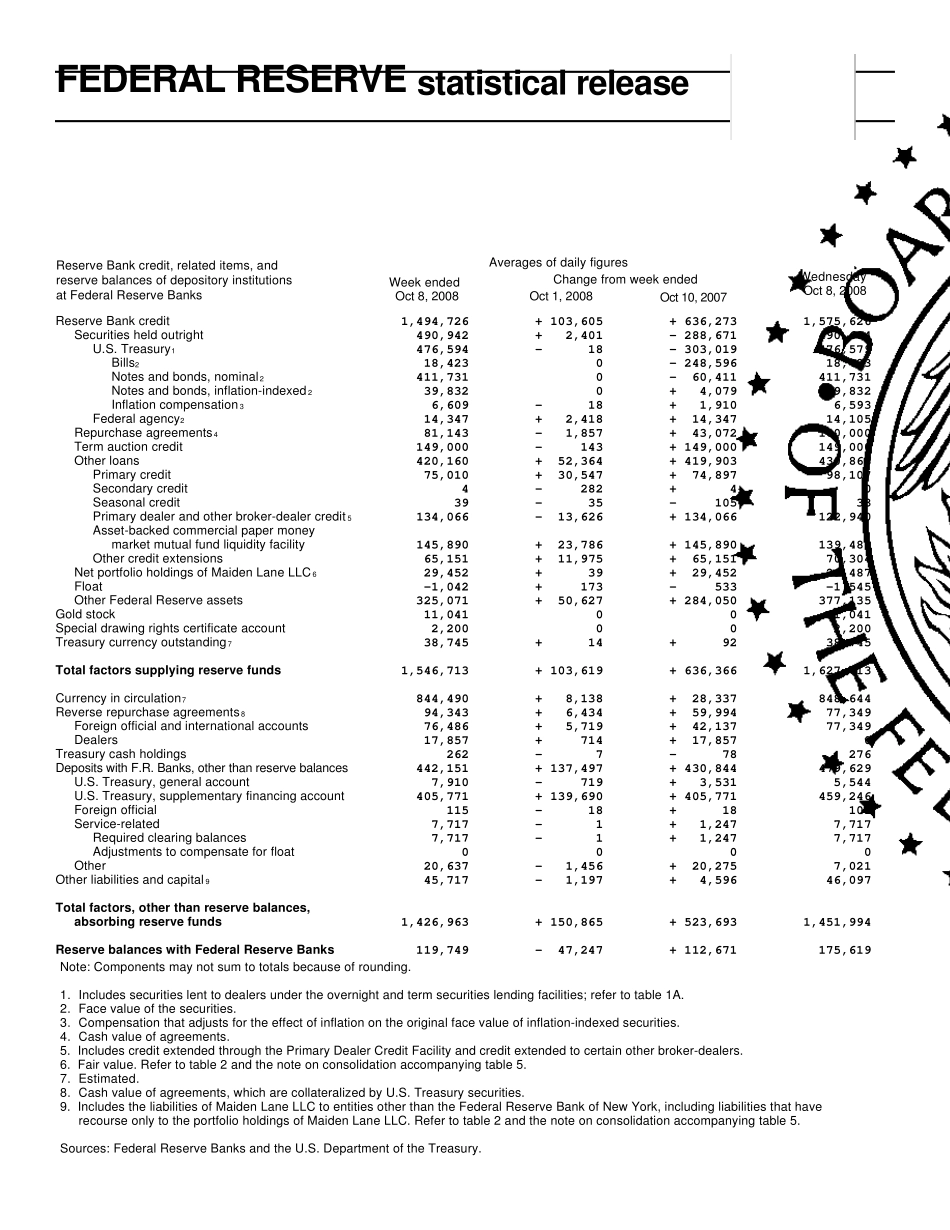

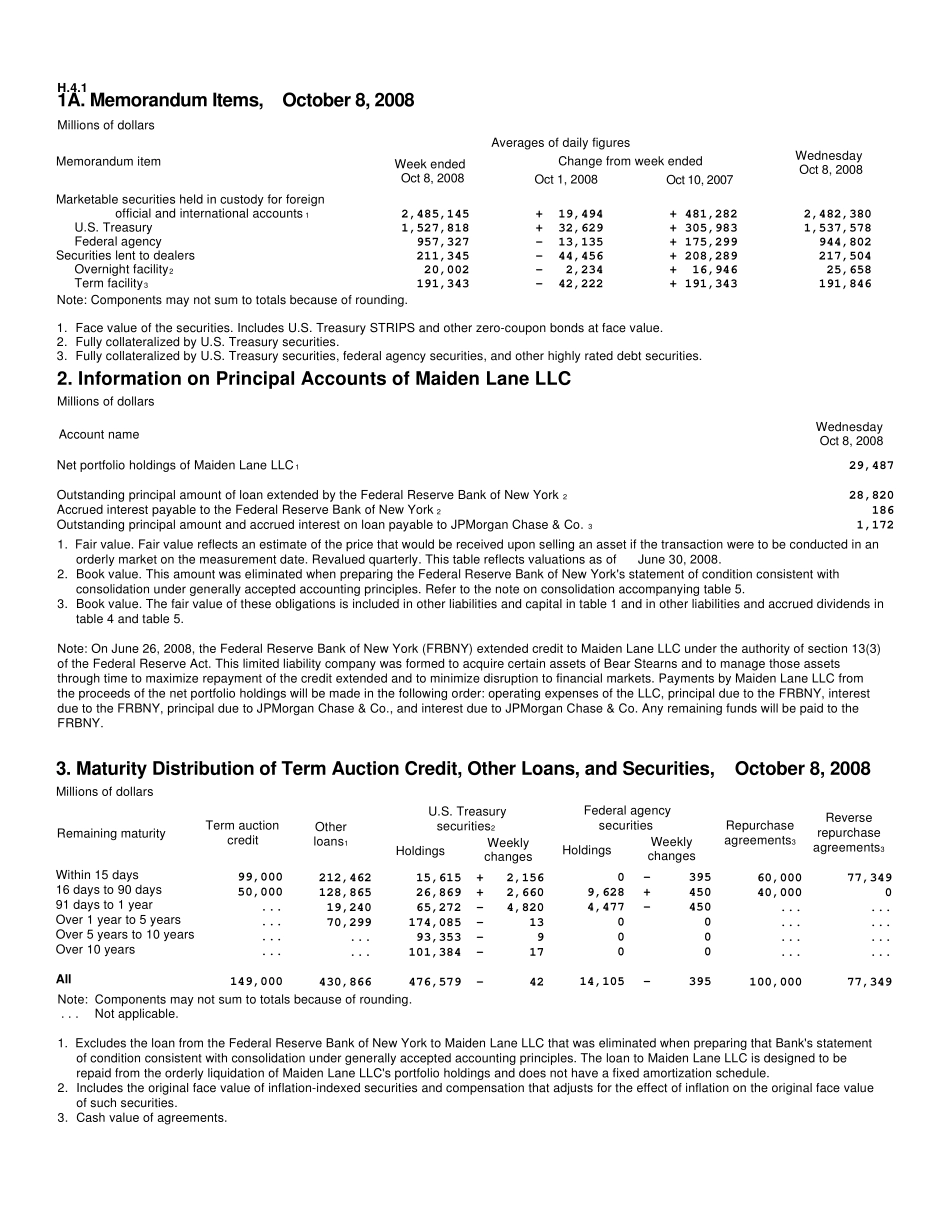

For Release at 4:30 P.M. Eastern time October 9, 2008 On October 8, 2008, the Federal Reserve Board announced that it had authorized the Federal Reserve Bank of New York to borrow securities from certain regulated U.S. insurance subsidiaries of the American International Group (AIG), under section 13(3) of the Federal Reserve Act. This transaction is economically equivalent to an extension of credit collateralized by the securities borrowed. The Board’s H.4.1 statistical release, “Factors Affecting Reserve Balances of Depository Institutions and Condition Statement of Federal Reserve Banks,” reports the funds extended to AIG under this transaction with other lending to AIG in table 1 in the line “Other credit extensions.” In tables 3, 4, and 5, all of the lending to AIG is included in the item “Other loans.” FEDERAL RESERVE statistical release Reserve Bank credit, related items, andreserve balances of depository institutionsat Federal Reserve BanksReserve Bank credit 1,494,726 + 103,605 + 636,273 1,575,626Securities held outright 490,942 + 2,401 - 288,671 490,684U.S. Treasury1 476,594 - 18 - 303,019 476,579Bills2 18,423 0 - 248,596 18,423Notes and bonds, nominal 2 411,731 0 - 60,411 411,731Notes and bonds, inflation-indexed 2 39,832 0 + 4,079 39,832Inflation compensation 3 6,609 - 18 + 1,910 6,593Federal agency2 14,347 + 2,418 + 14,347 14,105Repurchase agreements4 81,143 - 1,857 + 43,072 100,000Term auction credit 149,000 - 143 + 149,000 149,000Other loans 420,160 + 52,364 + 419,903 430,866Primary credit 75,010 + 30,547 + 74,897 98,107Secondary credit 4 - 282 + 4 0Seasonal credit 39 - 35 - 105 33Primary dealer and other broker-dealer credit 5 134,066 - 13,626 + 134,066 122,940Asset-backed commercial...