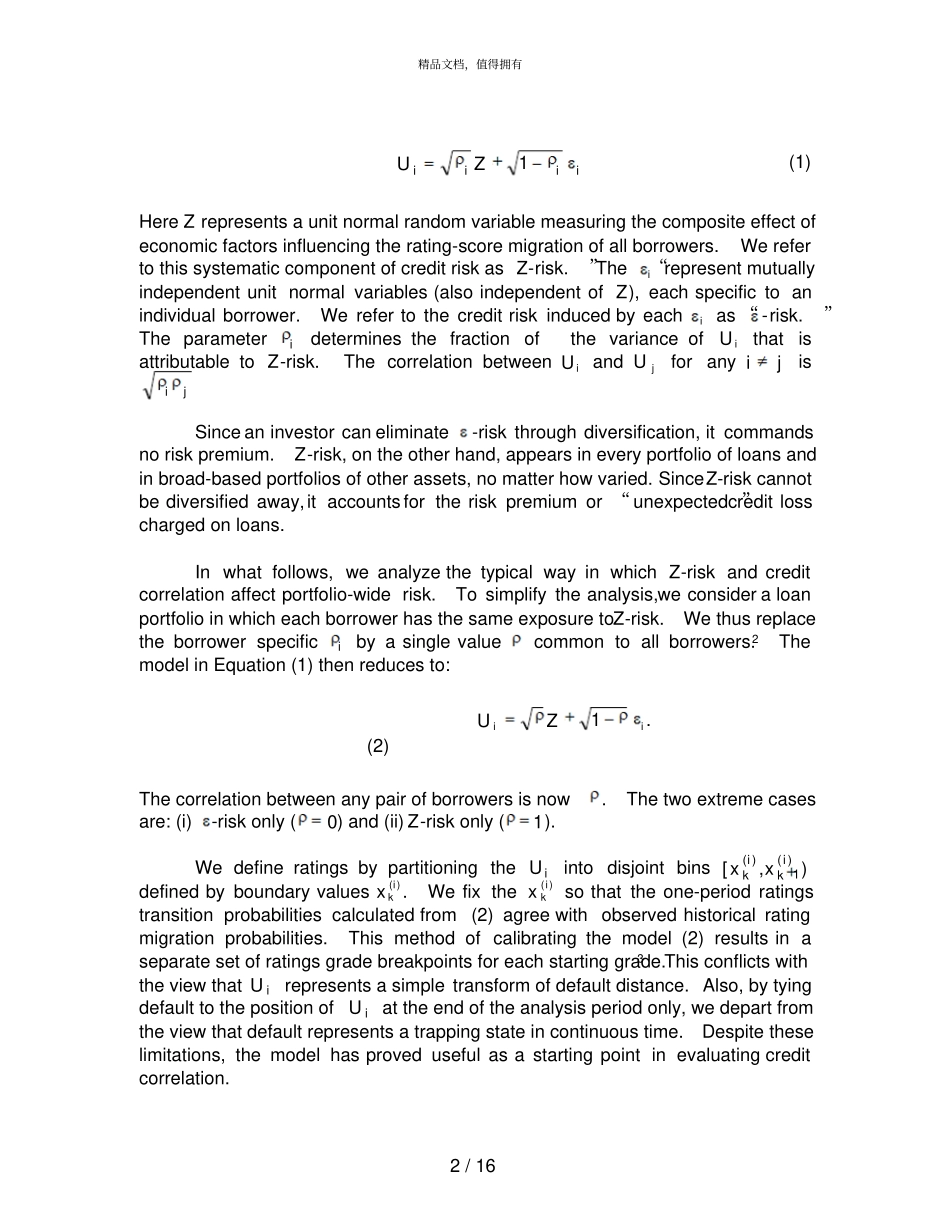

精品文档,值得拥有1/16TheEffectofSystematicCreditRiskonLoanPortfolioValueatRiskandonLoanPricingSubmittedtotheJPMorganCreditMetricsMonitorDr.BarryBelkin,DanielH.WagnerAssociatesDr.LawrenceR.Forest,Jr.,KPMGUsingacontingentclaimsmodelframework,CreditMetricsTMderivescorrelationsbetweenratingsmigrationsofdifferentborrowersfromtheobservedcorrelationsbetweenequityvaluesofthedifferentindustriesandcountriesofthoseborrowers.Asavariationofthatanalysis,wetreatcorrelationshereasarisingfromasinglesystematicriskfactor.Applyingthissingle-factormodel,inSectionIweevaluatetheeffectofsystematiccreditriskonloanportfoliovalueatrisk.InSectionIIwefocusonindividualloantransactionsandassesstheeffectofsystematicriskoncreditspreadsandthereforeloanpricingandvaluationdecisions.Weattachgreatimportancetothiseffect,becausearbitragetheoryprovidesthebasisfortheLoanAnalysisSystemSM(LAS)developedbyKPMGPeatMarwicktosupportcommercialloanvaluationandpricing.Ourresultsshowthatonemustproperlyaccountforsystematicfactorsseparatelyfromspecificfactorsifoneistoassessriskaccuratelyatboththeloanportfolioandloantransactionlevel.1I.SystematicCreditRiskattheLoanPortfolioLevelInthisSectionweevaluatetheeffectofsystematiccreditriskonloanportfoliovalueatrisk.Wecomparetheapproachthatconsidersonlytwocreditstates(defaultandno-default)withtheonethatdistinguishesamongmultiplenon-defaultstates(thefull-statemodel).Inaddition,wecomparetheportfoliopayoffdistributionunderthefull-statemodelwiththecorrespondingGaussiandistributionthatwouldobtainifallborrowerswereuncorrelated.Notsurprisingly,wefindthattheGaussiandistributionpoorlyapproximatesactualvalueatrisk.Thetwo-statemodelprovidesabetterestimate,thoughwestillobserveimportantdiscrepancies.Tomodelcredit-riskcorrelation,wefollowtheCreditMetricsTMapproachdescribedin[1]andassumethattransitionsindiscreteratingsgradesoccurasaresultofmigrationinanunderlyingprocessthatmeasures“distance”fromdefault.Tosimplifythepresentation,weworkwithdefaultdistancetransformedintoanormalizedriskscorewhoseone-periodchangeshaveaunitnormaldistribution.WeindexborrowersbyiandletUidenotetheone-periodchangeinthenormalizedriskscoreofborroweri.Torepresentcorrelationinastraightforwardway,weassumethatwecanwriteeachUias:精品文档,值得拥有2/16UZiiii1(1)HereZrepresentsaunitnormalrandomvariablemeasuringthecompositeeffectofeconomicfactorsinfluencingtherating-scoremigrationofallborrowers.Werefertothissystematiccomponentofcreditriskas“Z-risk.”Theirepresentmutuallyindependentunitnormalvariables(alsoindependentofZ),eachspecifictoanindividualborrower.Werefertothecreditriskinducedbyeachias“-risk.”TheparameterideterminesthefractionofthevarianceofUithatisattributabletoZ-risk.ThecorrelationbetweenUiandUjforanyijisijSinceaninvestorcaneliminate-riskthroughdiversification,itcommandsnoriskpremium.Z-risk,ontheotherhand,appearsineveryportfolioofloansandinbroad-basedportfoliosofotherassets,nomatterhowvaried.SinceZ-riskcannotbediversifiedaway,itaccountsfortheriskpremiumor“unexpected”creditlosschargedonloans.Inwhatfollows,weanalyzethetypicalwayinwhichZ-riskandcreditcorrelationaffectportfolio-widerisk.Tosimplifytheanalysis,weconsideraloanportfolioinwhicheachborrowerhasthesameexposuretoZ-risk.Wethusreplacetheborrowerspecificibyasinglevaluecommontoallborrowers.2ThemodelinEquation(1)thenreducesto:UZii1.(2)Thecorrelationbetweenanypairofborr...