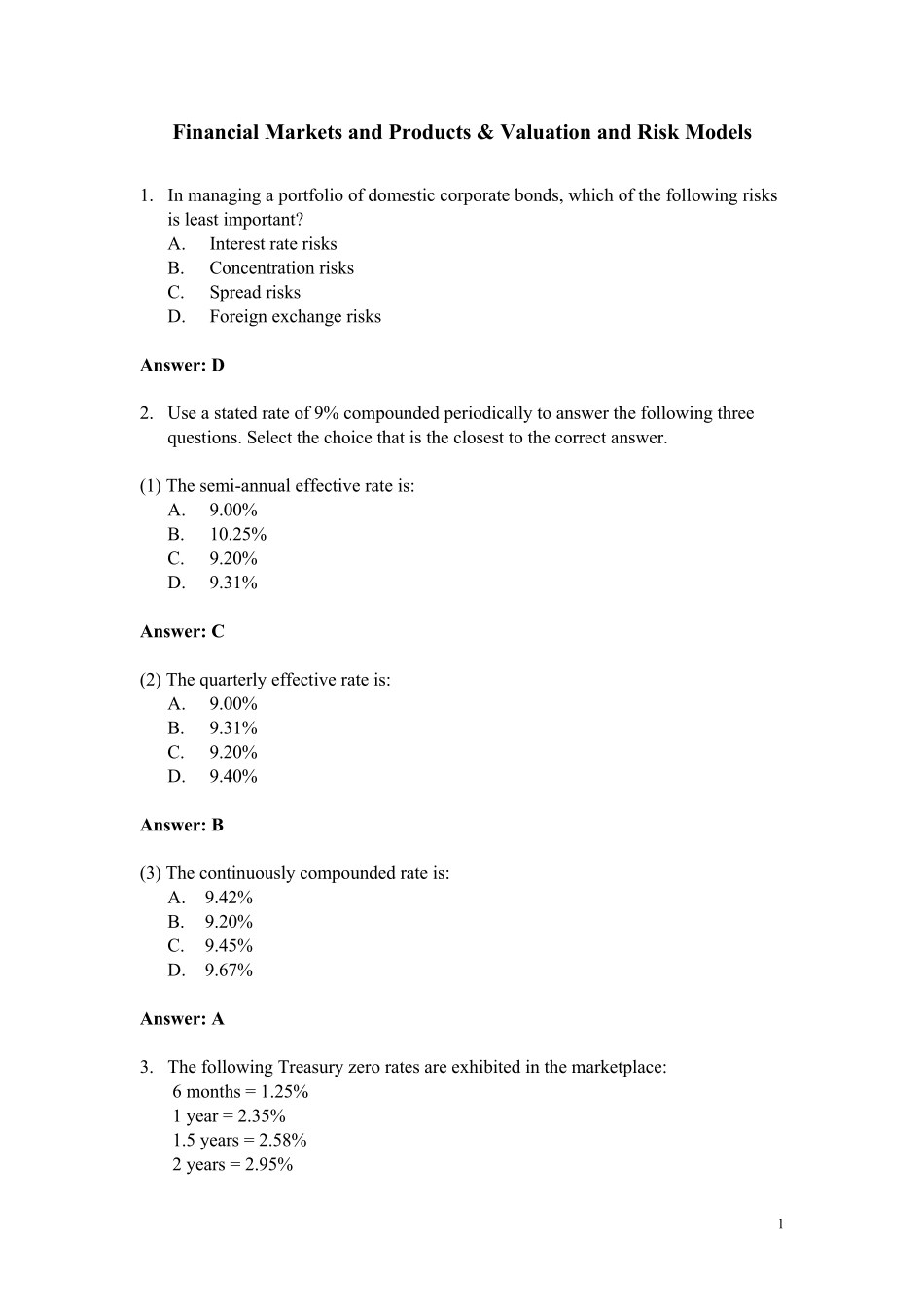

1Financial Markets and Products & Valuation and Risk Models 1. In managing a portfolio of domestic corporate bonds, which of the following risks is least important? A. Interest rate risks B. Concentration risks C. Spread risks D. Foreign exchange risks Answ er: D 2. Use a stated rate of 9% compounded periodically to answer the following three questions. Select the choice that is the closest to the correct answer. (1) The semi-annual effective rate is: A. 9.00% B. 10.25% C. 9.20% D. 9.31% Answ er: C (2) The quarterly effective rate is: A. 9.00% B. 9.31% C. 9.20% D. 9.40% Answ er: B (3) The continuously compounded rate is: A. 9.42% B. 9.20% C. 9.45% D. 9.67% Answ er: A 3. The following Treasury zero rates are exhibited in the marketplace: 6 months = 1.25% 1 year = 2.35% 1.5 years = 2.58% 2 years = 2.95% 2Assuming continuous compounding, the price of a 2-year Treasury bond that pays a 6 percent semiannual coupon is closest to: A. 105.20 B. 103.42 C. 108.66 D. 105.90 Answ er: D 4. A two-year zero-coupon bond issued by corporate XYZ is currently rated A. One year from now XYZ is expected to remain at A with 85% probability, upgraded to AA with 5% probability, and downgraded to BBB with 10% probability. The risk free rate is flat at 4%. The credit spreads are flat at 40, 80, and 150 basis points for AA, A, and BBB rated issuers, respectively. All rates are compounded annually. Estimate the expected value of the zero-coupon bond one year from now (for USD 100 face amount). Fixed Income Securities: A. USD 92.59 B. USD 95.33 C. USD 95.37 D. USD 95.42 Answ er: C 5. Assuming the long-term yield on a perpetual note is 5%, compute the dollar value of a 1 bp. Increase in the...