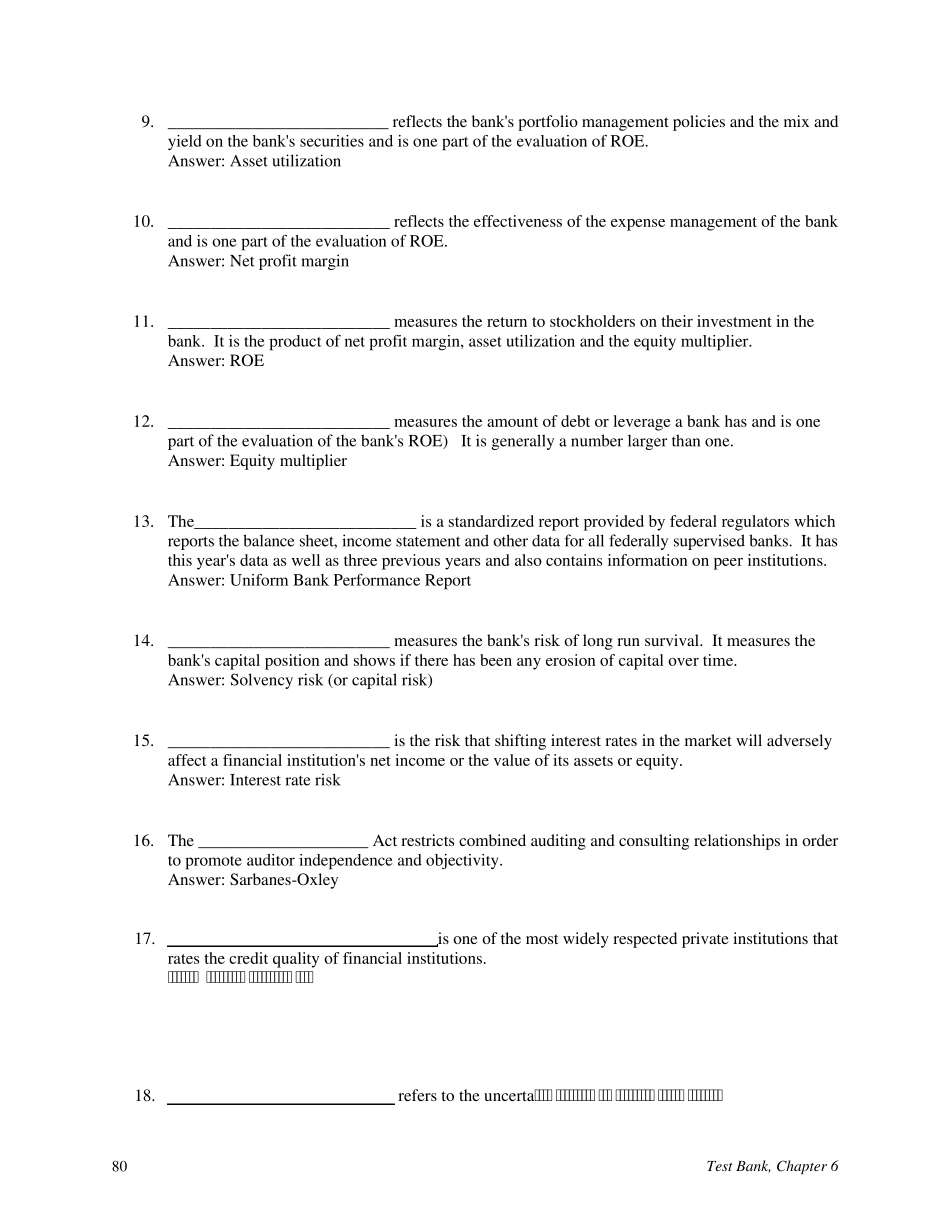

Rose/Hudgins, Bank Management and Financial Services, 8/e 79 Chapter 6 Measuring and Evaluating the Performance of Banks and Their Principal Competitors Fill in the Blank Questions 1. The equity multiplier for a bank measures the amount of _____________________ of the bank and is one part of the evaluation of the bank's ROE. Answer: leverage (debt) 2. __________________________ is the risk that has to do with the quality of the bank's assets and, in particular, the bank's loans. Answer: Credit risk 3. Solvency (or capital) risk for a bank can be measured by__________________________. List one way solvency risk can be measured. Answer: Purchased Funds/Total Liabilities (There are several other ratios that can answer this question as well) 4. __________________________ are the assets of a financial institution that will mature or be repriced within a set period of time. Answer: Interest Sensitive Assets 5. __________________________ is the risk that the value of the financial institution's asset portfolio (particularly government or other marketable securities) will decline in value. Answer: Market risk 6. Eurodollars, Fed Funds, Repurchase Agreements, and large CDs together are know as _____________________. Answer: Purchased Funds 7. __________________________ is the risk that the financial institution may not be able to meet the needs of depositors for cash. Answer: Liquidity risk 8. __________________________ are loans which are past due by 90 days or more. Answer: Nonperforming loans Test Bank, Chapter 6 80 9. __________________________ reflects the bank's portfolio management policies and the mix and yield on the bank's securities and is one part of the evaluation of ROE. Answer: Asset utilization 10. __...