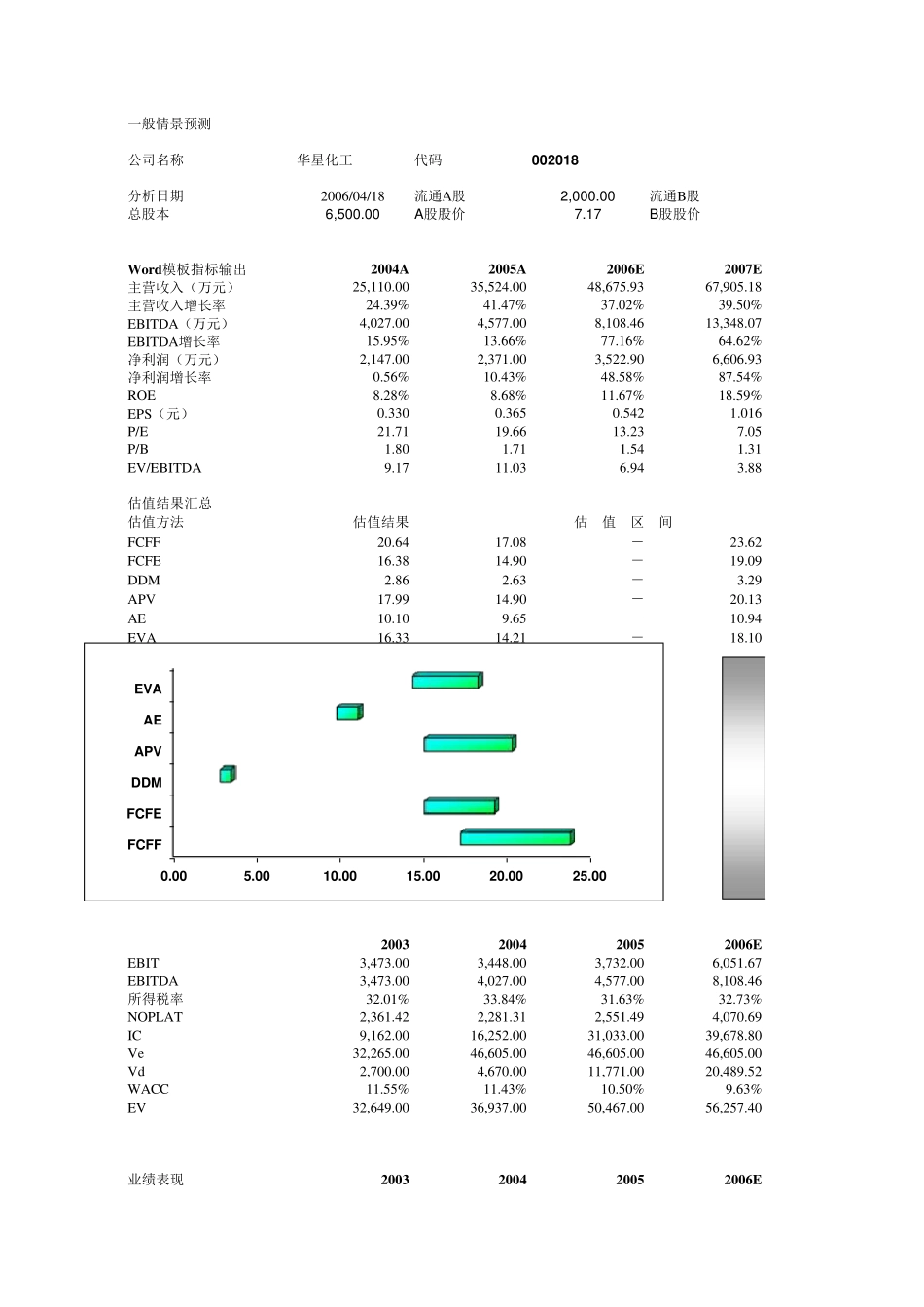

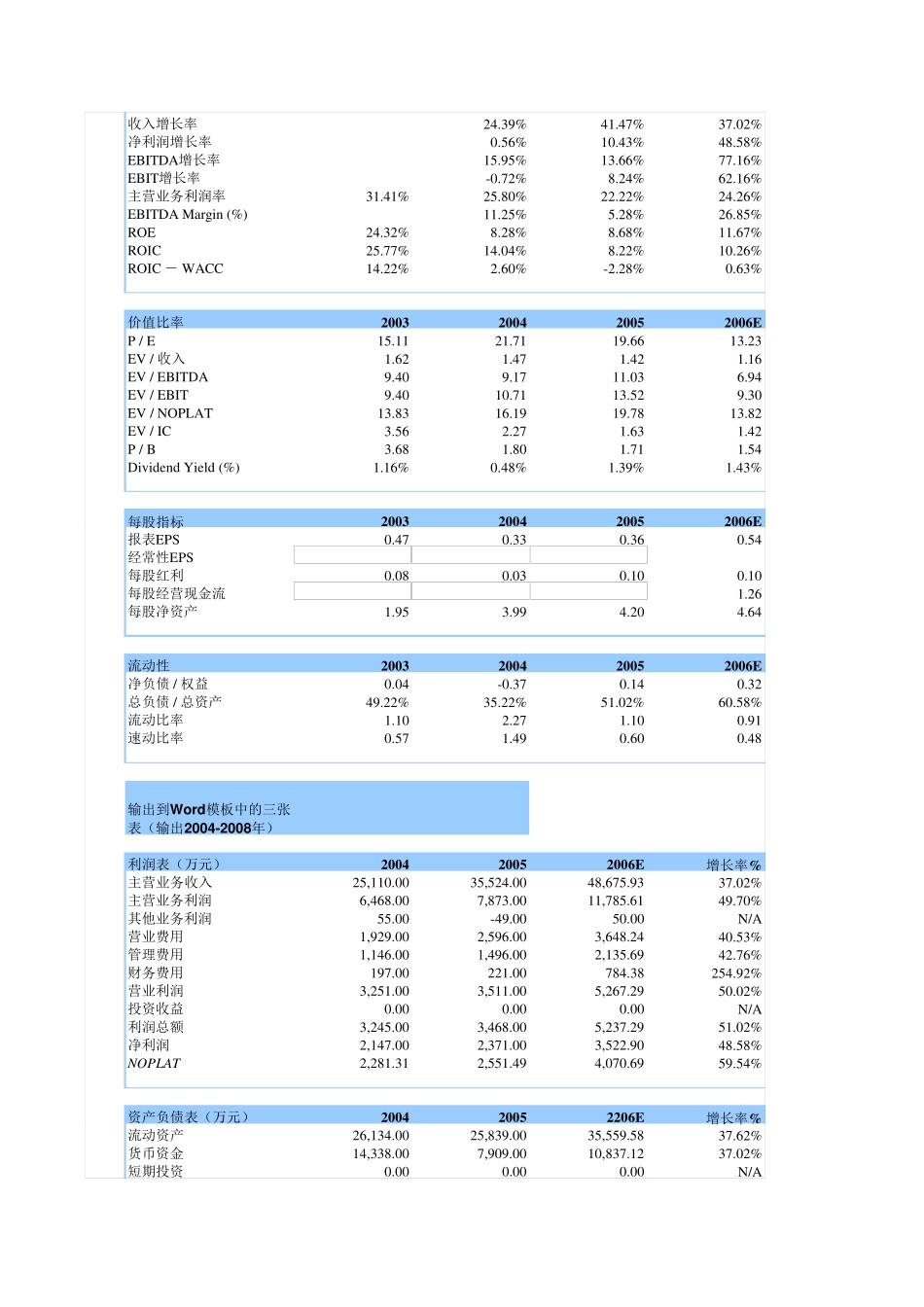

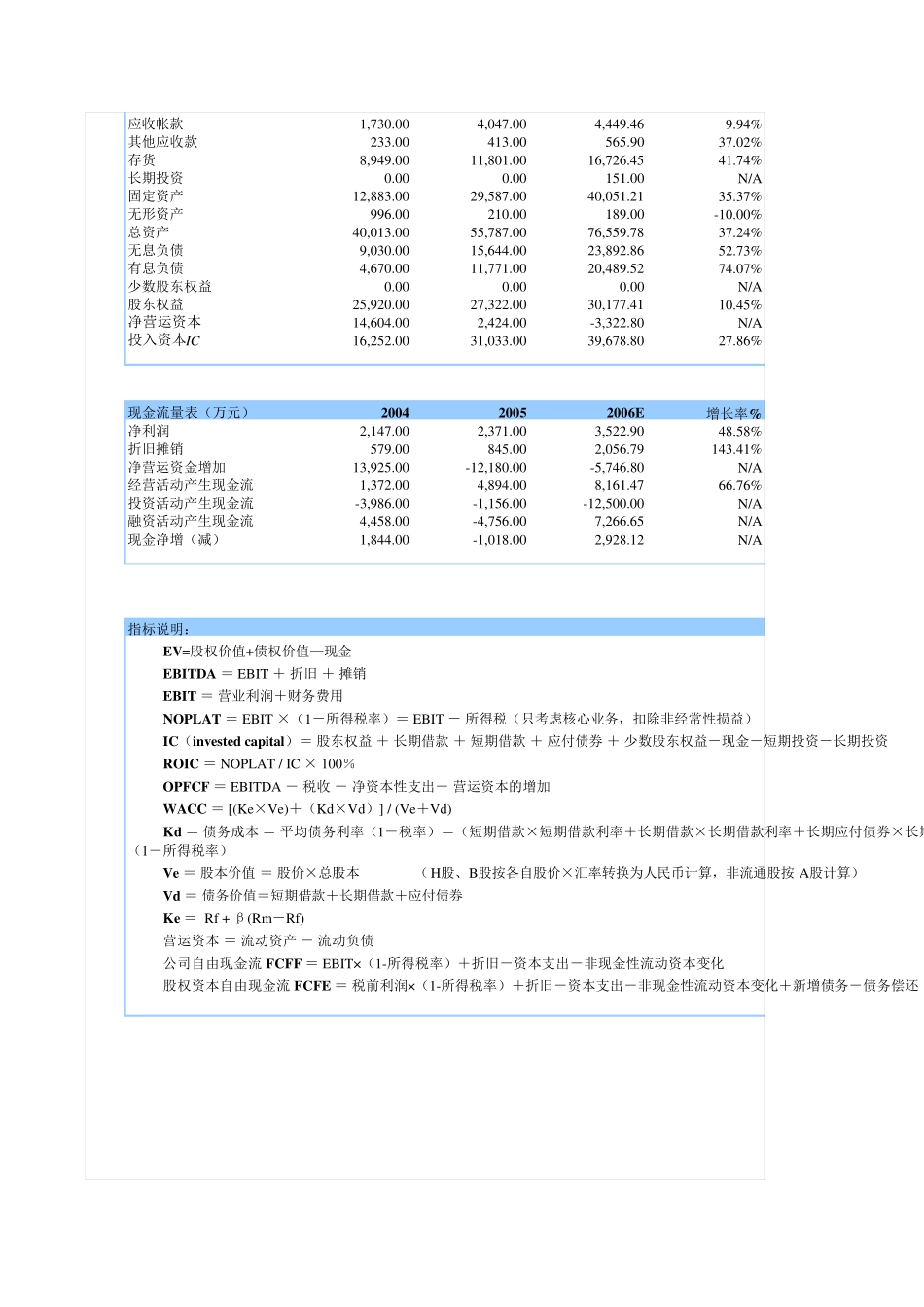

一般情景预测公司名称华星化工代码002018分析日期2006/04/18流通A股2,000.00流通B股总股本6,500.00A股股价7.17B股股价Word模板指标输出2004A2005A2006E2007E主营收入(万元)25,110.0035,524.0048,675.9367,905.18主营收入增长率24.39%41.47%37.02%39.50%EBITDA(万元)4,027.004,577.008,108.4613,348.07EBITDA增长率15.95%13.66%77.16%64.62%净利润(万元)2,147.002,371.003,522.906,606.93净利润增长率0.56%10.43%48.58%87.54%ROE8.28%8.68%11.67%18.59%EPS(元)0.3300.3650.5421.016P/E21.7119.6613.237.05P/B1.801.711.541.31EV/EBITDA9.1711.036.943.88估值结果汇总估值方法估值结果FCFF20.6417.08-23.62FCFE16.3814.90-19.09DDM2.862.63-3.29APV17.9914.90-20.13AE10.109.65-10.94EVA16.3314.21-18.102003200420052006EEBIT3,473.003,448.003,732.006,051.67EBITDA3,473.004,027.004,577.008,108.46所得税率32.01%33.84%31.63%32.73%NOPLAT2,361.422,281.312,551.494,070.69IC9,162.0016,252.0031,033.0039,678.80Ve32,265.0046,605.0046,605.0046,605.00Vd2,700.004,670.0011,771.0020,489.52WACC11.55%11.43%10.50%9.63%EV32,649.0036,937.0050,467.0056,257.40业绩表现2003200420052006E 估 值 区 间0.005.0010.0015.0020.0025.00FCFFFCFEDDMAPVAEEVA收入增长率24.39%41.47%37.02%净利润增长率0.56%10.43%48.58%EBITDA增长率15.95%13.66%77.16%EBIT增长率-0.72%8.24%62.16%主营业务利润率31.41%25.80%22.22%24.26%EBITDA Margin (%)11.25%5.28%26.85%ROE24.32%8.28%8.68%11.67%ROIC25.77%14.04%8.22%10.26%ROIC - WACC14.22%2.60%-2.28%0.63%价值比率2003200420052006EP / E15.1121.7119.6613.23EV / 收入1.621.471.421.16EV / EBITDA9.409.1711.036.94EV / EBIT9.4010.7113.529.30EV / NOPLAT13.8316.1919.7813.82EV / IC3.562.271.631.42P / B3.681.801.711.54Div idend Yield (%)1.16%0.48%1.39%1.43%每股指标2003200420052006E报表EPS0.470.330.360.54经常性EPS每股红利0.080.030.100.10每股经营现金流1.26每股净资产1.953.994.204.64流动性2003200420052006E净负债 / 权益0.04-0.370.140.32总负债 / 总资产49.22%35.22%51.02%60.58%流动比率1.102.271.100.91速动比率0.571.490.600.48输出到Word模板中的三张表(输出2004-2008年)利润表(万元)200420052006E增长率%主营业务收入25,110.0035...