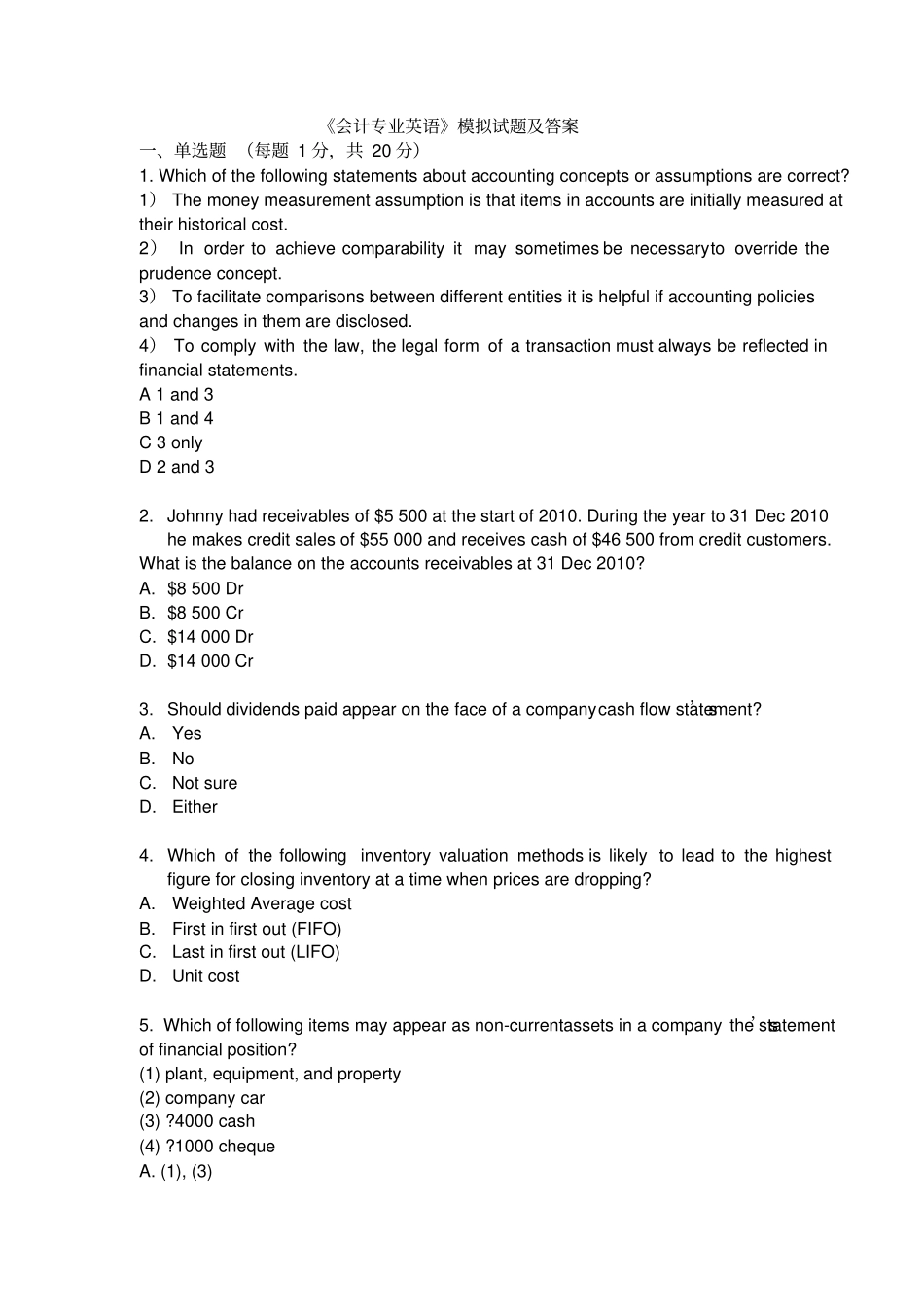

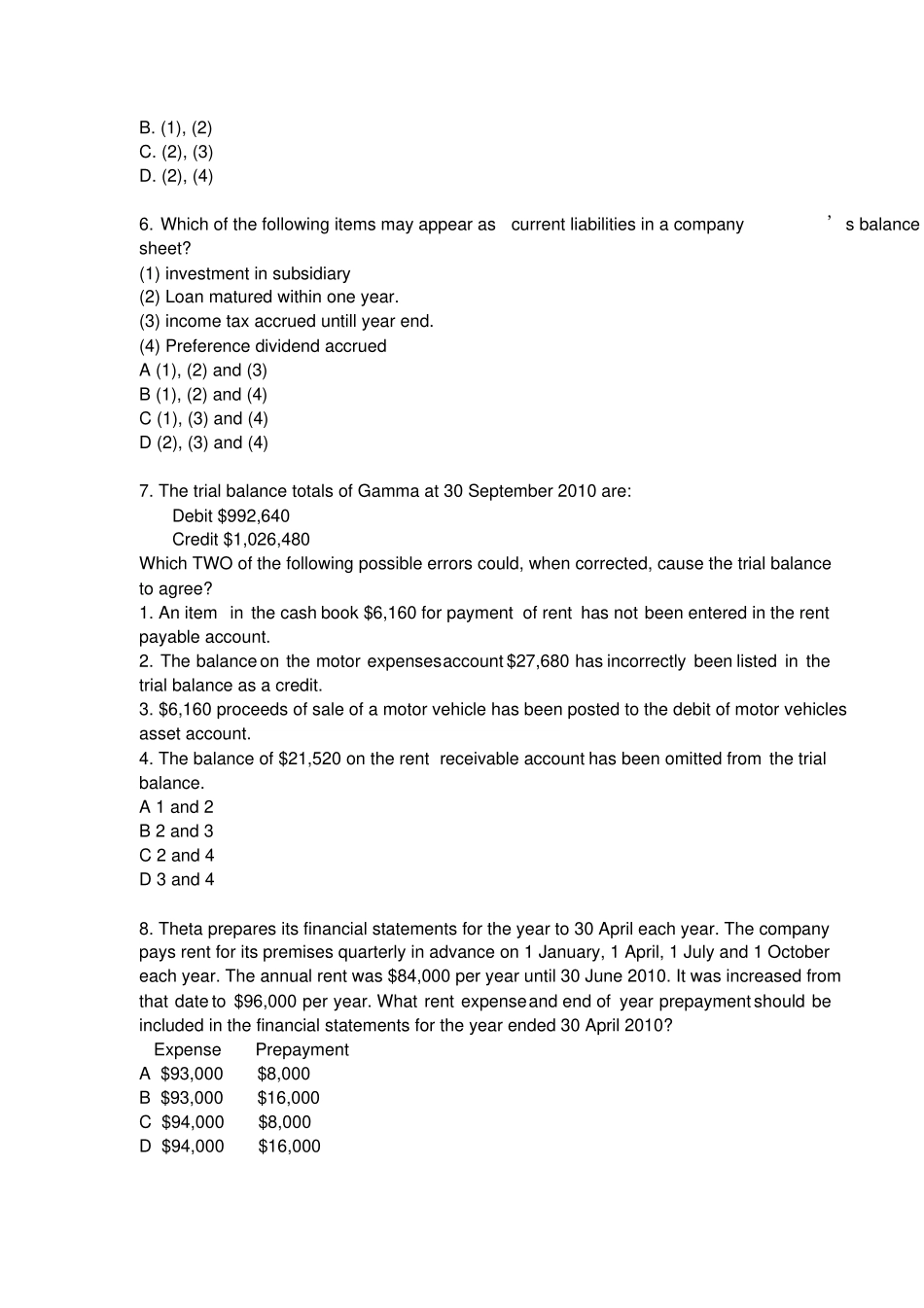

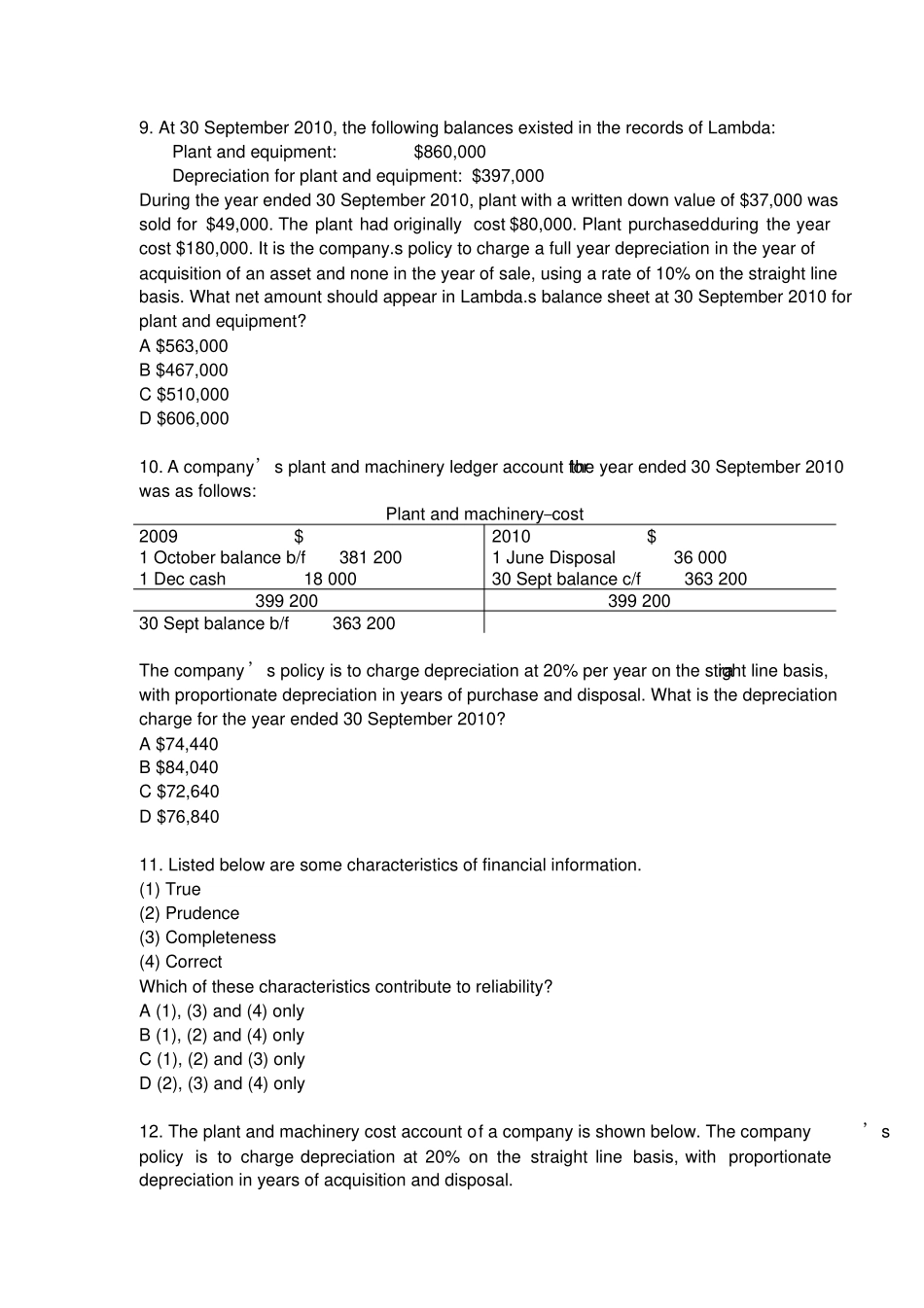

《会计专业英语》模拟试题及答案一、单选题(每题1分,共20分)1.Whichofthefollowingstatementsaboutaccountingconceptsorassumptionsarecorrect?1)Themoneymeasurementassumptionisthatitemsinaccountsareinitiallymeasuredattheirhistoricalcost.2)Inordertoachievecomparabilityitmaysometimesbenecessarytooverridetheprudenceconcept.3)Tofacilitatecomparisonsbetweendifferententitiesitishelpfulifaccountingpoliciesandchangesinthemaredisclosed.4)Tocomplywiththelaw,thelegalformofatransactionmustalwaysbereflectedinfinancialstatements.A1and3B1and4C3onlyD2and32.Johnnyhadreceivablesof$5500atthestartof2010.Duringtheyearto31Dec2010hemakescreditsalesof$55000andreceivescashof$46500fromcreditcustomers.Whatisthebalanceontheaccountsreceivablesat31Dec2010?A.$8500DrB.$8500CrC.$14000DrD.$14000Cr3.Shoulddividendspaidappearonthefaceofacompany’scashflowstatement?A.YesB.NoC.NotsureD.Either4.Whichofthefollowinginventoryvaluationmethodsislikelytoleadtothehighestfigureforclosinginventoryatatimewhenpricesaredropping?A.WeightedAveragecostB.Firstinfirstout(FIFO)C.Lastinfirstout(LIFO)D.Unitcost5.Whichoffollowingitemsmayappearasnon-currentassetsinacompany’sthestatementoffinancialposition?(1)plant,equipment,andproperty(2)companycar(3)?4000cash(4)?1000chequeA.(1),(3)B.(1),(2)C.(2),(3)D.(2),(4)6.Whichofthefollowingitemsmayappearascurrentliabilitiesinacompany’sbalancesheet?(1)investmentinsubsidiary(2)Loanmaturedwithinoneyear.(3)incometaxaccrueduntillyearend.(4)PreferencedividendaccruedA(1),(2)and(3)B(1),(2)and(4)C(1),(3)and(4)D(2),(3)and(4)7.ThetrialbalancetotalsofGammaat30September2010are:Debit$992,640Credit$1,026,480WhichTWOofthefollowingpossibleerrorscould,whencorrected,causethetrialbalancetoagree?1.Aniteminthecashbook$6,160forpaymentofrenthasnotbeenenteredintherentpayableaccount.2.Thebalanceonthemotorexpensesaccount$27,680hasincorrectlybeenlistedinthetrialbalanceasacredit.3.$6,160proceedsofsaleofamotorvehiclehasbeenpostedtothedebitofmotorvehiclesassetaccount.4.Thebalanceof$21,520ontherentreceivableaccounthasbeenomittedfromthetrialbalance.A1and2B2and3C2and4D3and48.Thetapreparesitsfinancialstatementsfortheyearto30Aprileachyear.Thecompanypaysrentforitspremisesquarterlyinadvanceon1January,1April,1Julyand1Octobereachyear.Theannualrentwas$84,000peryearuntil30June2010.Itwasincreasedfromthatdateto$96,000peryear.Whatrentexpenseandendofyearprepaymentshouldbeincludedinthefinancialstatementsfortheyearended30April2010?ExpensePrepaymentA$93,000$8,000B$93,000$16,000C$94,000$8,000D$94,000$16,0009.At30September2010,thefollowingbalancesexistedintherecordsofLambda:Plantandequipment:$860,000Depreciationforplantandequipment:$397,000Duringtheyearended30September2010,plantwithawrittendownvalueof$37,000wassoldfor$49,000.Theplanthadoriginallycost$80,000.Plantpurchasedduringtheyearcost$180,000.Itisthecompany.spolicytochargeafullyeardepreciationintheyearofacquisitionofanassetandnoneintheyearofsale,usingarateof10%onthestraightlinebasis.WhatnetamountshouldappearinLambda.sbalancesheetat30September2010forplantandequipment?A$563,000B$467,000C$510,000D$606,00010.Acompany’splantandmachineryledgeraccountfortheyearended30September2010wasasfollows:Plantandmachinery–cost2009$2010$1Octoberbalanceb/f3812001JuneDisposal360001Deccash1800030Septbalancec/f36320039920039920030Septbalanceb/f363200Thecompany’spolicyistochargedepreciationat20%peryearonthes...