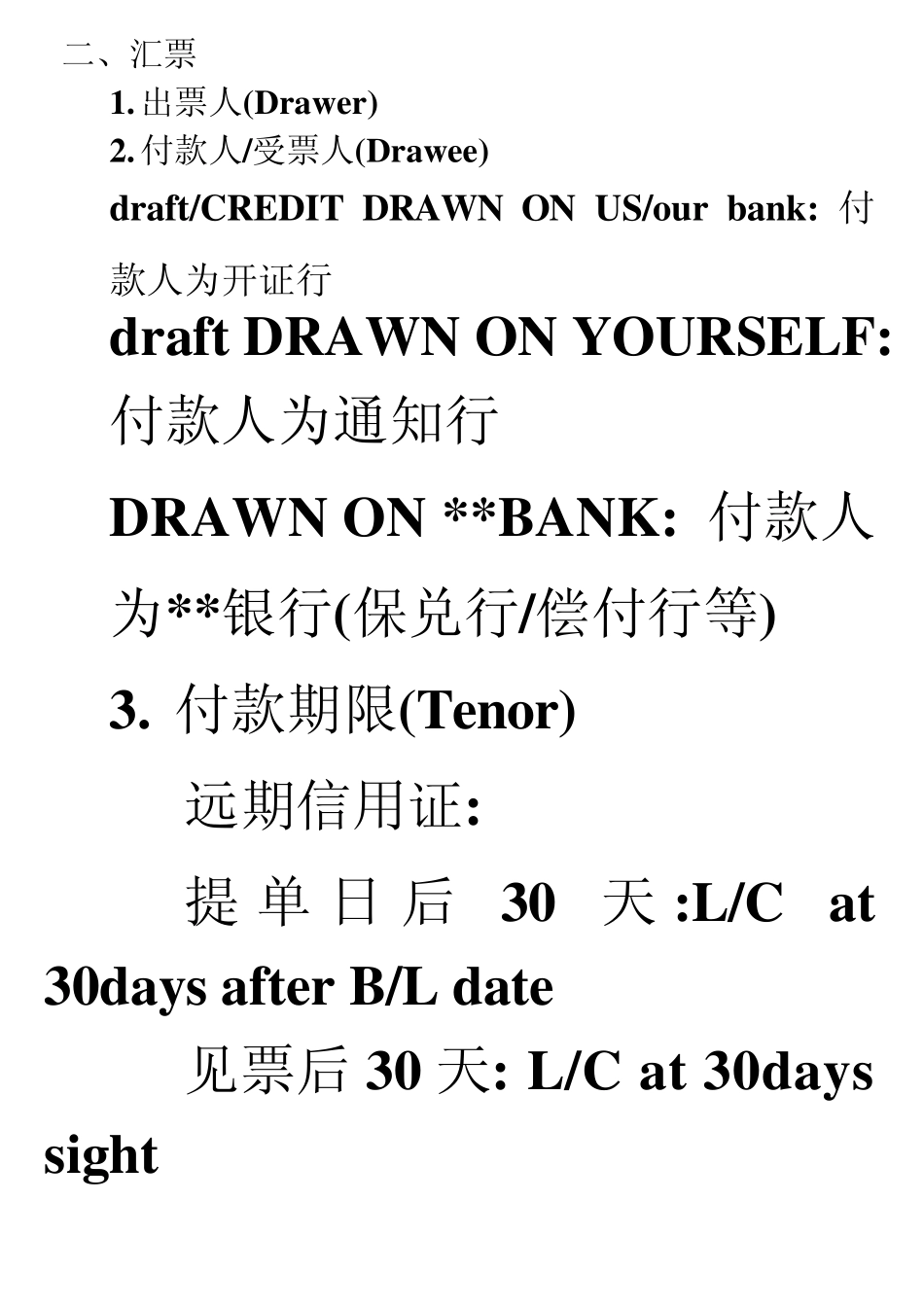

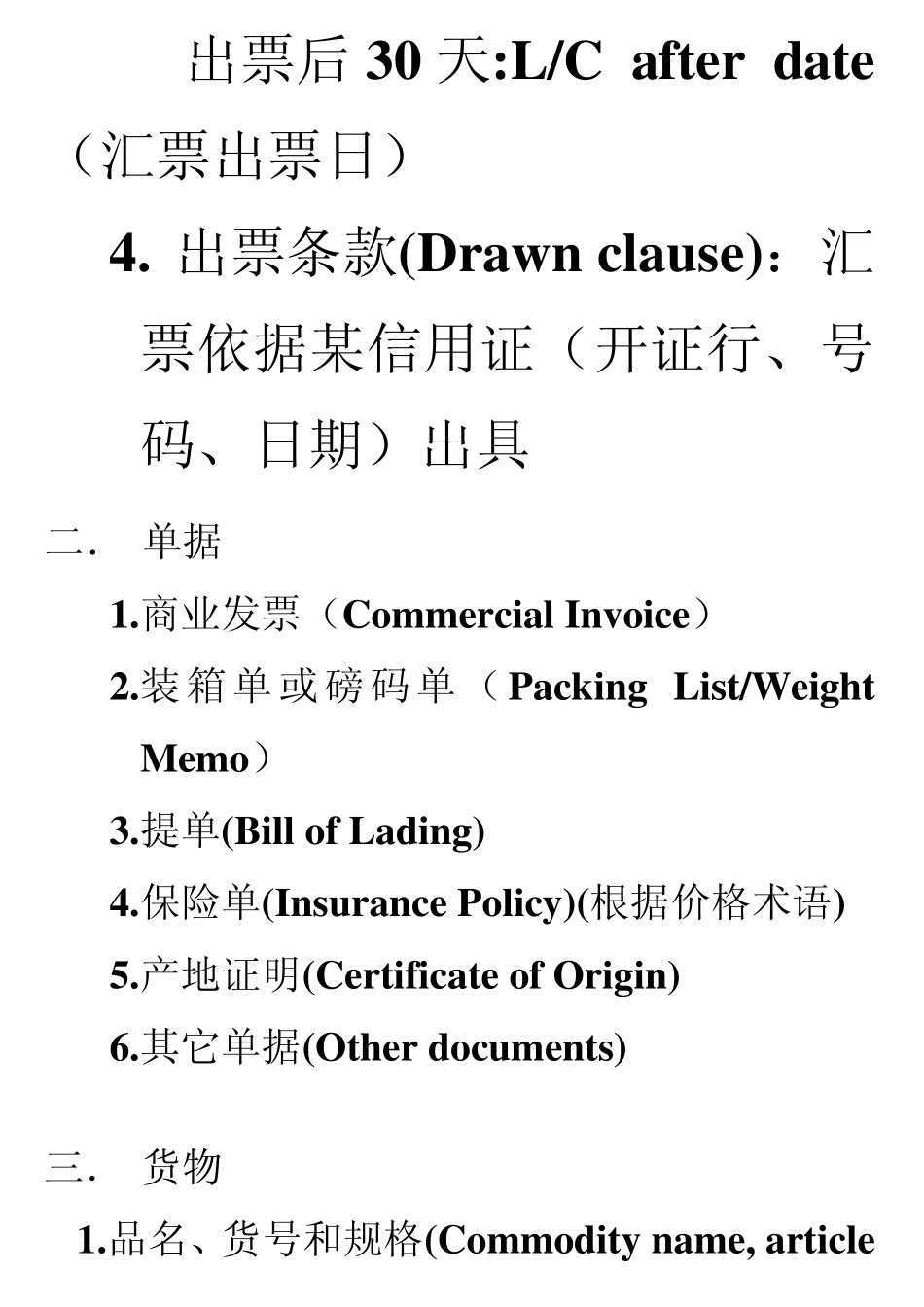

信用证内容 一. 信用证本身 **信用证的类型(Form of credit) 含义: L/C 是银行有条件的承诺付款的文件。 类型: 1. Revocable /Irrevocable L/C 2. Documentary /Clean L/C 3. Restricted/ Freely negotiation L/C 4. Confirmed/unconfirmed L/C 5. Sight /Time L/C 6. Transferable / Non-transferable L/C 7. buyer's /seller's usance L/C **信用证的当事人: 1. Applicant/ Accountee / Accreditor /Opener 2. Beneficiary 3. issuing /opening /establishing Bank 4. Advising /Notifying Bank 5. Confirming Bank 6. Negotiating Bank 7. Paying Bank 8. Reimbursing Bank **信用证号码( L/C number) **开证日期((Date of issue) **信用证金额(L/C amount) **有效期和到期地点(Expiry date and place) **单据提交期限(Documents presentation period) 二、汇票 1. 出票人(Drawer) 2. 付款人/受票人(Drawee) draft/CREDIT DRAWN ON US/our bank: 付款人为开证行 draft DRAWN ON YOURSELF: 付款人为通知行 DRAWN ON **BANK: 付款人为**银行(保兑行/偿付行等) 3. 付款期限(Tenor) 远期信用证: 提 单 日 后 30 天 :L/C at 30days after B/L date 见票后 30 天: L/C at 30days sight 出票后30 天:L/C after date(汇票出票日) 4. 出票条款(Drawn clause):汇票依据某信用证(开证行、号码、日期)出具 二. 单据 1. 商业发票(Commercial Invoice) 2. 装箱单或磅码单(Packing List/Weight Memo) 3. 提单(Bill of Lading) 4. 保险单(Insurance Policy)(根据价格术语) 5. 产地证明(Certificate of Origin) 6. 其它单据(Other documents) 三. 货物 1. 品名、货号和规格(Commodity name, article number and specifications) 2. 数量和包装(Quantity and packing) 3. 单价(Unit price) 四. 运输 1. 装货港(Port of lading/shipment) 2. 卸货港或目的地(Port of discharge or destination) 3. 装运期限(Latest date of shipment) 4. 可否分批装运(Partial shipments allowed /not allowed) 5. 可否转船(Transhipment allowed/not allowed) 五. 其它 1. 特别条款(Special conditions) 2. 开证行对议付行的指示(In...