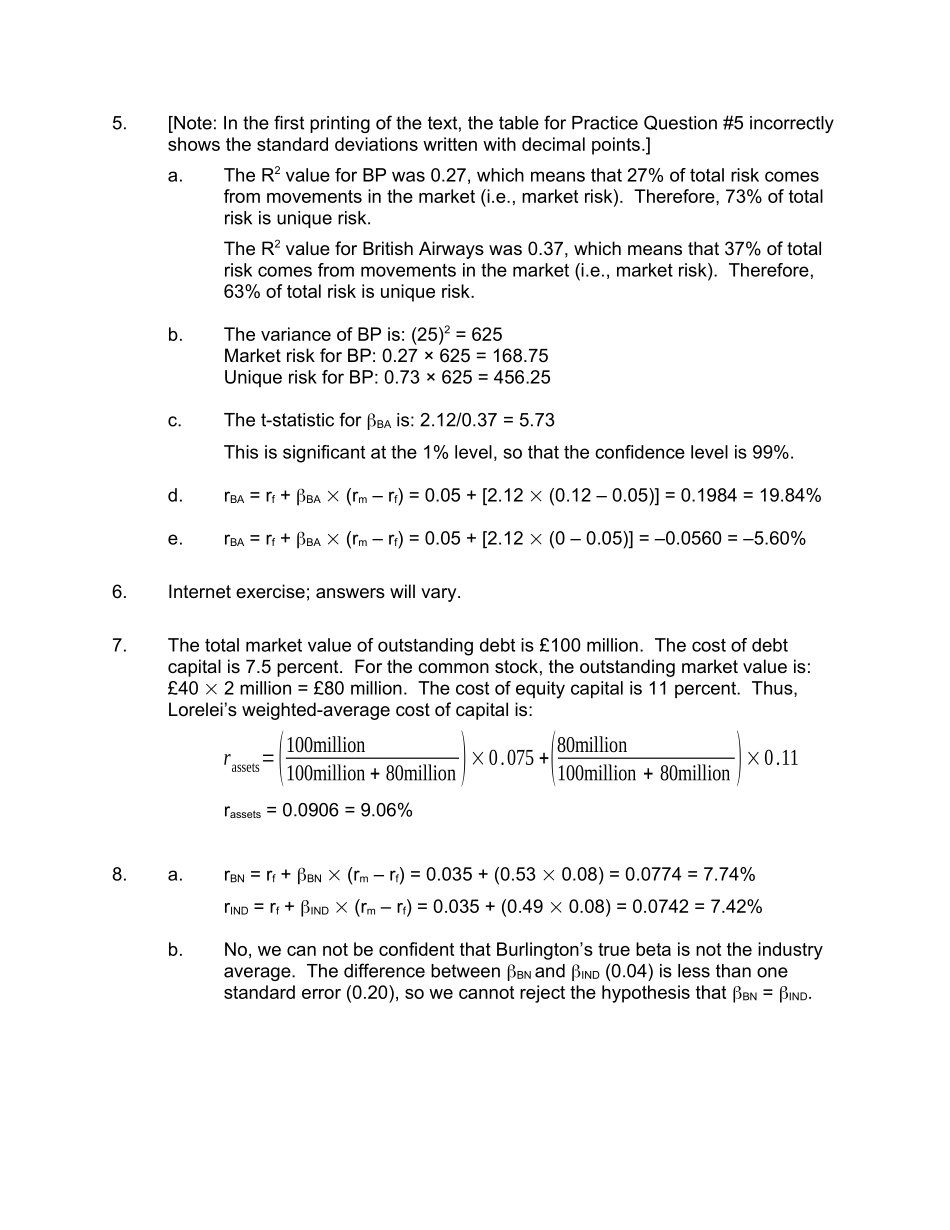

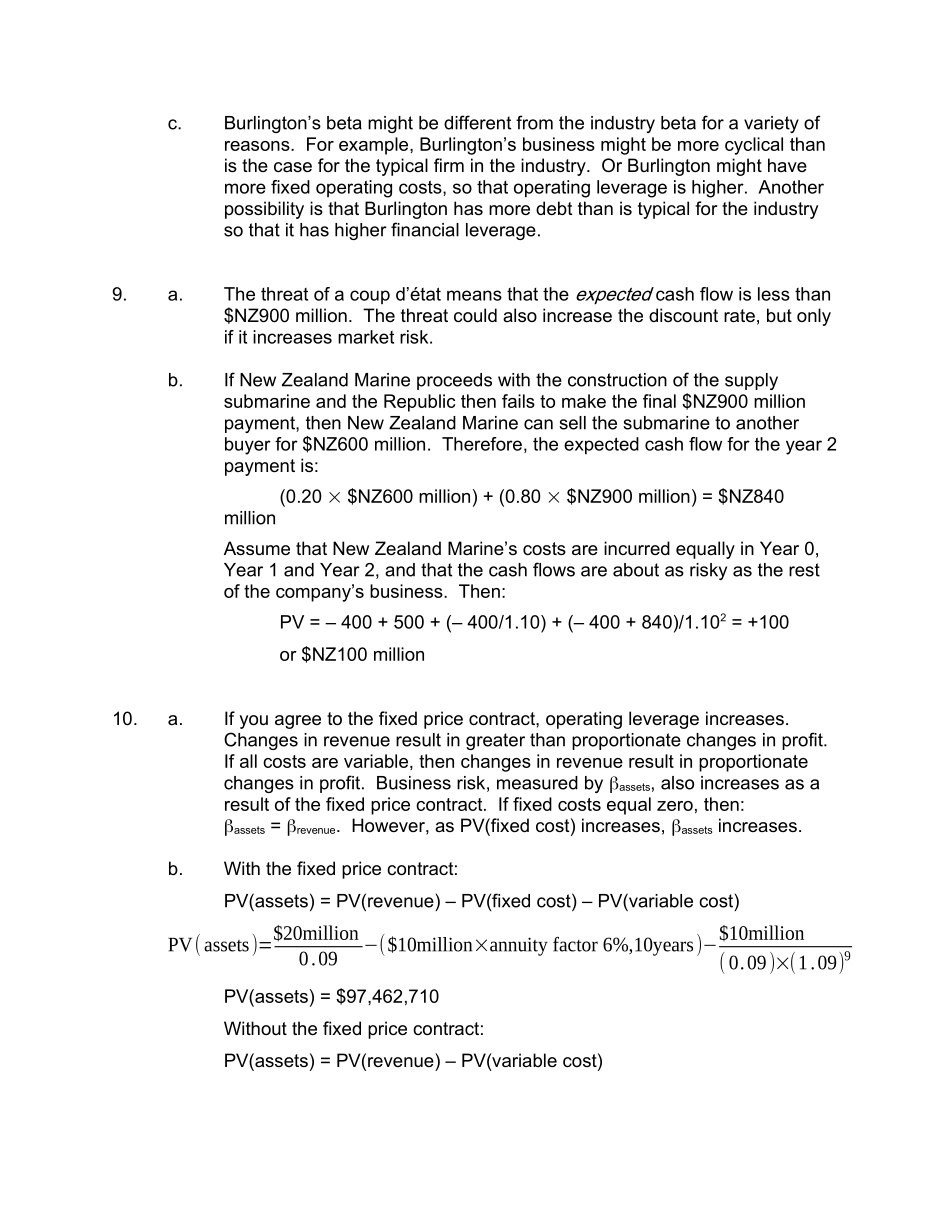

CHAPTER9CapitalBudgetingandRiskAnswerstoPracticeQuestions1.a.requity=rf+(rm–rf)=0.04+(1.50.06)=0.13=13%b.rassets=DVrdebt+EVrequity=($4million$10million×0.04)+($6million$10million×0.13)rassets=0.094=9.4%c.Thecostofcapitaldependsontheriskoftheprojectbeingevaluated.Iftheriskoftheprojectissimilartotheriskoftheotherassetsofthecompany,thentheappropriaterateofreturnisthecompanycostofcapital.Here,theappropriatediscountrateis9.4%.d.requity=rf+(rm–rf)=0.04+(1.20.06)=0.112=11.2%rassets=DVrdebt+EVrequity=($4million$10million×0.04)+($6million$10million×0.112)rassets=0.0832=8.32%2.a.βassets=(βdebt×DV)+(βpreferred×PV)+(βcommon×CV)=(0×$100million$439million)+(0.20×$40million$439million)×(1.20×$299million$439million)=0.836b.r=rf+(rm–rf)=0.05+(0.8360.06)=0.10016=10.016%3.Internetexercise;answerswillvary.4.Internetexercise;answerswillvary.5.[Note:Inthefirstprintingofthetext,thetableforPracticeQuestion#5incorrectlyshowsthestandarddeviationswrittenwithdecimalpoints.]a.TheR2valueforBPwas0.27,whichmeansthat27%oftotalriskcomesfrommovementsinthemarket(i.e.,marketrisk).Therefore,73%oftotalriskisuniquerisk.TheR2valueforBritishAirwayswas0.37,whichmeansthat37%oftotalriskcomesfrommovementsinthemarket(i.e.,marketrisk).Therefore,63%oftotalriskisuniquerisk.b.ThevarianceofBPis:(25)2=625MarketriskforBP:0.27×625=168.75UniqueriskforBP:0.73×625=456.25c.Thet-statisticforBAis:2.12/0.37=5.73Thisissignificantatthe1%level,sothattheconfidencelevelis99%.d.rBA=rf+BA(rm–rf)=0.05+[2.12(0.12–0.05)]=0.1984=19.84%e.rBA=rf+BA(rm–rf)=0.05+[2.12(0–0.05)]=–0.0560=–5.60%6.Internetexercise;answerswillvary.7.Thetotalmarketvalueofoutstandingdebtis£100million.Thecostofdebtcapitalis7.5percent.Forthecommonstock,theoutstandingmarketvalueis:£402million=£80million.Thecostofequitycapitalis11percent.Thus,Lorelei’sweighted-averagecostofcapitalis:rassets=(100million100million+80million)×0.075+(80million100million+80million)×0.11rassets=0.0906=9.06%8.a.rBN=rf+BN(rm–rf)=0.035+(0.530.08)=0.0774=7.74%rIND=rf+IND(rm–rf)=0.035+(0.490.08)=0.0742=7.42%b.No,wecannotbeconfidentthatBurlington’struebetaisnottheindustryaverage.ThedifferencebetweenBNandIND(0.04)islessthanonestandarderror(0.20),sowecannotrejectthehypothesisthatBN=IND.c.Burlington’sbetamightbedifferentfromtheindustrybetaforavarietyofreasons.Forexample,Burlington’sbusinessmightbemorecyclicalthanisthecaseforthetypicalfirmintheindustry.OrBurlingtonmighthavemorefixedoperatingcosts,sothatoperatingleverageishigher.AnotherpossibilityisthatBurlingtonhasmoredebtthanistypicalfortheindustrysothatithashigherfinancialleverage.9.a.Thethreatofacoupd’étatmeansthattheexpectedcashflowislessthan$NZ900million.Thethreatcouldalsoincreasethediscountrate,butonlyifitincreasesmarketrisk.b.IfNewZealandMarineproceedswiththeconstructionofthesupplysubmarineandtheRepublicthenfailstomakethefinal$NZ900millionpayment,thenNewZealandMarinecansellthesubmarinetoanotherbuyerfor$NZ600million.Therefore,theexpectedcashflowfortheyear2paymentis:(0.20$NZ600million)+(0.80$NZ900million)=$NZ840millionAssumethatNewZealandMarine’scostsareincurredequallyinYear0,Year1andYear2,andthatthecashflowsareaboutasriskyastherestofthecompany’sbusiness.Then:PV=–400+500+(–400/1.10)+(–400+840)/1.102=+100or$NZ100million10.a.Ifyouagreetothefixedpricecon...