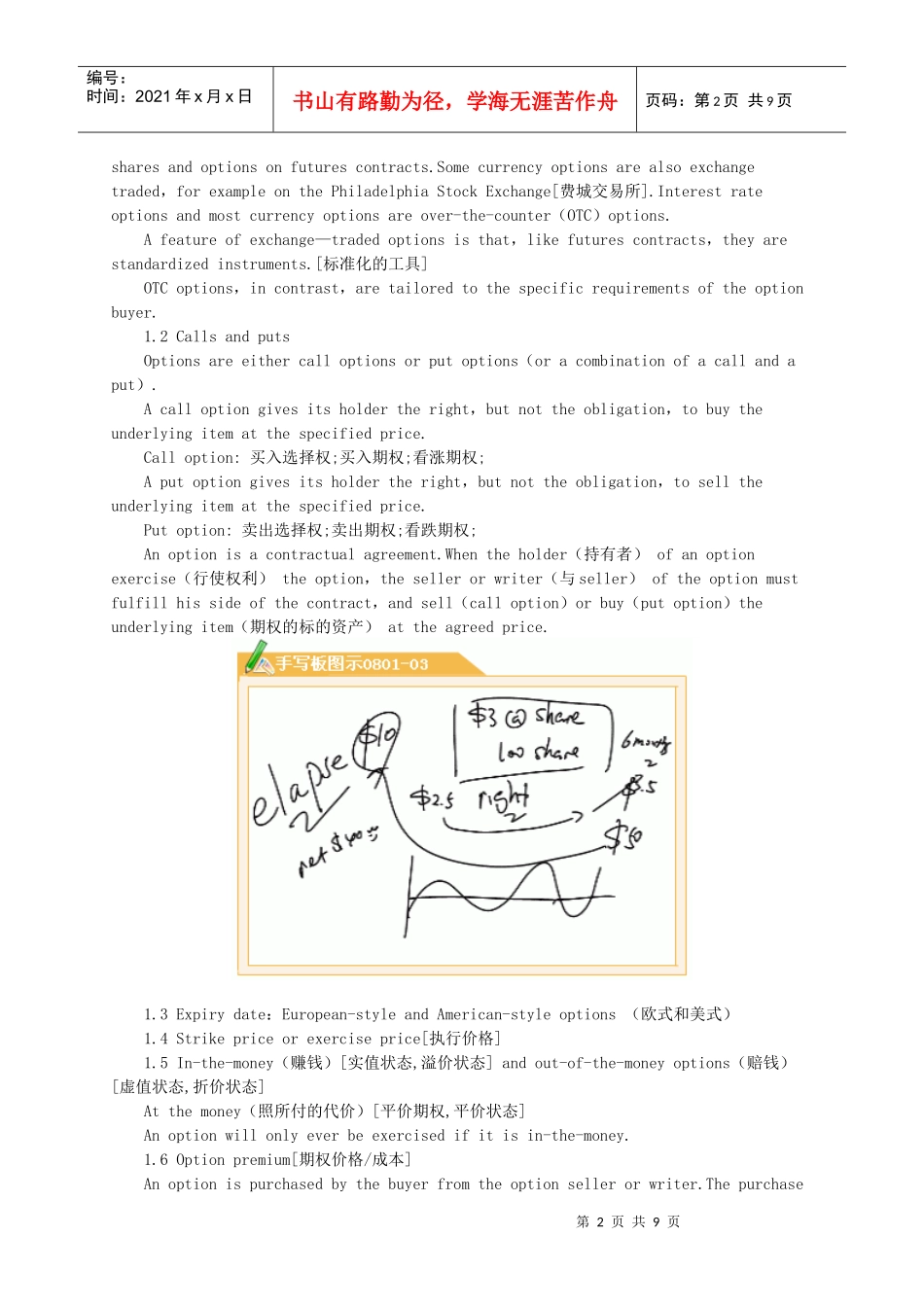

第1页共9页编号:时间:2021年x月x日书山有路勤为径,学海无涯苦作舟页码:第1页共9页BusinessandOptionValuation[对应中文教材2008年财务成本管理第十章:企业价值评估、第十一章:期权估价]1.Themainfeaturesofoptions(期权的主要特征)Anoptiongivesitsholdertheright(butnottheobligation)tobuyorsellaspecificquantityofaspecificassetatafixedpriceonorbeforeaspecifiedfuturedate.Anoptionispurchasedbytheoptionholderandissoldbytheoption‘writer’.期权是指一种合约,该合约赋予持有人在某一特定日期或该日之前的任何时间以固定价格购进或售出一种资产的权利。1.1Exchange-tradedandOTCoptionsOptionsmightbeboughtandsoldonanoptionsexchangesuchasLIFFE[LONDONINTERNATIONALFINANCIALFUTURESEXCHANGE:伦敦国际金融期货交易所],orarranged‘over-the-counter’[场外交易]withabank.Exchange-tradedoptionsincludeoptionsonequity第2页共9页第1页共9页编号:时间:2021年x月x日书山有路勤为径,学海无涯苦作舟页码:第2页共9页sharesandoptionsonfuturescontracts.Somecurrencyoptionsarealsoexchangetraded,forexampleonthePhiladelphiaStockExchange[费城交易所].Interestrateoptionsandmostcurrencyoptionsareover-the-counter(OTC)options.Afeatureofexchange—tradedoptionsisthat,likefuturescontracts,theyarestandardizedinstruments.[标准化的工具]OTCoptions,incontrast,aretailoredtothespecificrequirementsoftheoptionbuyer.1.2CallsandputsOptionsareeithercalloptionsorputoptions(oracombinationofacallandaput).Acalloptiongivesitsholdertheright,butnottheobligation,tobuytheunderlyingitematthespecifiedprice.Calloption:买入选择权;买入期权;看涨期权;Aputoptiongivesitsholdertheright,butnottheobligation,toselltheunderlyingitematthespecifiedprice.Putoption:卖出选择权;卖出期权;看跌期权;Anoptionisacontractualagreement.Whentheholder(持有者)ofanoptionexercise(行使权利)theoption,thesellerorwriter(与seller)oftheoptionmustfulfillhissideofthecontract,andsell(calloption)orbuy(putoption)theunderlyingitem(期权的标的资产)attheagreedprice.1.3Expirydate:European-styleandAmerican-styleoptions(欧式和美式)1.4Strikepriceorexerciseprice[执行价格]1.5In-the-money(赚钱)[实值状态,溢价状态]andout-of-the-moneyoptions(赔钱)[虚值状态,折价状态]Atthemoney(照所付的代价)[平价期权,平价状态]Anoptionwillonlyeverbeexercisedifitisin-the-money.1.6Optionpremium[期权价格/成本]Anoptionispurchasedbythebuyerfromtheoptionsellerorwriter.Thepurchase第3页共9页第2页共9页编号:时间:2021年x月x日书山有路勤为径,学海无涯苦作舟页码:第3页共9页priceiscalledtheoptionpremium.Apositioninoptionscanbeopenedbybuyingoptionstoholdalongpositionorsellingoptionstocreateashortposition.Alongorshortpositioncanbeheldineithercallsorputs.Thevalueofanoption[期权价值](itspremiumorcurrentmarketvalue)issaidtoconsistoftwoelements:Intrinsicvalue[内在价值]Timevalue[时间溢价]Intrinsicvalueisthedifferencebetweenthestrikepricefortheoptionandthecurrentmarketpriceoftheunderlyingitem.[内在价值的大小,取决于期权标的资产的现行市价与期权执行价格的高低.]Onlyanin-the-moneyoptionhasanintrinsicvalue,however.Intrinsicvaluecannotbenegative,soanout-of-the-moneyoptionhasintrinsicvalueof0.Timevalueisthevalueplacedontheoption.[期权的时间溢价是指期权价值超过内在价值的部分]Timevaluedependsonfactorssuchas:Theperiodoftimeremainingtotheoption'sexpirydate.[到期期限]Thevolatilityofthemarketpriceoftheunderlyingitem.[股票价格的波动率]Foranout-of-the-moneyoption,theextenttowhichtheunderlyingmarketpricemustmovebeforetheoptionbecome...