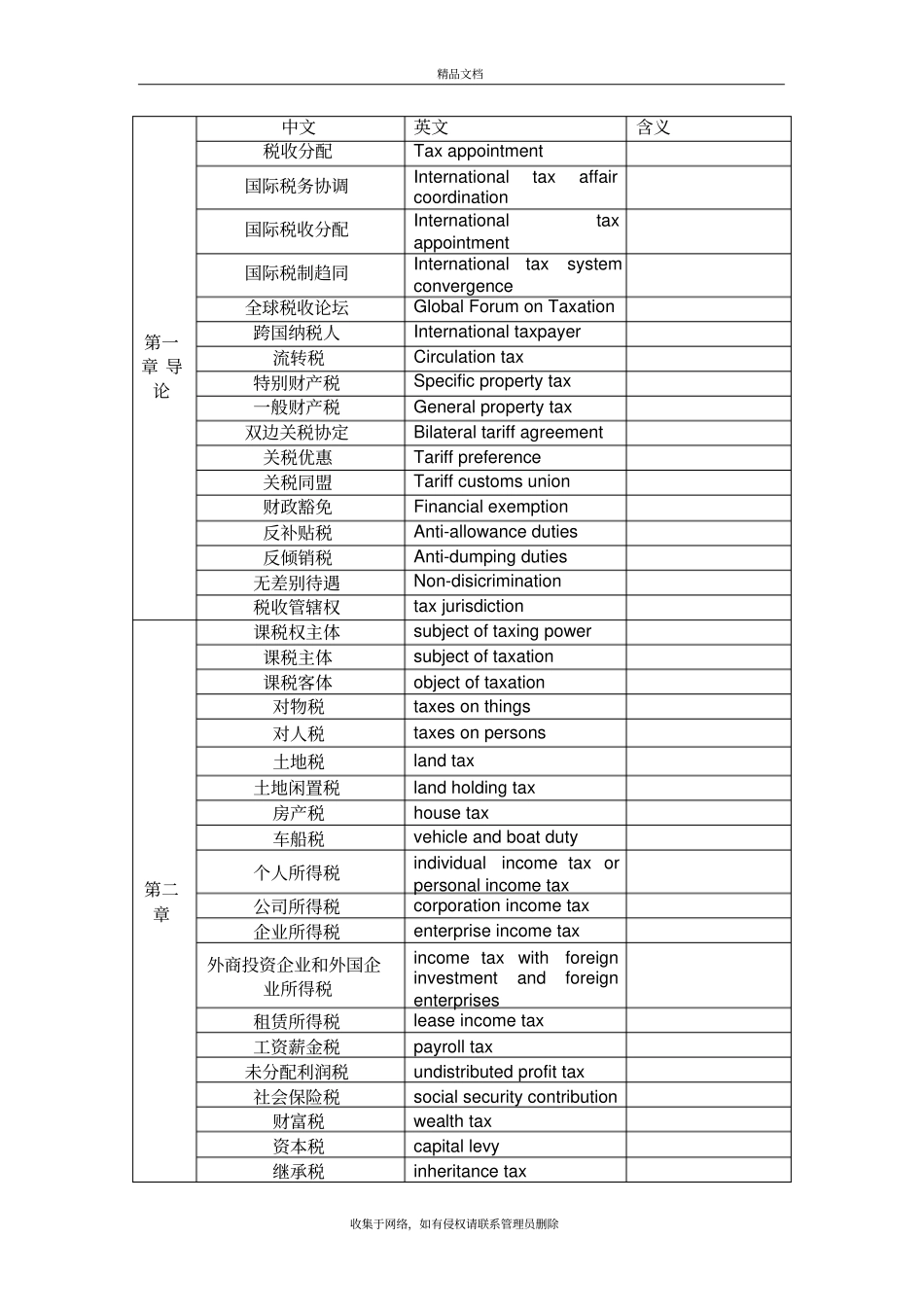

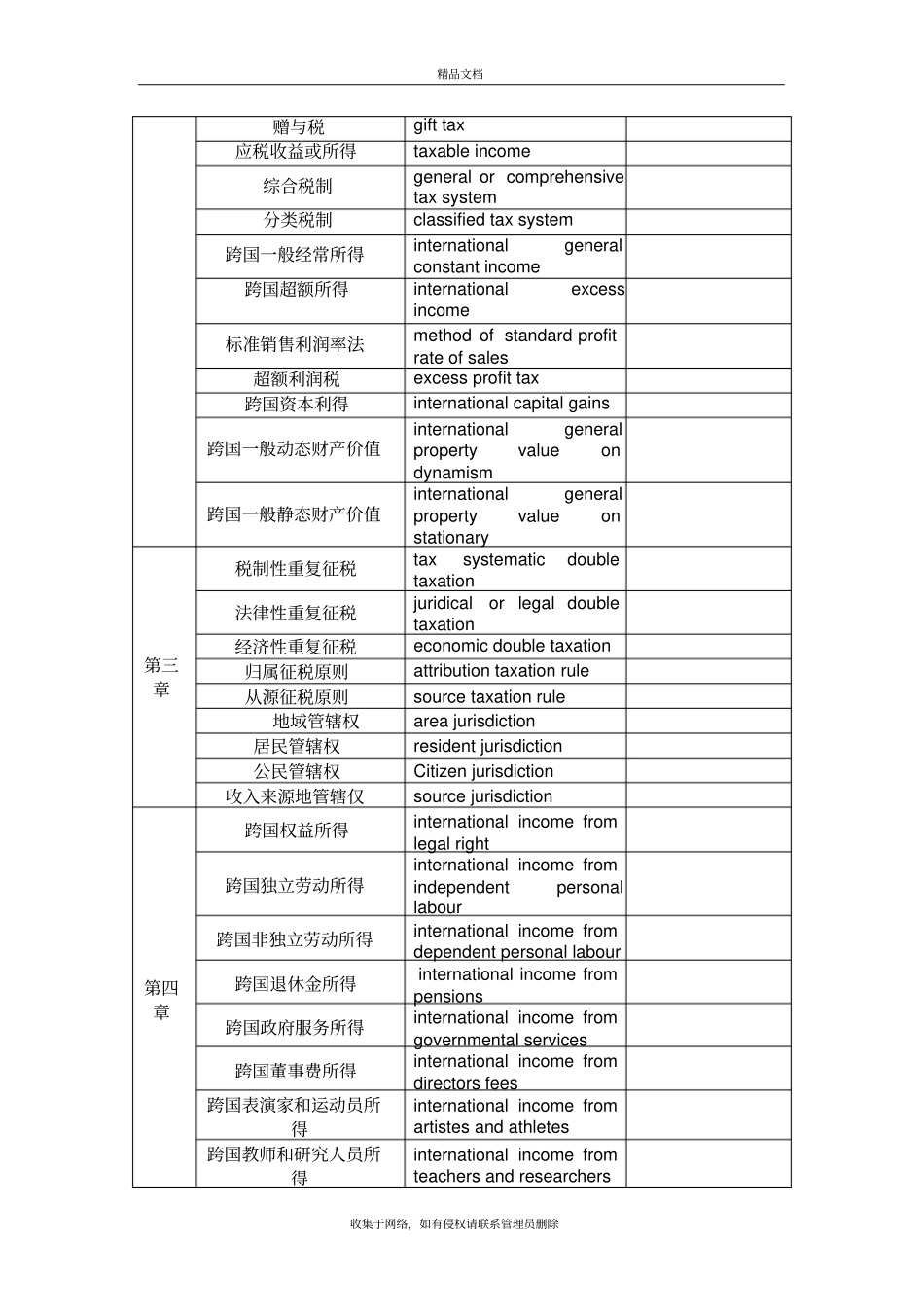

国 际 税 收 协 定 中 英 对照精品文档收集于网络,如有侵权请联系管理员删除第一章 导论中文英文含义税收分配Tax appointment 国际税务协调International tax affair coordination 国际税收分配International tax appointment 国际税制趋同International tax system convergence 全球税收论坛Global Forum on Taxation 跨国纳税人International taxpayer 流转税Circulation tax 特别财产税Specific property tax 一般财产税General property tax 双边关税协定Bilateral tariff agreement 关税优惠Tariff preference 关税同盟Tariff customs union 财政豁免Financial exemption 反补贴税Anti-allowance duties 反倾销税Anti-dumping duties 无差别待遇Non-disicrimination 税收管辖权tax jurisdiction 第二章课税权主体subject of taxing power 课税主体subject of taxation 课税客体object of taxation 对物税taxes on things 对人税taxes on persons 土地税land tax 土地闲置税land holding tax 房产税house tax 车船税vehicle and boat duty 个人所得税individual income tax or personal income tax 公司所得税corporation income tax 企业所得税enterprise income tax 外商投资企业和外国企业所得税income tax with foreign investment and foreign enterprises 租赁所得税lease income tax 工资薪金税payroll tax 未分配利润税undistributed profit tax 社会保险税social security contribution 财富税wealth tax 资本税capital levy 继承税inheritance tax 精品文档收集于网络,如有侵权请联系管理员删除赠与税gift tax 应税收益或所得taxable income 综合税制general or comprehensive tax system 分类税制classified tax system 跨国一般经常所得international general constant income 跨国超额所得international excess income 标准销售利润率法method of standard profit rate of sales 超额利润税excess profit tax 跨国资本利得international capital gains 跨国一般动态财产价值international general property value on dynamism 跨国一般静态财产价值international general property value on stationary 第三章税制性重复征税tax systematic double ta...